Every check you get from your boss has personal expense derivations deducted from it. That is because of the way that both bureaucratic and state legislatures force personal expense all through the schedule year. This assists you with seeing exactly how much cash was made and how much went to charges in a particular set period. A W2 structure got in January 2021 for example, will mirror the pay and derivations of the year 2020.

This structure is typically conveyed to workers either as a printed copy or a W2 online no later than January 31st of every year except if obviously, that falls on an end of the week then it should be conveyed on the extremely next work day. There is an exemption for this also. On the off chance that you are a self employed entity or a consultant, you should finish up a 1099 misc structure without anyone else as that isn't a structure given out by a business for your administrations.

An entrepreneur should convey the W2 structure to both the worker as well as the IRS. There's not a lot to be finished with your W2 once you get it. To the IRS, the W2 structure is otherwise called worldwide return since it is conveyed to the different gatherings, fundamentally the accompanying.

- The National Government

- The State

- The Worker

What Does A W2 Frame Resemble?

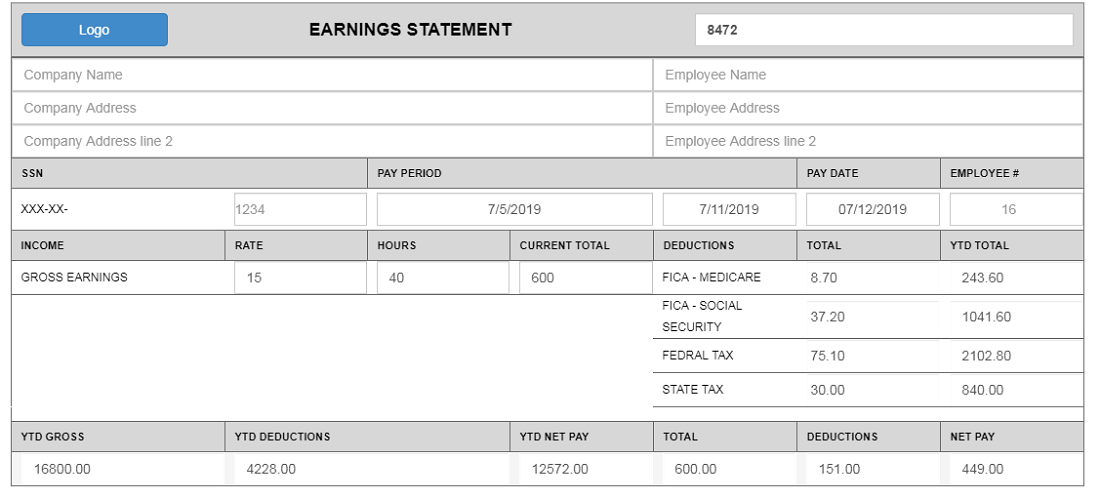

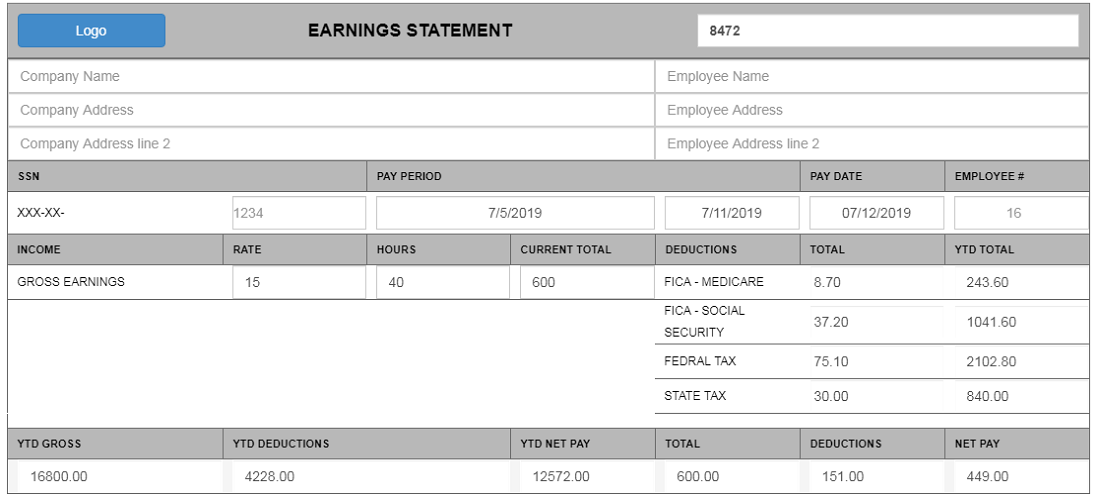

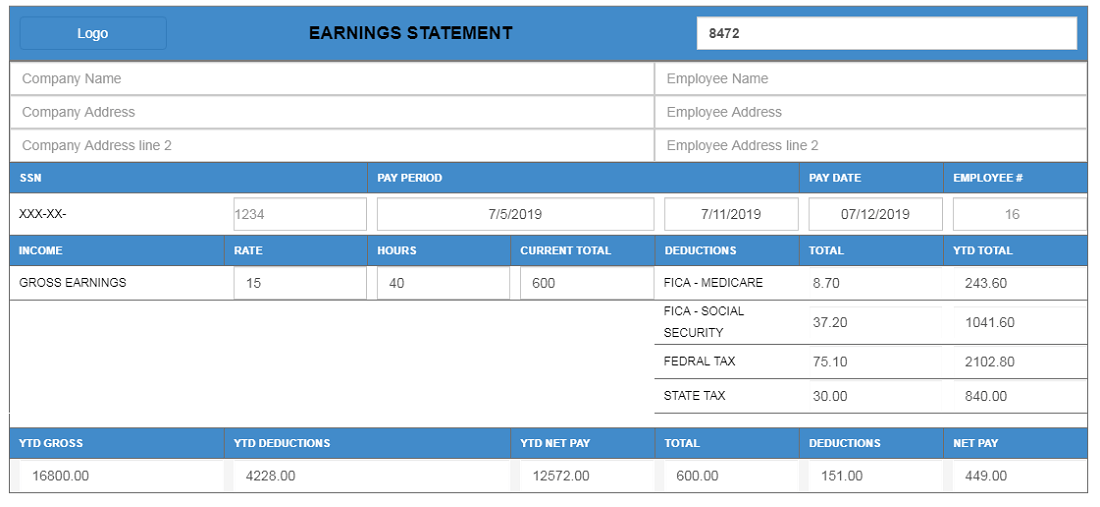

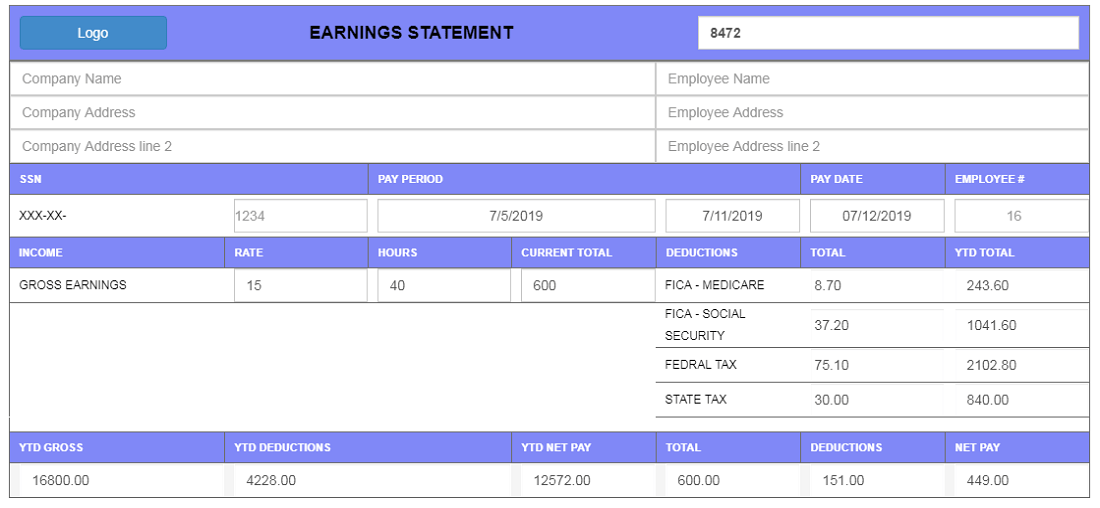

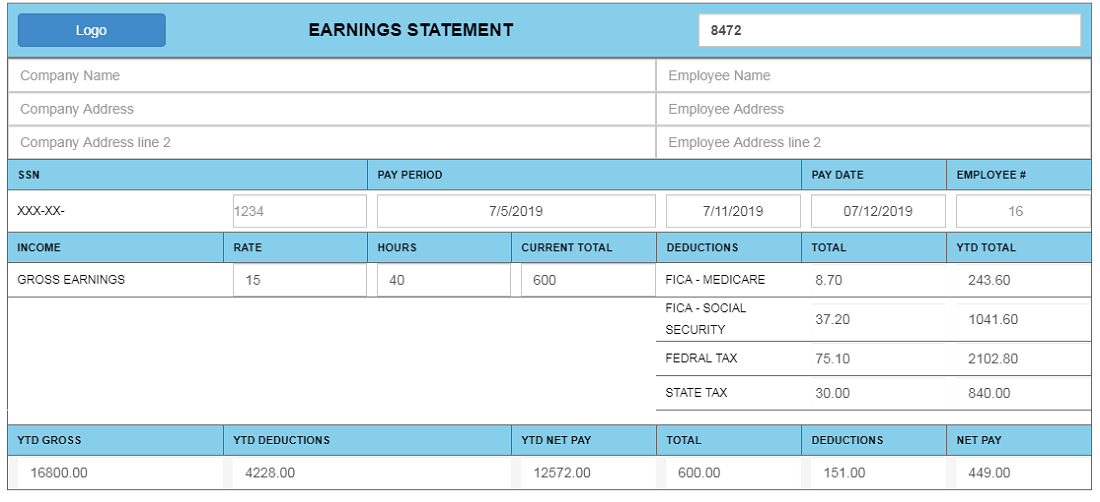

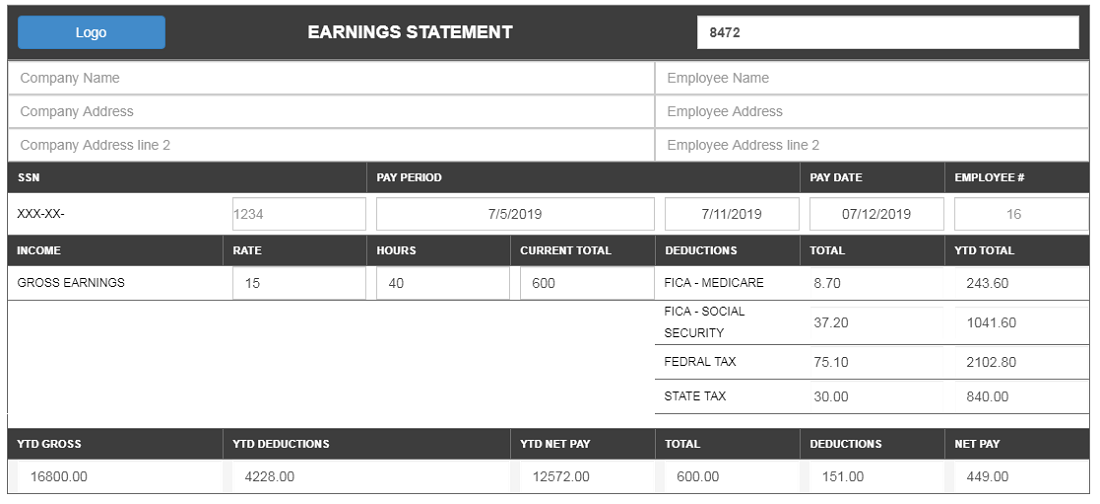

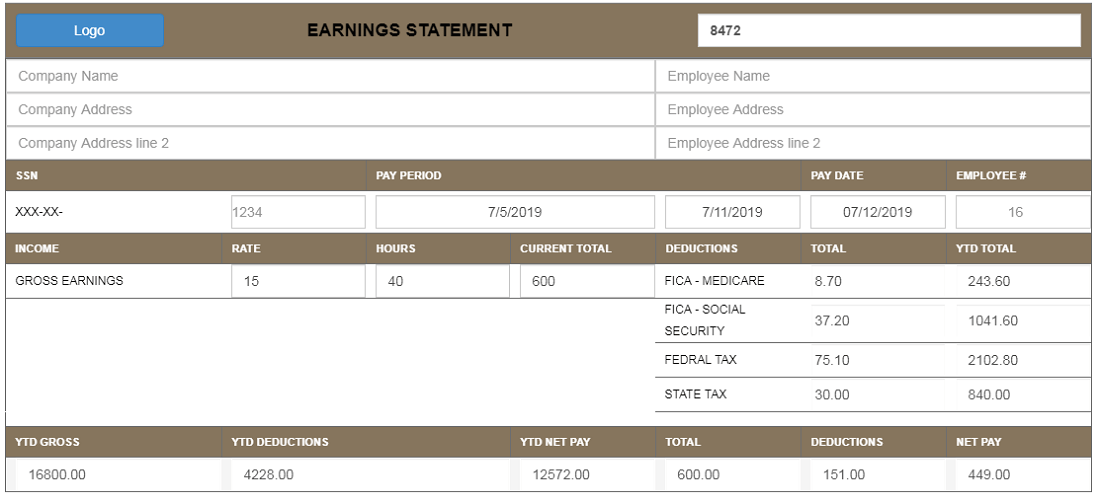

That far sounds very deterring right? We should separate it a piece further.What does a W2 pay proclamation seem to be? A structure W2 contains a lot of boxes, each referencing a piece of your income and portions. Having the option to comprehend these crates and their meaning permits you to appropriately and accurately convey the story on your government form structures.

Assuming for the situation that your structure W2 was sent to you and you didn't accept your W2 on the web, you can without much of a stretch tear it open. You will see various boxes loaded up with a wide range of data and contractions. How about we take the abbreviation AGI for example. Changed gross pay or AGI is an equation best depicted as complete gross pay less specific derivations. It is the most vital move towards finding your expense responsibility or the amount you owe the public authority.

You can likewise utilize AGI to decide different derivations. Some, deduct clinical costs yet you can do that assuming your clinical derivations surpass a specific level of your AGI. Figure out more about AGI and how you can ascertain it from your W2 structure. Underneath you will discover a portion of the cases found on your W2 structure examined with their importance initially.

- Box A - F: Incorporate Your Own And Business Data.

- Box 1:Shows The amount Of Your Pay During The Financial Year Was Available.

- Box 2 - 6: Show You Assuming Any Pay Was Kept For Government Or State Annual Assessment, Federal medical insurance, Government backed retirement Expense, And so on.

- Box 7 - 10:Rundown Things Like Tips, Repayments, Or Even Pay Credits.

- Box 13:Is Discretionary And Depends Assuming that You've Partaken In Your Boss' Retirement Program, Or on the other hand On the off chance that You Got Any Outsider Wiped out Pay.

- Box 14:Incorporates Any Extra Duty Data Your Boss Would See as Significant And Notice.

- Box 15 - 20:Incorporate State Annual Duty Data Fundamental.

Look at the full aide on the most proficient method to comprehend your W2 structure in more detail, to turn into an expert on this subject. Remember, that you should realize the aggregate sum of expenses kept before you can sort out whether or not you will return the money in question or need to make an extra assessment installment.

When Will I Get My W2?

The Very smart arrangement:

Preferably, a representative would get an envelope via the post office from his/her manager with the structure W2 encased or a W2 online by email. Generally, this is finished by or before January 31st. On the off chance that you have not accepted your structure W2 in time, you can contact your boss. If, by some coincidence, you have given them a few endeavors to consent, yet all to no end, you can raise this issue with the IRS and reach them straightforwardly at 800-829-1040.

The Past Boss Circumstance:

Whether you have exchanged positions, or as of late left your place of employment and moved to a completely separate space, it doesn't make any difference. You really want to get sufficiently close to the entirety of your W2 structures. Regardless of whether you relinquished your position a while back, your manager or past business is expected to send you a W2 structure via mail or a W2 online by a similar date of January 31 except if you explicitly request it prior. The organization then, at that point, has 30 days to give you your W2 structure.

Paystub Makers Circumstance:

If under any circumstance, you couldn't accept your structure W2 via mail or a W2 on the web, you can in any case get the required data to decide your available pay through a past compensation stub that you have gotten. Find out about working out your W2 compensation from a paystub in our brief video.

The W2 Creator Circumstance:

Allow us to accept that nothing from what was just mentioned techniques demonstrated productive. What could you at any point do then, at that point? A W2 producer can be your most ideal choice to document your expense form in time. Utilizing the W2 maker stage, you can make W2 online effectively and receive the rewards of an early expense discount. Help your W2 online today through our easy to use W2 generator. One record in and you'll most likely be filling your companions and partners in regarding the W2 maker. Simply look at our surveys page and perceive the number of people and organizations that make W2 online with our w2 generator.

Could I at any point Document Both W2 And 1099 MISC Structure?

In a standard situation, one would require a proof of pay to record an expense form. What happens then to people who have both a structure W2 online as well as a 1099 misc? Imagine a scenario where you are an independently employed citizen yet have gotten a W2 structure previously. This can build how much weight on people as though charge season isn't sufficiently upsetting yet you can definitely relax, continue to peruse.

A 1099 misc structure is a report made by the IRS to help any pay that doesn't come from a standard work. It fills in as proof that extra pay has been made. Pondering which structure to record? That is an extremely normal inquiry that has many responses yet the short one is, document both your W2 and 1099 misc structure. More is always better and the more archives you record, the better you stand with the IRS. It just shows that you are being industrious and don't have anything to stow away.

Sadly, all types of revenue should be referenced and recorded as needs be. Fortunately on the off chance that you get both these structures, you likely will not owe as much cash as somebody who just gets a 1099. An independently employed individual or specialist will have the cerebral pain of working out the amount they owe in charges precisely rather than somebody who gets a W2 on the web or a printed version.

How Would I Make W2 Online With A W2 Generator?

Hefting around a ton of duty stress and uneasiness? Let it go! Our focus on Paystubmakers is to ease you of any further pressure. Utilizing our W2 creator, you can do precisely that by effectively making and checking your structure W2 on the web.

You can likewise send your W2 online to the separate gatherings electronically. Isn't this choice a lot more straightforward than the option of sitting around idly for your manager? You can figure out how you can get your W2 online by means of different ways too in fact.

You can likewise assess the amount you owe in duties and how much was removed from your check for the set year. This choice likewise assists a great deal of organizations hoping to smooth out all of their finance records and even save them for later use or basically for reference.

There are many reports that you want to keep or deliver come charge recording time simply don't confound a W2 structure with a W4 structure. They are very unique. A W4 structure is what you fill toward the start of your work at any association. This is where you enter your conjugal status, the quantity of wards, expected tax reduction as well as expected allowances.

Documenting out the W4 structure as precisely as conceivable is vital. Any misstep can make you wind up owing more duties when you record your return. Note that you can present another W4 structure to your HR office whenever assuming anything in your circumstance changes. In any case, thinking about what makes them unique? Look at the full aide on the significant contrasts between a W2 structure and a W4.

Do Organizations Report Organization Health care coverage Inclusion For Workers?

Organizations, philanthropies, and public substances are completely expected to give medical coverage to their workers under a gathering wellbeing plan. This shows that they have agreed with IRS guidelines. On the off chance that a business has under 25 full-time workers, they could be qualified for a private company medical services tax break. This is a drive from the IRS to assist with the expense of giving inclusion.

In the event that nonetheless, the business has less than 50 full-time representatives, they might be qualified to purchase inclusion through the Private venture Wellbeing Choice Program (SHOP). Businesses should record worker medical services benefits on the W2 structure be it in printed copy structure or a W2 online inside Box 12 with code DD.

As per the AICPA, all business elements should report the absolute organization health care coverage cost of all gathering plans. Such gathering plans could incorporate, self-guaranteed, contributed a rate to the business, as well as manager supported wellbeing inclusion. This incorporates immediate, aberrant or some other types of medical coverage.

People and relatives should know that most states expect Americans to have qualifying medical coverage or possibly the absolute minimum. Implementing this permits people with ongoing circumstances to not worry about each of the concerns of the actual installment. Each state has an alternate arrangement of rules with regards to medical care.

Ensure you are consistent with the medical services laws of the state where you dwell. Figure out what your medical care plan means for your government form in the different situations gave so you have a healthy comprehension of the subject and you don't get tricked without any problem.

What Are The Punishments To Keep an eye Out For While Neglecting To Consent to The IRS?

Organizations and business substances should keep an eye out for the strong punishments that could come crashing down on them in the event that they are not agreeable with the IRS rules and proposition least fundamental medical care. Organizations should give evidence of inclusion to 95% of their workers and their wards at some random month.

The IRS issues fines for each month that a representative has not gotten a proposal of inclusion. More dollars down the channel yet it doesn't need to be like this. Luckily, entrepreneurs can stay away from the problem and the overwhelming punishments by understanding the ACA detailing necessities and precisely revealing medical coverage.

Huge organizations who don't consent to the ACA wellbeing inclusion rule should pay a robust aggregate. Businesses are really not expected to work out the common obligation installment on any assessment form that they record. Be that as it may, the IRS will mail them a paper posting all of their duty responsibility and give them a potential chance to answer or fight back before they request installment to be made.

Concerning individual punishments and fines, you should constantly make sure that you are in full consistence with the standards of the state you live in as well as the IRS guidelines or you should plan to have to deal with certain fines and severe damages. The absolute most normal punishments include:

- Inability To Record On Time Or By The Expansion Time Allowed.

- Inability To Cover Duties Revealed And Owed By Their Due Date Of April 15.

- Inability To Make good on Unreported Expense Or At the end of the day Didn't Settle An adequate number of In Charges.

- Disrespected Check Because of Deficient Assets.

Fortunately you might meet all requirements for punishment help. You should simply show proof that you have put forth every cognizant attempt to consent to every one of the necessities important yet were as yet incapable to meet the expected duty commitments. This should be because of specific episodes that were beyond your control.

If you get a notification from the IRS, make certain to check all the data on it cautiously and confirm it. On the off chance that you can determine any issue on your notification, your punishment may not be relevant to you any longer! You can likewise look at the punishment request report and remain in the loop. At last a reason to have some hope.

What Do I Do Assuming I Lost My W2?

Perhaps of the most well-known human mistake in the US is losing a duty report, one being the W2 structure. To that end the vast majority suggest utilizing a W2 on the web. People who have a missing w2 or a lost w2 could confront a couple of entanglements with the IRS particularly on the off chance that they do exclude and record the missing report co me charge time. There are a couple of ways you can resolve this issue.

Contact your past boss

Request that they send or resend the W2 FORM to you via mail or email so you can keep your W2 on the web

Contact your past manager

Request that they send or resend the W2 structure to you via mail or email so you can keep your W2 on the web

Contact the IRS

Notice that you have lost your report and record for an expansion. You can apply for an expansion that normally goes on for quite a long time. You can do this by visiting the IRS site and utilizing the free record to e-document the augmentation. Moreover, you could likewise remote structure 4868 for a programmed expansion to document your government form. Ensure you send it in by or before the 12 PM of April 15.

Use the W2 maker Stage

Make W2 online today and save yourself the desk work bother. Utilizing a W2 generator can assist you with keeping away from additional punishments too since you can make your report with perfect timing for charge documenting.

Remember that the IRS could punish you for deficient government form recording or even late documenting. Documenting your expense form late could bring about a month to month punishment. That is the last thing you believe should do as it influences your FICO rating adversely and starts the excursion of your aggregating obligation.

On the off chance that over 60 days have passed you actually have not recorded, be ready to pay a heavy aggregate. The IRS could force a cruel punishment going somewhere in the range of $135 to 100 percent of your neglected duties for any of the above circumstances.

Your smartest option is to record every one of your reports on time. The assessment form date is expected April fifteenth of each and every year. Prepare of time so you don't fall into superfluous obligation and punishments. Remember that the IRS could defer handling your return until it confirms all the data.

What Do I Do Assuming I Have Multiple W2 Structures?

Here is an intriguing truth, the most recent examinations have shown that Americans have hit an unsurpassed record high of having at least 2 positions. It is assessed that in excess of 13 million Americans have various positions and side hustles. That is a great number.

Having at least 2 positions can likewise be overwhelming since you without a doubt will have a ton of obligations and commitments at work and at home. Indeed, there is the question of various W2 structures that you want to consider. This can add a couple of additional means come charge time since you should give all of your W2 structures from each and every work you kept or still hold inside a fiscal year.

Having your W2 structure provides you with a precise report of how much cash you made in a given year. Its motivation is to give you, the IRS, the state and central government with your pay, assessment, and allowance data. This assists the IRS with deciding if you get a liberal expense discount or conceivably owe more in charges. Hopefully it's the previous one!

Subsequently and a common guideline of thumb, you should join all of your W2 structures from every business. So what occurs in the event that you neglect or just don't record your structure W2 on the web or via mail?

Indeed, the uplifting news is, on the off chance that you documented your expense form, with a w2 missing, you could get a return. If in any case, the expense documenting appears to be obscure like you attempted to disguise some data and you owe more in extra assessment then you should promptly petition for a revision and pay the duty owed no later than April 15 to stay away from late punishments and pointless charges.

Whether you are an individual, top of a family, money manager, or organization proprietor, remain in the loop of duty news and keep away from unnecessary expenses by perusing our useful blog segment or in any event, looking at our paystubs creation administrations. Maybe you could select one of our paystub layouts to finish charge recording in time and get your get back quicker.

Our records make it simpler for you to change to an all the more harmless to the ecosystem choice of electronic exchange as opposed to printing and squandering paper. All things considered, we are all in the race towards feasible turn of events.

W-2 Form Generator – FAQs (USA)

1. What is a W-2 form?

A W-2 form is an official IRS tax document that reports an employee’s annual wages, tips, and taxes withheld by an employer in the United States.

2. Who needs to generate a W-2 form?

U.S. employers must generate W-2 forms for every employee they paid wages to during the tax year. Employees use W-2 forms to file their federal and state income taxes.

3. Can I create a W-2 form online using this generator?

Yes. Our online W-2 form generator allows you to create accurate, IRS-style W-2 forms quickly by entering employee wage and tax information.

4. Is this W-2 form generator compliant with U.S. payroll standards?

Yes, the generator is following the standard U.S. payroll and IRS formatting guidelines which includes the required W-2 boxes for wages, federal tax, Social Security, and Medicare.

5. Can employees use this tool or is it only for employers?

This tool is available for both employers and employees. Employers generate W-2 forms, meanwhile employees can preview or get to know how W-2 wage and tax information is structured.

6. Can I use the generated W-2 form for tax filing?

The generated W-2 form is meant for accurate reporting and reference. For official filing, it is always necessary to check that the information entered is correct and corresponds to your payroll records.

7. What information is required to generate a W-2 form?

The following information will be required:

- Employer name & EIN

- Employee name & SSN

- Annual wages

- Federal, state, Social Security & Medicare tax amounts

8. Is my information secure when using the W-2 generator?

Absolutely. The handling of your data is secure, further no unnecessary personal information is stored beyond the form creation process.

9. Can I download or print the W-2 form after creating it?

Certainly, the W-2 form can be printed and downloaded once created for record-keeping or distribution purposes.

10. What is the difference between a W-2 and a 1099 form?

A W-2 is for employees and includes tax withholdings while a 1099 form is for independent contractors and does not show withheld taxes.