Managing payroll can be a daunting task, especially for small business owners and freelancers. One crucial aspect of payroll is generating pay stubs for employees and contractors. Pay stubs are essential documents that provide a detailed breakdown of an employee’s earnings, deductions, and net pay. Fortunately, with the advent of technology, creating pay stubs has never been easier. Enter the Free Pay Stub Generator — a tool designed to simplify your payroll process and ensure accuracy in your financial documentation.

What is a Pay Stub?

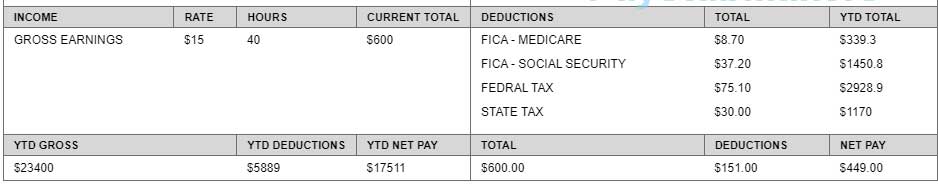

A pay stub, also known as a paycheck stub or pay slip, is a document that accompanies an employee’s paycheck. It details the amount earned during a specific pay period, including:

Gross Income: The total earnings before deductions.

Deductions: Taxes, health insurance, retirement contributions, and other withholdings.

Net Income: The final amount the employee takes home after deductions.

Pay stubs are crucial for both employers and employees. For employers, they provide a transparent record of payments made, and for employees, they serve as proof of income, which is often required for loans, rentals, and other financial transactions.

Why Use a Free Pay Stub Generator?

Cost-Effective: As a free tool, the pay stub generator eliminates the need for expensive payroll software or outsourcing to accounting firms.

Time-Saving: Generating pay stubs manually can be time-consuming. A pay stub generator automates the process, allowing you to create accurate stubs in minutes.

Accuracy: Manual calculations are prone to errors. A pay stub generator ensures that all calculations are accurate, reducing the risk of mistakes that can lead to compliance issues or employee dissatisfaction.

Professionalism: A professional-looking pay stub enhances your business’s credibility. Pay stub generators often come with templates that produce clean, professional documents.

Convenience: Accessible online, these generators can be used anytime, anywhere, providing flexibility for businesses with remote or mobile operations.

How to Use a Free Pay Stub Generator?

Using a pay stub generator is straightforward. Here’s a step-by-step guide:

Choose a Reliable Generator: Start by selecting a reputable free pay stub generator. Look for one with good reviews and user feedback.

Enter Company Information: Input your business name, address, and contact details. This information will be displayed on the pay stub.

Input Employee Details: Add the employee’s name, address, and social security number or employee ID.

Enter Payment Information: Provide details about the employee’s earnings, including hourly wage or salary, hours worked, and any bonuses or commissions.

Add Deductions: Specify any deductions such as federal and state taxes, health insurance, retirement contributions, and other withholdings.

Generate the Pay Stub: Once all the information is entered, the generator will create the pay stub. Review it for accuracy, and then download or print it.

Distribute the Pay Stub: Provide the pay stub to your employee either electronically or as a printed document.

Features to Look for in a Pay Stub Generator

When selecting a free pay stub generator, consider the following features:

User-Friendly Interface: The tool should be easy to navigate, even for those with limited technical skills.

Customization Options: The ability to customize the template to include your business logo and specific details.

Compliance: Ensure the generator adheres to state and federal regulations regarding payroll documentation.

Security: Look for a generator that guarantees the privacy and security of your financial and employee information.

Conclusion

A free pay stub generator is an invaluable tool for any business owner looking to streamline their payroll process. It offers a cost-effective, accurate, and convenient solution for creating professional pay stubs. By leveraging such a tool, you can save time, reduce errors, and focus on what you do best – growing your business. Embrace the power of technology and simplify your payroll tasks with a free pay stub generator today.

FAQ’s

- How to create a pay stub for free?

Ans : Creating a pay stub for free is simple with an online pay stub generator. Start by choosing a reputable free tool. Enter your company’s information and the employee’s details, including their name and Social Security number. Provide payment details such as the pay period, hours worked, and earnings. Include necessary deductions like taxes and insurance. Generate the pay stub, review it for accuracy, and then download and distribute it to the employee. This process ensures you can quickly and easily produce professional pay stubs without any cost.

- What is the basic pay stub?

Ans : A basic pay stub is a document provided by an employer that outlines an employee’s earnings for a specific pay period. It includes essential details such as gross wages, deductions (taxes, insurance, retirement contributions), and net pay. The pay stub helps employees understand their compensation and keep track of their income and deductions.

- How to get pay stubs online?

Ans : To get pay stubs online, use a reliable pay stub generator. Enter your company and employee details, including payment information and deductions. Generate the pay stub, review it for accuracy, and download it. You can then print or email the pay stub to the employee.