In the realm of tax compliance and paperwork, the advent of technology has ushered in a new era of convenience and efficiency. Among the many advancements, the ability to generate W9 forms online through the integration of paystub makers stands out as a game-changer. Let’s delve into how this technological integration simplifies the process and enhances the management of tax-related documentation.

Understanding the Significance of W9 Forms

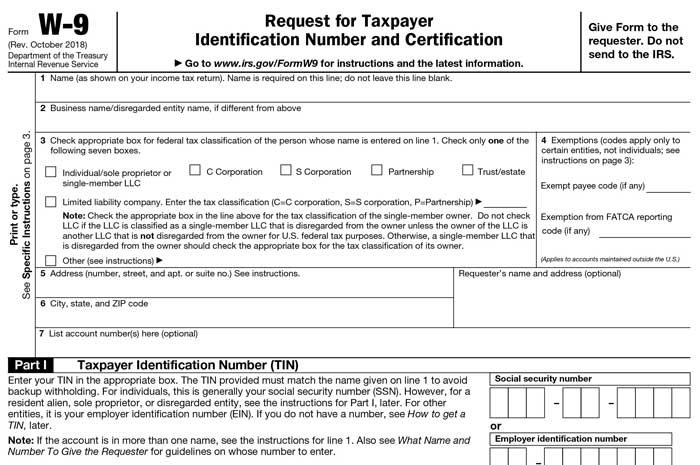

The W9 form is a fundamental document used in the United States for tax purposes. It’s commonly utilized by businesses to request information from independent contractors, freelancers, or other entities they work with. This form collects essential details such as the recipient’s name, address, taxpayer identification number (TIN), and classification.

The Traditional Paperwork Hassle

Traditionally, procuring and completing W9 form involved cumbersome paperwork. Individuals or businesses would exchange physical documents, often leading to delays, errors, and administrative burdens. This conventional method was not only time-consuming but also prone to inaccuracies and inefficiencies.

The Emergence of Online W9 Generation

With the evolution of technology, online W9 generation has become a viable solution, simplifying and expediting the process. Various platforms now offer W9 creator tools that enable users to generate, fill, and manage W9 forms entirely online.

Integration with Paystub Makers : The Next Frontier

The integration of W9 creator tools with paystub makers represents the epitome of convenience and efficiency in tax management. Paystub makers, primarily designed for generating pay stubs, have expanded their functionalities to incorporate W9 form creation seamlessly.

Benefits of Using Paystub Makers for W9 Form Generation

1. Streamlined Process: By centralizing the creation of W9 forms within the paystub maker platform, users benefit from a consolidated and streamlined process. This integration eliminates the need to switch between multiple tools or platforms, saving time and effort.

2. Data Consistency: Integration ensures that data inputted for pay stubs and W9 forms remains consistent and error-free. This helps in maintaining accuracy across various financial documents, reducing the risk of discrepancies.

3. Efficient Management: Paystub makers equipped with W9 forms creator tools offer features for easy management of generated forms. Users can store, edit, and retrieve W9 forms alongside other financial documents, creating a comprehensive repository.

4. Accessibility and Security: Online platforms ensure accessibility from anywhere with an internet connection, enabling users to create W9 forms on the go. Additionally, these platforms prioritize data security, employing encryption methods to safeguard sensitive information.

5. Integration with Tax Return Generator: Some advanced paystub makers not only facilitate W9 creation but also seamlessly integrate with tax return generators. This integration streamlines the entire tax filing process, enabling users to transition from W9 forms to tax returns effortlessly.

Using Technology to Create W9 Forms Online with Paystub Makers: A Step-by-Step Guide

1. Select a Reputable Platform: Choose a reliable paystub maker that offers W9 creation features. Ensure the platform complies with security standards and provides a user-friendly interface.

2.Create an Account: Sign up or log in to the chosen platform and navigate to the W9 creation section.

3. Input Required Information: Enter the necessary details as prompted by the form, ensuring accuracy in all fields.

4. Review and Finalize: Carefully review the completed W9 form to confirm accuracy and completeness. Make any necessary edits before finalizing.

5. Save and Access: Save the completed W9 form within the platform for future reference or download it for immediate use.

In Conclusion

The synergy between W9 creator tools and paystub makers epitomizes the power of technology in simplifying complex tax-related processes. By harnessing these tools, individuals and businesses can create W9 forms online seamlessly, ensuring accuracy, efficiency, and compliance with tax regulations.