Managing year-end tax forms can be a hassle for any business, but it doesn’t have to be. An Online W-2 Form Generator can simplify the process, allowing you to create and distribute W-2 forms instantly. In this blog, we’ll explore the benefits of using an online W-2 form generator and guide you through the steps to create a W-2 form quickly and accurately.

What is a W-2 Form?

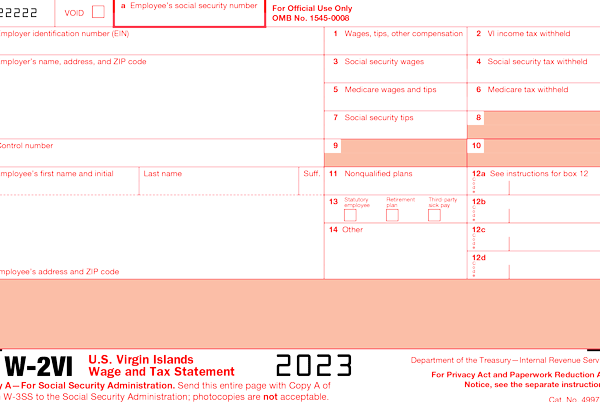

A W-2 form, officially known as the Wage and Tax Statement, is a document that employers must provide to their employees at the end of each year. This form details the employee’s annual wages and the amount of taxes withheld from their paycheck. The W-2 form is essential for employees to file their federal and state tax returns accurately.

Benefits of Using an Online W-2 Form Generator

- Time-Saving:

- Manually filling out W-2 forms can be time-consuming, especially for businesses with many employees. An online generator automates this process, significantly reducing the time required to prepare each form.

- Accuracy:

- An online W-2 form generator ensures that all calculations are precise, minimizing the risk of errors that could lead to penalties or tax complications for both employers and employees.

- Convenience:

- Access the form generator from anywhere, at any time. This flexibility is particularly useful for remote businesses or employers who manage payroll from different locations.

- Cost-Effective:

- Online generators often come at a fraction of the cost of traditional payroll services, making them an affordable solution for small businesses and startups.

- Compliance:

- Online tools are frequently updated to comply with the latest tax laws and regulations, ensuring that your W-2 forms meet all IRS requirements.

How to Create a W-2 Form Instantly Using an Online Generator

Creating a W-2 form using an online generator is straightforward. Follow these simple steps to get started:

- Choose a Reputable Online W-2 Form Generator:

- Select an online generator with positive reviews and reliable service. Ensure it offers the features you need and complies with IRS guidelines.

- Enter Company Information:

- Input your business name, address, and Employer Identification Number (EIN). This information will appear on the W-2 form.

- Input Employee Details:

- Provide each employee’s name, address, Social Security number, and other required personal information.

- Add Earnings and Withholding Information:

- Enter the employee’s total earnings for the year, including wages, tips, and other compensation. Include details of federal, state, and local tax withholdings, as well as any additional deductions or benefits.

- Generate and Review the Form:

- Click the generate button to create the W-2 form. Carefully review all the information for accuracy before finalizing.

- Download and Distribute the W-2 Form:

- Download the completed W-2 form and distribute it to your employees. You can provide it as a printed document or send it electronically via email.

- Submit to the IRS:

- Ensure you submit the required copies of the W-2 form to the IRS and any relevant state tax authorities. Most online generators also offer options to file electronically, simplifying this step.

Conclusion

An Online W-2 Form Generator is an invaluable tool for businesses looking to streamline their year-end tax reporting. By automating the creation of W 2 forms, you save time, reduce errors, and ensure compliance with tax regulations. Whether you run a small business or a large corporation, using an online W-2 form generator can make the process of issuing W 2 forms quick, easy, and hassle-free. Try it today and experience the benefits for yourself!

FAQ’s

Q: What is an online W-2 form generator? A: An online W-2 form generator is a digital tool that allows employers to create W-2 forms quickly and accurately. It automates the process of inputting employee earnings and tax withholding information, generating compliant W-2 forms that can be downloaded, printed, and distributed to employees and tax authorities.

Q: How does an online W-2 form generator save time?

A: By automating the data entry and calculation process, an online W-2 form generator significantly reduces the time required to prepare each W-2 form. This is especially beneficial for businesses with multiple employees, as it eliminates the need for manual entry and minimizes errors.

Q: Are online W-2 form generators accurate?

A: Yes, reputable online W-2 form generators ensure accuracy by automatically performing necessary calculations and adhering to the latest tax regulations. This reduces the risk of errors that can lead to penalties or issues with tax filings.

Q: Is it cost-effective to use an online W-2 form generator?

A: Absolutely. Online W-2 form generators are often more affordable than traditional payroll services. They provide a cost-effective solution for small businesses and startups to manage their year-end tax reporting without incurring high costs.

Q: How do I choose the right online W-2 form generator?

A: Look for an online W-2 form generator with positive user reviews, robust customer support, and features that meet your business needs. Ensure that the tool complies with IRS guidelines and offers the necessary functionalities, such as automatic calculations and electronic filing options.