A pay stub is a document that shows your earnings and deductions from your job. It is a reliable form of proof of income for rental applications. When providing a pay stub for a rental application, it is important to make sure that it is:

• Recent: Landlords typically want to see pay stubs from the past. This gives them a good idea of your current income.

• Complete: The pay stub should include all of your earnings and deductions, including your gross pay, net pay, taxes, and any other deductions.

• Valid: The pay stub should be from a legitimate employer and should not be altered or forged.

To provide proof of income with a pay stub for an employee, you will need to:

1. Obtain your pay stubs from your employer : Obtaining your pay stubs directly from your employer is crucial for providing proof of income. By contacting your employer’s human resources department or payroll provider, you can request electronic or physical copies of your pay stubs. This ensures the information is official, accurate, and up-to-date. Review the pay stubs to confirm they include essential details like your name, employer’s name, pay period dates, gross and net income, and year-to-date earnings. By obtaining your pay stubs from your employer, you can confidently present reliable documentation to landlords, demonstrating your financial stability and capability to meet rental payment obligations.

2. Make sure that the pay stubs are complete and recent: It is important to ensure that the pay stubs you provide as proof of income are complete and recent. Landlords want to see the most up-to-date information regarding your earnings. Review the pay stubs carefully to make sure all the necessary details are included. If any information is missing or outdated, reach out to your employer to obtain the correct and current pay stubs. By providing complete and recent pay stubs, you give landlords confidence in your financial situation and increase the chances of a successful rental application.

3. Photocopy the physical pay stubs and keep the originals for your records: After obtaining your physical pay stubs, it’s important to make photocopies of them and keep the originals for your records. Having copies allows you to provide them to potential landlords while safeguarding the original documents. By maintaining the originals, you have a reference for future use and can easily access the information if needed.

4. Attach the photocopied pay stubs to your rental application: Once you have obtained photocopies of your pay stubs, it is important to attach them to your rental application. This step allows you to provide concrete proof of your income to the landlord or property manager. Make sure the photocopies are clear and legible, ensuring that all the relevant information is visible. You can attach the pay stubs digitally by scanning or uploading them to an online application portal. Attaching the photocopied physical pay stubs strengthens your application and demonstrates your financial stability and ability to afford the rental property.

Here are some additional tips for providing proof of income with a pay stub:

• Be organized: Make sure that you have all of your pay stubs in order and that they are easy to read.

• Be clear: Explain to the landlord how your income is calculated and how much you can afford to pay in rent.

By following these tips, you can ensure that your pay stubs will be accepted as proof of income for your rental application.

Here are some additional documents that you may be asked to provide as proof of income:

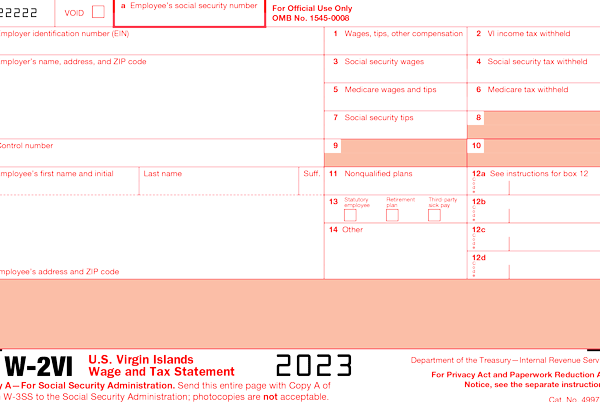

• W-2 form : The W-2 form is a tax document that employers provide to their employees at the end of the year. It reports the employee’s wages, salaries, and other compensation, as well as the taxes withheld from their paychecks throughout the year. The W-2 form is crucial for accurately filing income tax returns as it provides a comprehensive summary of the employee’s earnings and tax withholdings. It includes information such as the employee’s Social Security number, the employer’s identification number, and details about wages, tips, and bonuses. Employees should receive their W-2 forms from their employers by January 31st of each year. It is important to keep the W-2 form safe as it serves as a crucial document for tax filing purposes.

1099 form: The 1099 form is a tax document used to report income received by individuals who are not employees of a company. It is typically issued to freelancers, independent contractors, or self-employed individuals. The 1099 form reports various types of income, such as payments for services rendered, rental income, or investment income.

There are different types of 1099 forms, including:

1. 1099-MISC: Used to report miscellaneous income, including non-employee compensation.

2. 1099-INT: Used to report interest income earned from banks, financial institutions, or other sources.

3. 1099-DIV: Used to report dividend income received from investments.

4. 1099-B: Used to report proceeds from the sale of stocks, bonds, or other securities.

5. 1099-R: Used to report distributions from retirement accounts, pensions, or annuities.

The specific type of 1099 form you receive depends on the nature of the income you have earned. It is important to keep the 1099 forms and use them when filing your income tax return. The information on the 1099 form is also provided to the Internal Revenue Service (IRS), so it is essential to accurately report the income to avoid any discrepancies or audit issues.

Bank statements : Bank statements are official documents provided by banks or financial institutions that detail the financial transactions and balances for a specific period. They are important for various purposes, including:

1. Proof of Income: Bank statements can be used as supplementary proof of income, especially for self-employed individuals or those with irregular income. They show deposits and income received, providing additional evidence of financial stability.

2. Verification of Funds: Landlords or lenders may request bank statement to verify the availability of funds or the ability to cover rental payments or loan installments. Bank statements provide a snapshot of an individual’s financial position, showcasing their savings and transaction history.

3. Auditing and Tax Purposes: Bank statements serve as supporting documents during audits or when filing income tax returns. They provide a comprehensive record of income, expenses, and financial activities, helping individuals accurately report their financial information.

It is advisable to retain bank statements for several years for future reference, tax obligations, or any legal requirements. However, be mindful of sensitive information present on bank statements and take precautions to protect your personal data and account details.

Letter from the employer for an Employee: A letter from an employer is a document provided by an employer to verify an employee’s employment status and other relevant details. This letter is often requested for various purposes, such as rental applications, loan applications, immigration processes, or as proof of income.

Here are some key points about a letter from an employer:

1. Employment Verification: The letter verifies the employee’s current employment status, including job title, start date, and whether the employment is full-time, part-time, or contractual.

2. Income Verification: The letter may also include information about the employee’s income, such as the annual salary or hourly wage, the average number of hours worked per week, and whether the income is fixed or variable.

3. Contact Information: The letter typically includes the employer’s contact information, such as the company name, address, and phone number. This allows the recipient to verify the authenticity of the letter if required.

4. Purpose-Specific Details: Depending on the purpose of the letter, additional information may be included. For example, a rental application letter from an employer may confirm the employee’s ability to pay rent, while an immigration-related letter may address the employee’s job responsibilities and duration of employment.

5. Professional Tone: The letter is written in a professional format, usually on company letterhead, and signed by an authorized representative of the employer.

When requesting a letter from your employer, it is advisable to provide them with specific details or requirements to ensure that the letter includes all the necessary information. It is also important to maintain a positive and professional relationship with your employer to facilitate the process of obtaining such letters when needed.

Conclusion: The specific documents that you will need to provide will vary depending on your individual circumstances. However, by providing clear and concise proof of income, you can increase your chances of being approved for a rental property.

1 thought on “A Guide to Pay Stubs for Rental Applications : How to Provide Proof of Income ?”