Why is a Partnership Agreement required?

In the absence of a partnership agreement, the partnership regulations and statutes of the state would apply, which may not be appropriate in your situation. For example, if one of your partners leaves or dies, your partnership may be automatically dissolved. Second, in the absence of an agreement, your state rules may dictate the allocation of earnings and debts of your partnership, which may be unjust to partners who have invested more funds or effort in the partnership.

A partnership agreement lets you avoid the automatic application of state partnership regulations, allowing you to specify and protect your rights and responsibilities as a partner. It would also aid in the resolution of disagreements among the partners concerned, as the substance of oral partnership agreements may be difficult to prove or ascertain.

Sample Templates

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

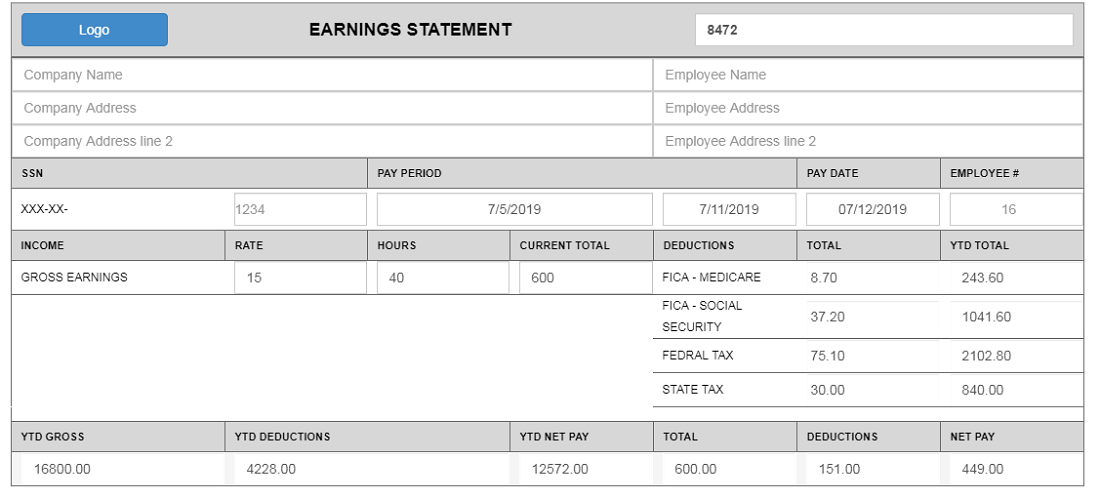

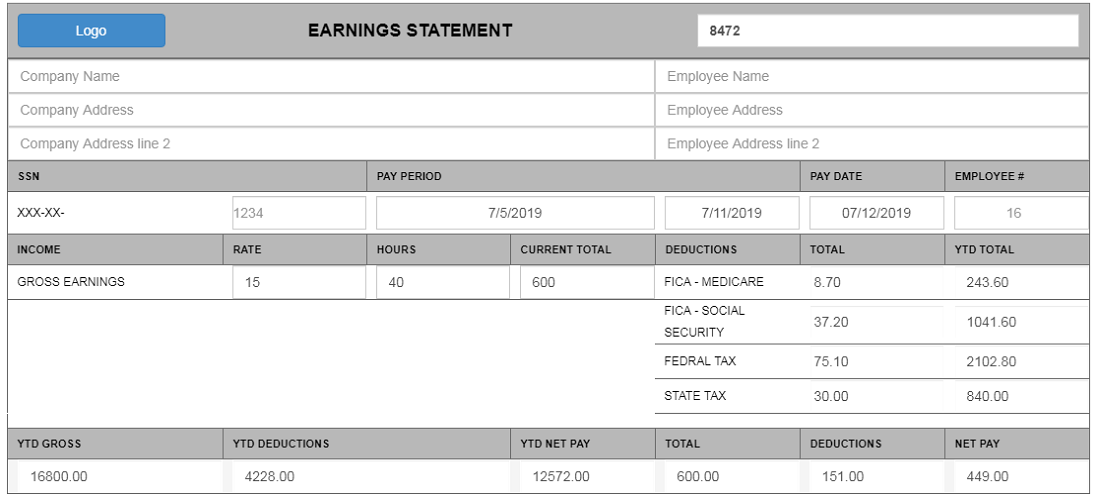

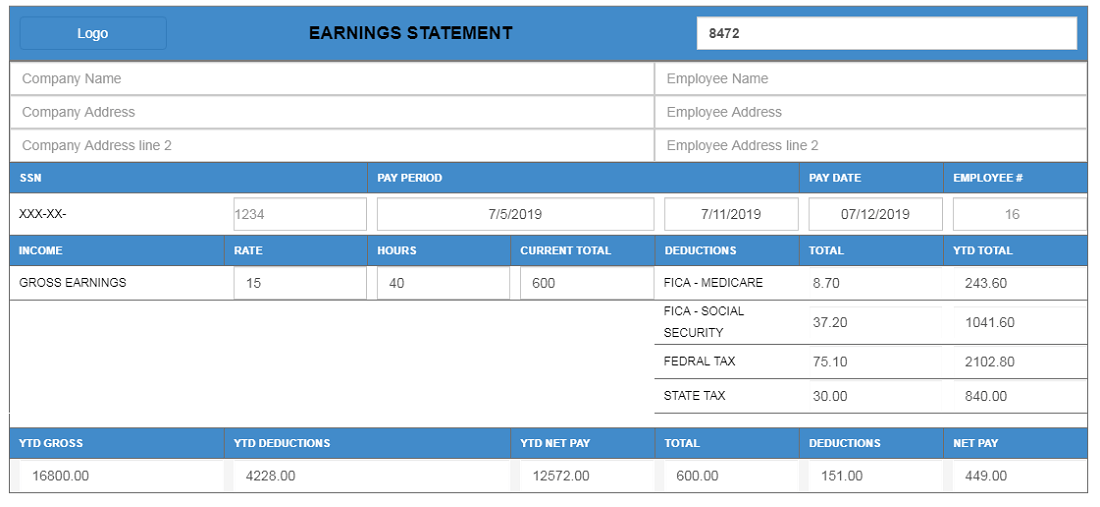

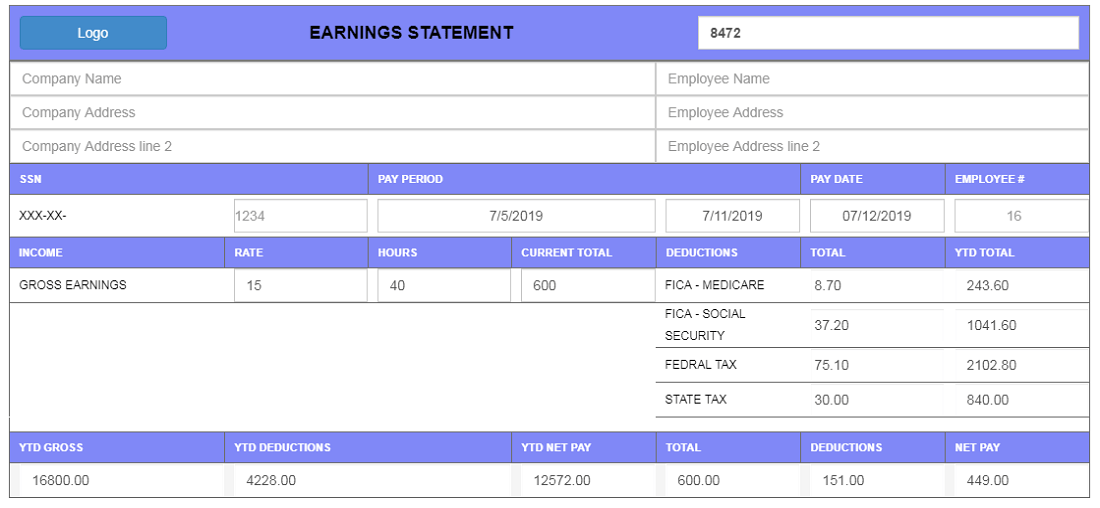

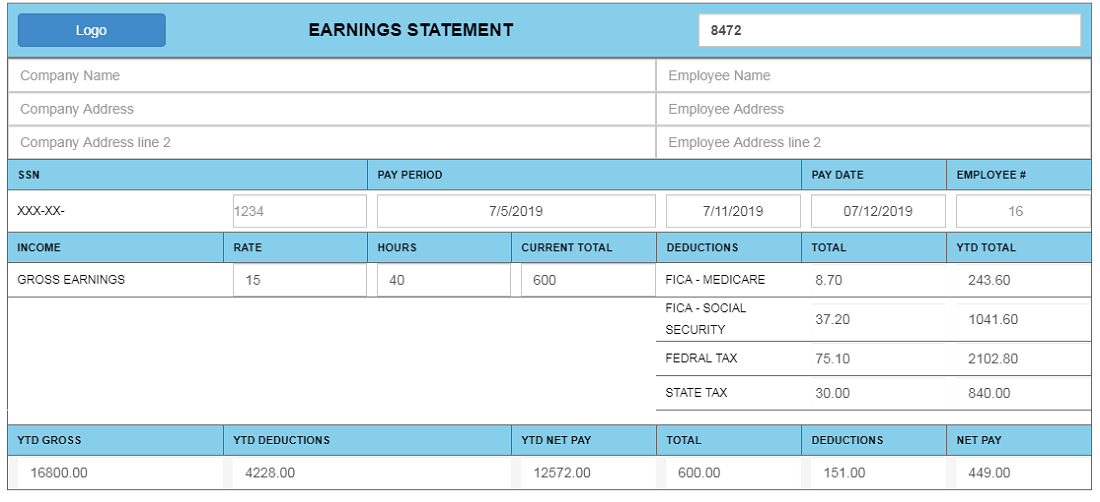

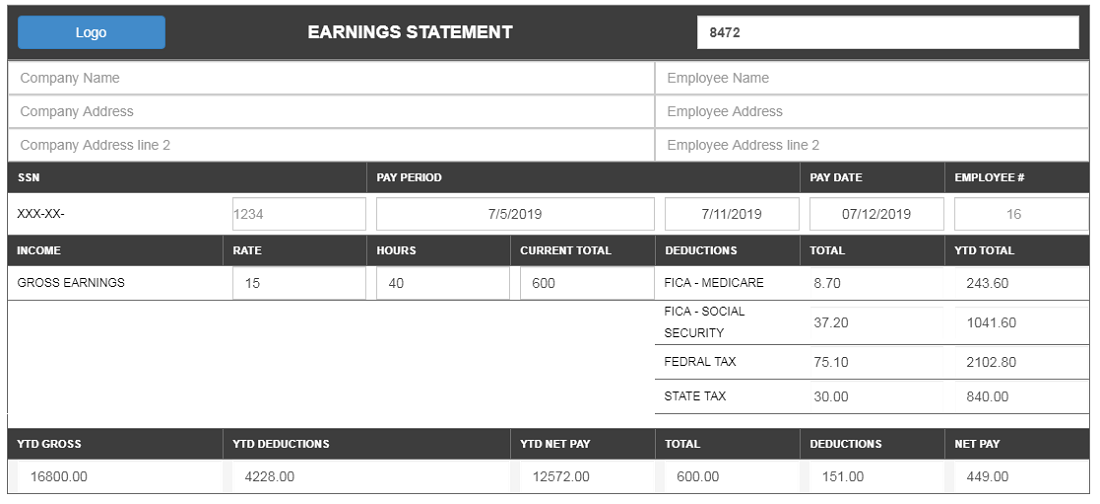

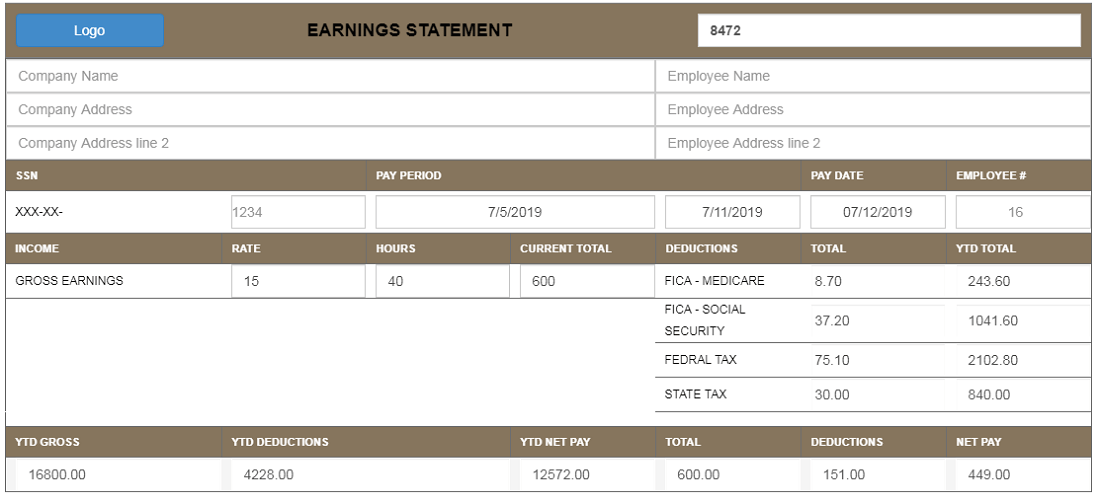

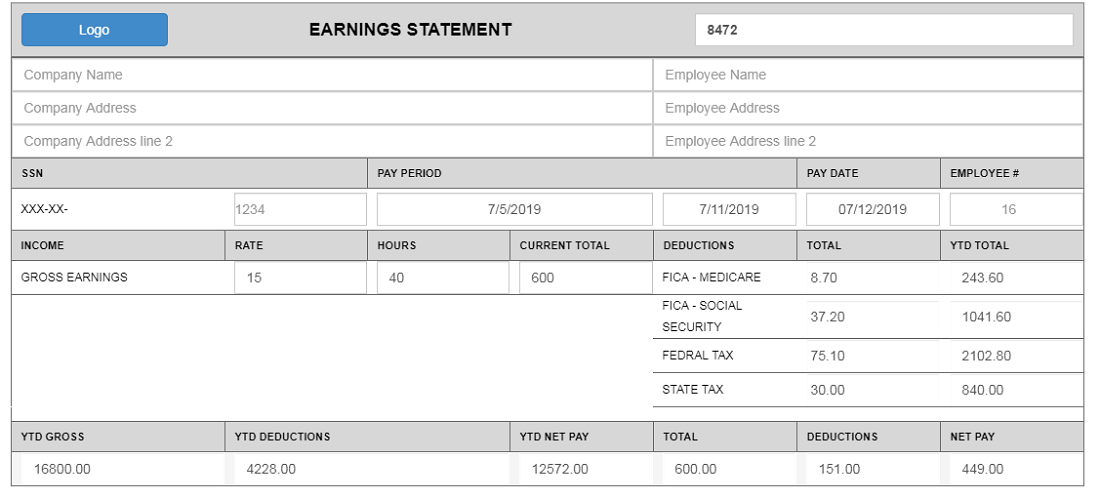

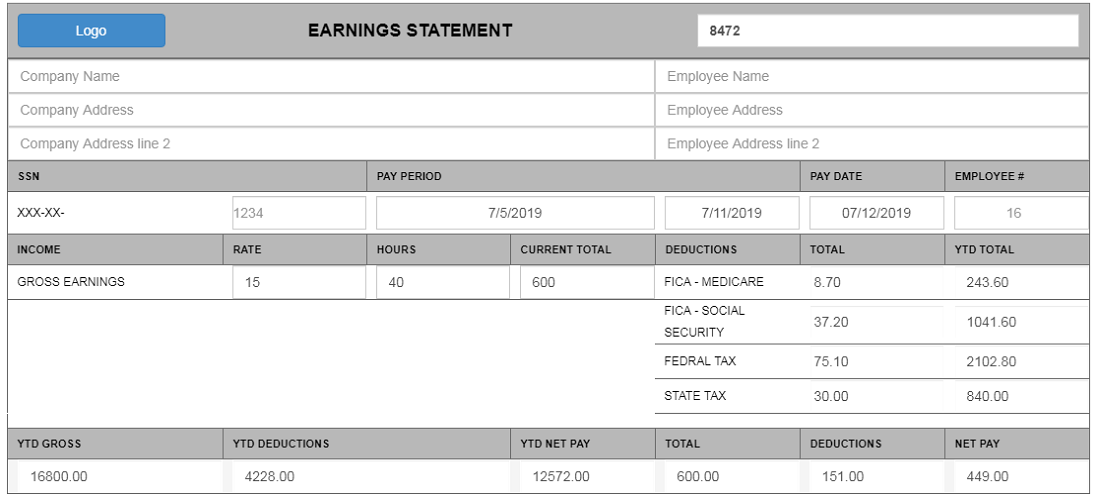

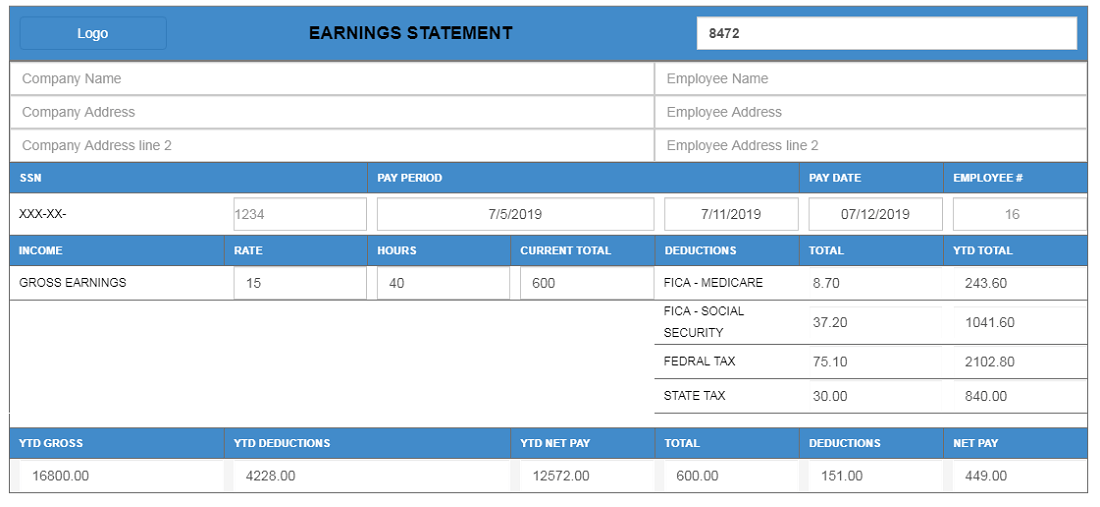

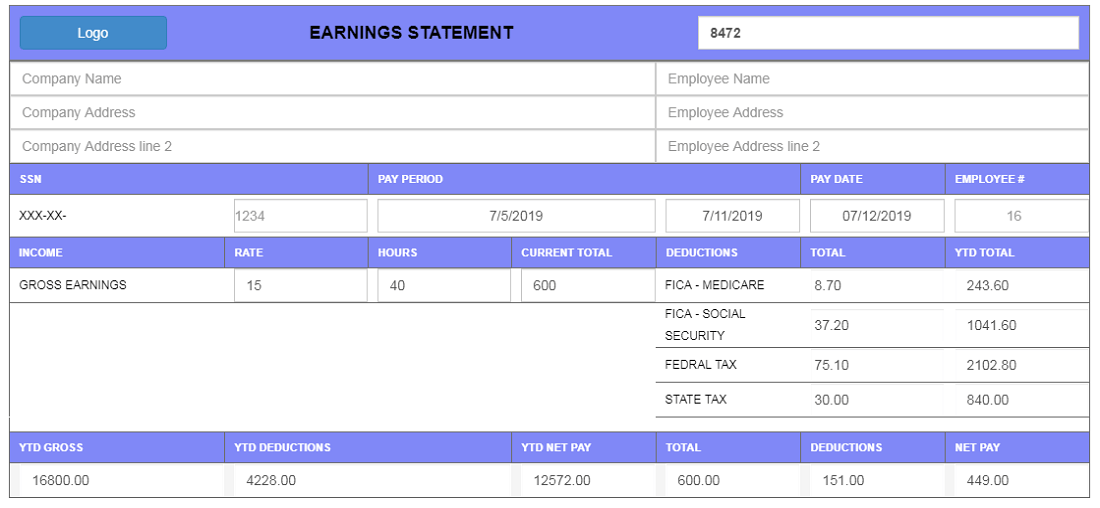

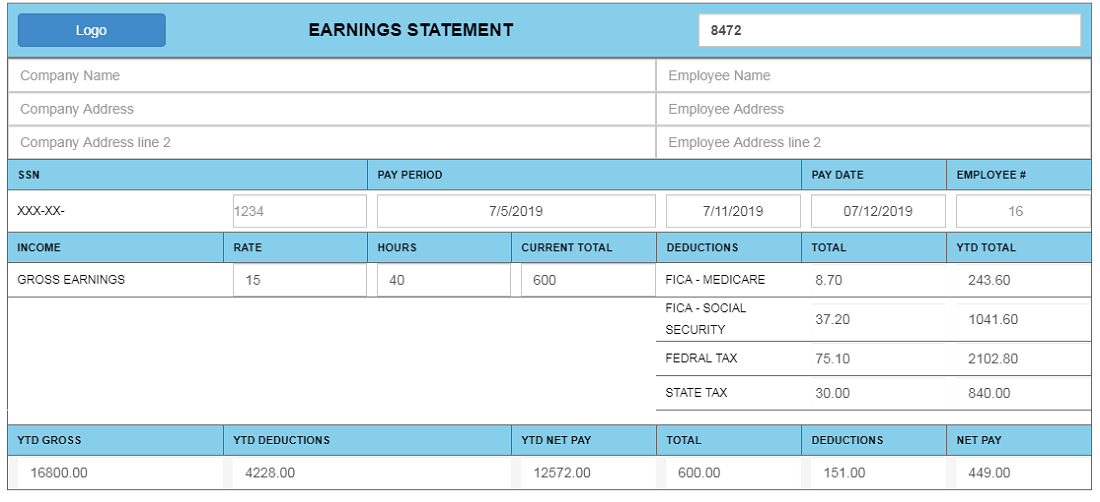

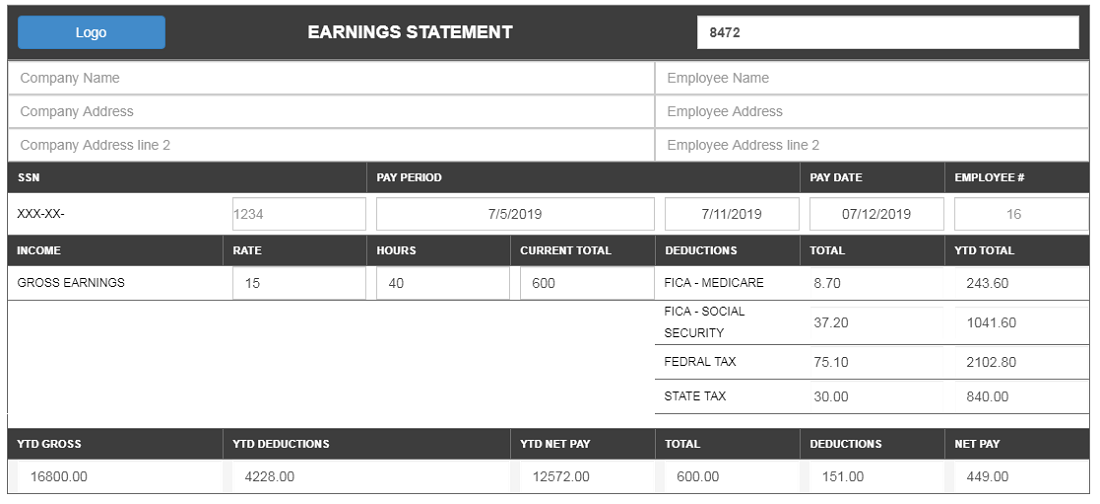

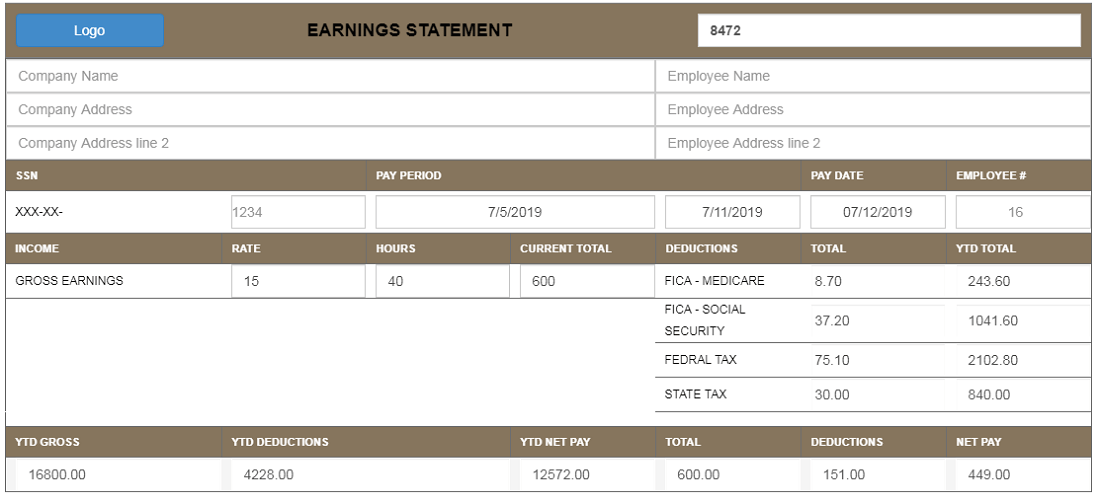

This is a sample paystub.

The watermark will be removed once you’ve made the payment.

When should you use a partnership agreement?

While partnership agreements are not required to be in writing, it is preferable not to miss preparing and signing a formal agreement for your partnership. Consider a circumstance in which you give the majority of the capital or do the most of the work, but you only receive an equal share of the partnership profits in the absence of proof that you were expected to receive more. When you collaborate with other individuals or entities in a business, a partnership agreement can help you prevent such a situation and limit the variables and unknowns.

What are some of the most typical blunders to avoid?

While it may be tempting to rely on trust alone when forming a partnership with a relative or childhood friend, forgoing a written partnership agreement or relying on informal provisions can leave you vulnerable. A legal conflict can swiftly arise, altering the dynamics of your disagreement and leading to unforeseen consequences.Common disagreements arise when one spouse grows unsatisfied with carrying a greater share of the obligations or when the couple's personalities are incompatible.

Of course, serious contractual errors would include failing to properly define or include any of the following:

- Each partner's contributions;

- Each partner's partnership interest;

- The voting and implementation mechanisms required to carry out partnership decisions (especially if there is a dispute);

- Provisions relating to how a partner can willingly quit or be pushed out of a partnership, as well as how a partnership can be dissolved.

Are there any deadlines or times when this form must be completed?

It would be desirable to have a formal partnership agreement before the partnership begins; oral contracts are nearly impossible to prove due to their very nature.

What are the key components of this form?

A partnership agreement generally includes the capital contribution of the partners, the division of labor and responsibilities between them, the partners' share of the partnership's profits or losses, and provisions relating to the partnership's management. The following are some of the essential requirements:

A partnership agreement must include the names and contact information of its partners.

The partnership's name, purpose, place of business, governing state, and date of formation should all be clearly stated.

A partnership agreement should specify the partners' initial capital contributions as well as their agreed-upon ownership percentage.

A partnership agreement should also specify how the partners will share the partnership's earnings and losses (whether equally, on the basis of capital contribution, on the basis of ownership stake, or on the basis of some fixed percentage).

Other key provisions in the agreement would be how a partner can voluntarily leave or be ejected from the partnership, the firm's books, audits, accounting methods, and clauses relating to the dissolution of a partnership and its accompanying ramifications.

What is the most straightforward approach to writing a Partnership Agreement?

Given the intricacy and multiple parts of a partnership agreement, using an easily fillable and intelligent legal template is the ideal method to design one. It would be quite easy to make mistakes or overlook essential stipulations on your own.

Why should you use our partnership agreement maker?

Paystub Makers user-friendly legal template form can assist you in quickly creating a customized partnership agreement for your company. All you'd have to do is answer a few simple questions about your proposed collaboration, and our clever template would build your collaboration agreement for you.

This is unquestionably easier and more convenient than the risk of preparing the agreement on your own or employing an expensive lawyer.

Do I need to hire a lawyer, accountant, or notary?

Consultation with a lawyer, accountant, or notary is not required for a Partnership Agreement.