Who files form 1099 misc.?

Any business or individual who has made a legal payment of $600 or more needs to file form 1099 misc. in leu of all the miscellaneous payments that are not subject to self-employment taxes. For instance, you should file form 1099 misc. as a property owner against all the payments made to all the non-employee professionals like attorneys, repair and maintenance professionals, contractors, etc. However, you should always keep in mind that these payments should be equal to or more than $600.

Apart from this, you also need to file form 1099 misc. for all the independent contractors and freelancers who are subject to backup withholdings, regardless of the amount of their income.

How to fill form 1099 MISC?

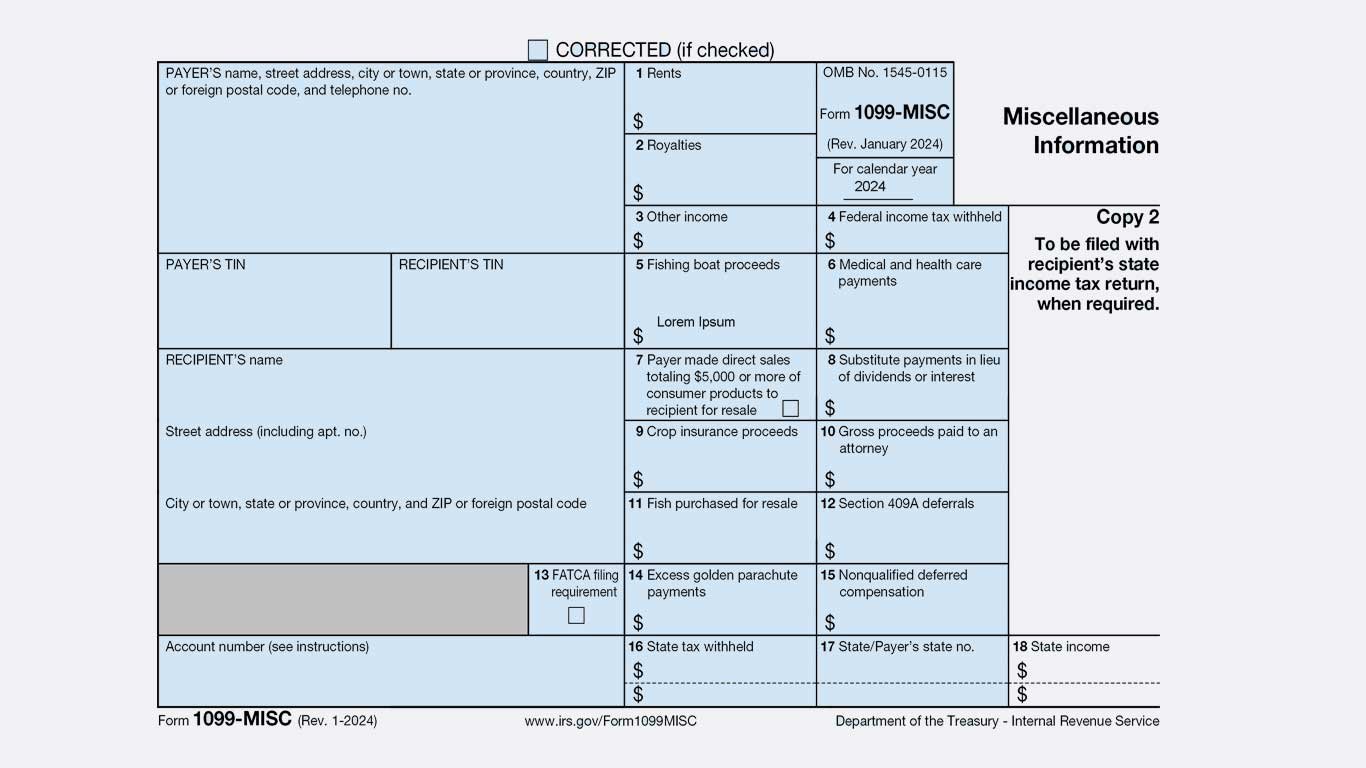

You can easily download the 1099 misc. tax form from the official website of the IRS. It is available in different parts.

Copy A of the 1099 misc. form appears in the red colored ink that is machine readable. This copy is not supposed to be printed and is intended only for the IRS use.

The other parts including Copy 1, Copy B, Copy 2, and Copy C are available in the downloadable and printable format. They are printed with a black ink.

Copy 1 needs to be submitted in the recipient’s state tax department.

Copy B is for the recipient use.

Copy 2 is required at the time filing state tax return.

Copy C is kept in the files of the payer for record keeping purposes.

The tax form 1099 misc. contains various columns and boxes to report different kinds of payments and sources of income.

How to read form 1099 misc.?

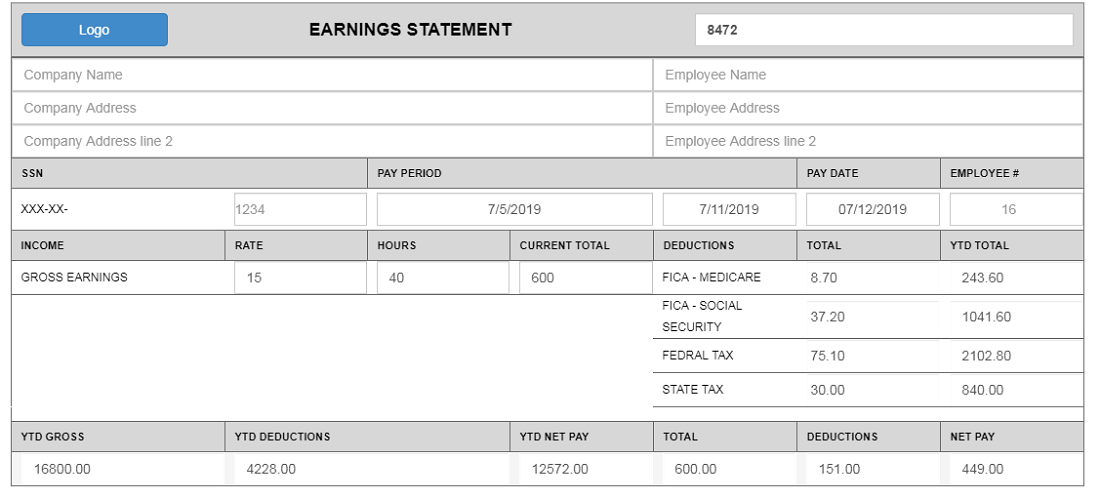

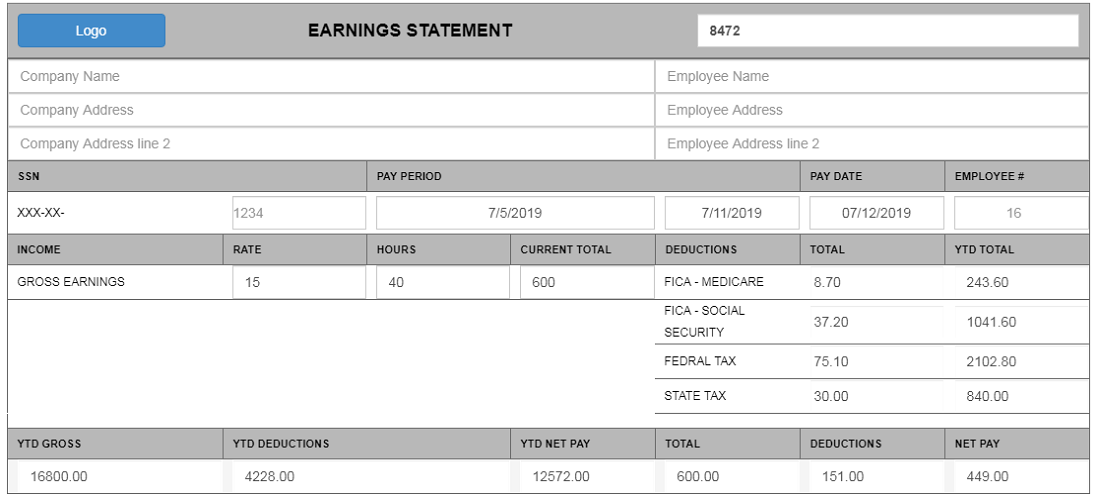

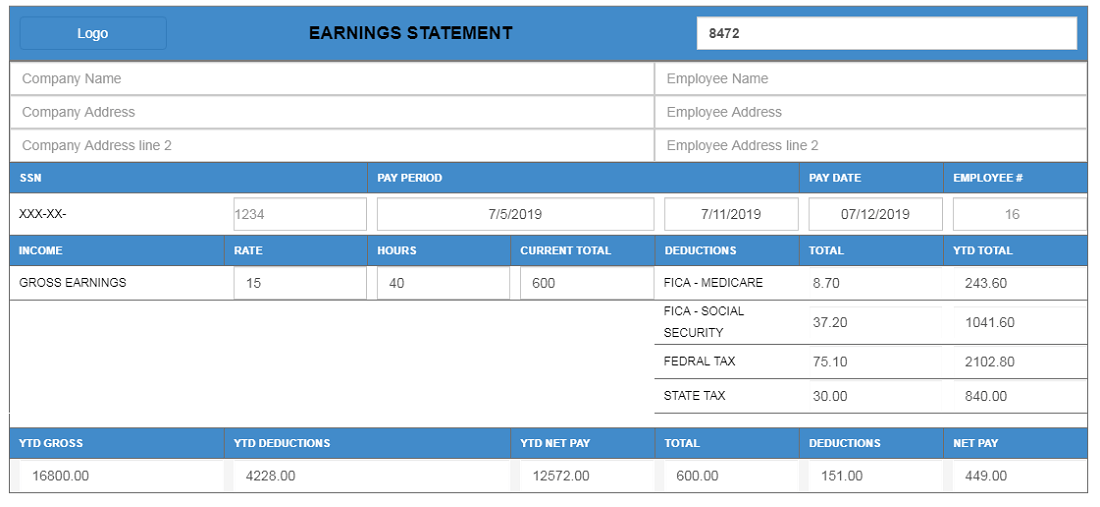

Form 1099 misc. is used to classify different miscellaneous sources of income and report them to IRS at the time of annual tax filling. Apart from the sources of income it also contains information like the payee’s name, payee’s address, and his/her social security number (SSN). It also has a column to specify whether the payee is an individual, proprietor, or an LLC form. All this information allows you to calculate your total annual taxable income and the amount of tax you are required to pay in the specific financial year.

The following different boxes display different types of incomes and payments:

Box-1: Rents

Under this section, the amount equal to or more than $600 is reported against various rental payments including rent for the land, office space, machinery, etc. The rent directly paid to the owner will be reflected in this section. Here, you can also enter the working interest against any payment.

Box-2: Royalties

Under this section, you need to report the payment made against any royalty. The amount of the payment should be at least $10 or more. It covers payments against the purchase of copyrights, patents, and trademarks.

Box-3: Other Income

Under this section, you need to report the payment against any prize or awards. You can also enter the prize amount that you have won as a winner of any game. These awards are irrespective of the services performed.

Box-4: Federal Income Tax Withheld

You need to report the amount of taxes withheld with you. Mention the total amount of backup withholdings that you have with you.

Box-5: Fishing Boat Proceeds

If you own a fishing boat, the amount received against its proceeds needs to be reported in this section. You should ensure that the amount paid should exceed $600.

Box-6: Medical & Healthcare Payments

Under this section, you need to report all the payments that you have made to any medical supplier against the purchase of any medicine or medical equipment. The amount of these payments should not be less than $600.

Box-7: Payer made direct sales of $5000 or more other than an established retailer

You need to enter the letter “X” under this section to display the direct sales of at least $5000. This sale should not include the sale to an established and permanent retailer. Ensure that you should not enter this amount in dollars.

Box-8: Substitute Payments in Lieu of dividends or interest

Under this section, you need to report the amount paid to any broker in lieu of dividends or tax-exempt interest. This amount should be $10 or more. The payment can either be made to any individual, partnership form, proprietorship firm, or corporation.

Box-9: Crop Insurance Proceeds

Under this section, you need to report the payment of $600 or more paid by an insurance company against the crop insurance.

Box-10: Amount Paid to Attorney

Under this section, you need to report the amount paid to the attorney of the firm or land against legal services. The amount paid should not be less than $600.

Box-11: Amount paid against Fish Purchase

Under this section, you need to report the amount paid against the purchase of fish or any other aquatic animal. If you are in any business or trade that involves the reselling of aquatic animals, you need to report this amount to the IRS.

Box-12: Section-409A Deferrals

In this box, you need to report your earnings on the current and prior years’ deferrals that are listed under section 409A.

Box-13: FATCA Filing Requirement

Box 13 is also known as the Foreign Account Tax Compliance Act (FATCA) filing requirement checkbox. You need to report whether you have to satisfy any accounting requirement under this chapter 14.

Box-14: Excess Golden Parachute Payments

In this box, you need to report the excess golden parachute payments over the last 5 years.

Box-15: Non-Qualified Deferred Compensation

Under this section, you need to report the payment mentioned in box-12, if the payment to a contractor doesn’t qualify under section-409A.

Box-16-18: State Tax Withheld, Payer’s State, State Income

If you have any state income tax withheld, then you need to report it in the boxes-16, 17, and 18.

What is the use of form 1099 MISC?

A 1099 misc. tax form is used to report your miscellaneous payment like rent, royalties, awards, prizes, payment to attorneys, etc. to the internal revenue service (IRS). It allows the IRS to compare the total payments with the income details reported by the taxpayer at the time of income tax return filing.

Moreover, it also helps you to keep a track of your total taxable income. Our online platform helps you to calculate your income and taxes automatically without spending much time on the manual calculations. It helps you to determine the accurate amount of the tax that you owe to the government in a specific financial year.

In what conditions do I need to file form 1099 MISC?

You should file a 1099 misc. tax form to report the following miscellaneous incomes or payments:

- A minimum amount of $10 royalties and broker payments against tax-exempt interest.

- Selling consumer products worth $5,000 to any party other than a permanent retail establishment.

- A payment equal to or more than $600 in the following situations:

- Rent

- Prizes and awards won

- Healthcare payments

- Crop insurance proceeds

- Resale of fishes or any other aquatic animals

- Payment against a national principal contract

- Payment to attorneys

- Proceeds from fishing boat

What are the exemptions against filing form 1099 MISC?

There are certain exceptional cases against filling a 1099 misc. tax form as reported by IRS standards. The following are some of the common specific exceptions against filing 1099 misc. tax form:

- You don’t need to file 1099 misc. form against a corporation and an S-Corp entity.

- If you paid the rent to any real estate manager or agent rather than directly paying it to the owner.

- Payments made via any credit card or debit card or PayPal account are not included in the 1099 misc. tax form.

- Payments made to tax-exempt organizations and certain government organizations.

- Payments made against the purchase of merchandise or freight charges.

- Payments made to the criminal informants.

- Payments against scholarships, foster care facilities, etc. are also not reported via 1099 misc. tax form.

Are there any penalties or taxes against form 1099 MISC?

Although, you are required to pay taxes on each income reported on the 1099 tax forms. However, receiving a 1099 misc. tax form doesn’t mean that you need to pay taxes on that income. Your taxable income may reduce by implementing the exceptions and offsets. A 1099 misc tax form is generally used to report your miscellaneous sources of income to the IRS. You might be the subject to penalties if you fail to file tax form 1099 misc. on time. The amount of penalty is lower for small businesses with a gross income less than $5 million.

Apart from failure to file form 1099 misc., you can be penalized for the following cases:

- If you file the tax form on paper, when you were supposed to file electronically.

- If you fail to enter the correct TIN.

- If you fail to use machine-readable red ink paper.

What are the due dates of filing form 1099 MISC?

The due date to send form 1099 misc. to the payee is 28th February of the coming financial year. However, it exceeds to 31st March in case of electronically filling 1099 misc. tax form.

It should be noted that these dates may vary from year to year depending on the weekends and holidays. For instance, if 31st March falls on a weekend or holiday, you can file the tax form 1099 misc. on the next upcoming business day.

Difference between 1099 Misc. and 1099 NEC tax form

1099 misc. and 1099 NEC both forms are amongst many 1099 forms that are used to report different types of incomes to the IRS. However, the only and major point of difference between them is the type of income they cover.

Tax form 1099 misc. is used for reporting payments that are not subject to self-employment taxes. These miscellaneous payments include rents, medical healthcare payments, prizes and awards, etc. On the other hand, tax form 1099 NEC reports the non-employee compensation payments that are subject to self-employment taxes. This form includes payments to independent contractors and freelancers for their services.

Other 1099 forms

Apart from 1099 misc. tax form, there are many other 1099 tax forms that are used to report different payments and purpose. We have listed some 1099 tax forms along with their specific purposes for your reference below:

- 1099 A: It is used to report acquisition or abandonment of the secured property.

- 1099 B: It is used to report proceeds from broker and barter exchange transactions.

- 1099 C: It is used to report the cancellation of the debt.

- 1099 CAP: It is used to report the changes in capital structure and corporate control.

- 1099 DIV: It is used to report dividends and distributions.

- 1099 G: It is used to report specific payments for government and legal purposes.

- 1099 H: It is used to report Health Coverage Tax Credits (HCTC) advance payments.

- 1099 INT: It is used to report income received through interest payments.

- 1099 K: It is used to report payments through cards and third-party transactions.

- 1099 LS: It is used for reportable life insurance scale.

- 1099 LTC: It is used to report long-term healthcare and accelerated death benefits.

- 1099 NEC: It is used to report non-employee compensation.

- 1099 OID: It is used to report original issue discount.

- 1099 PATR: It is used to report taxable distributions received from cooperatives.

- 1099 Q: It is used to report payments from qualified education programs.

- 1099 QA: It is used to report distributions from ABLE accounts.

- 1099 R: It is used to report distributions from pensions, annuities, retirement plans, profit-sharing plans, insurance contracts, etc.

- 1099 S: It is used to report proceeds from real estate transactions.

- 1099 SA: It is used to report distributions from an HAS, Archer MSA, or Medicare Advantage MSA.

- 1099 SB: It is used to report seller’s investment in life insurance contract.