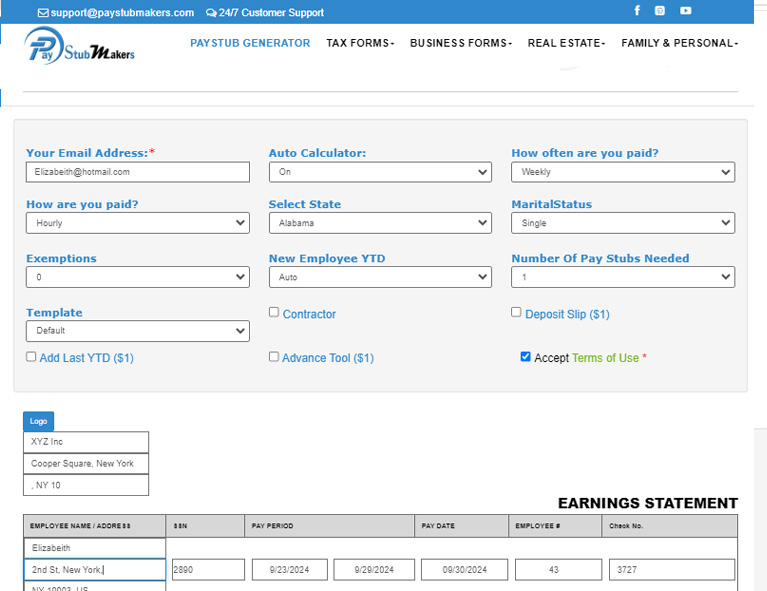

Our paystub makers has an extremely easy-to-use interface that makes online paystub generation very easy.

With our online pay stub generator, you are just a few clicks away from generating a professional pay

stub for your employees. Here are the three simple steps that you need to follow for hassle-free

generation of the pay stubs online:

Step-1: Fill

Initially, enter all the required information including your company name and payment details.

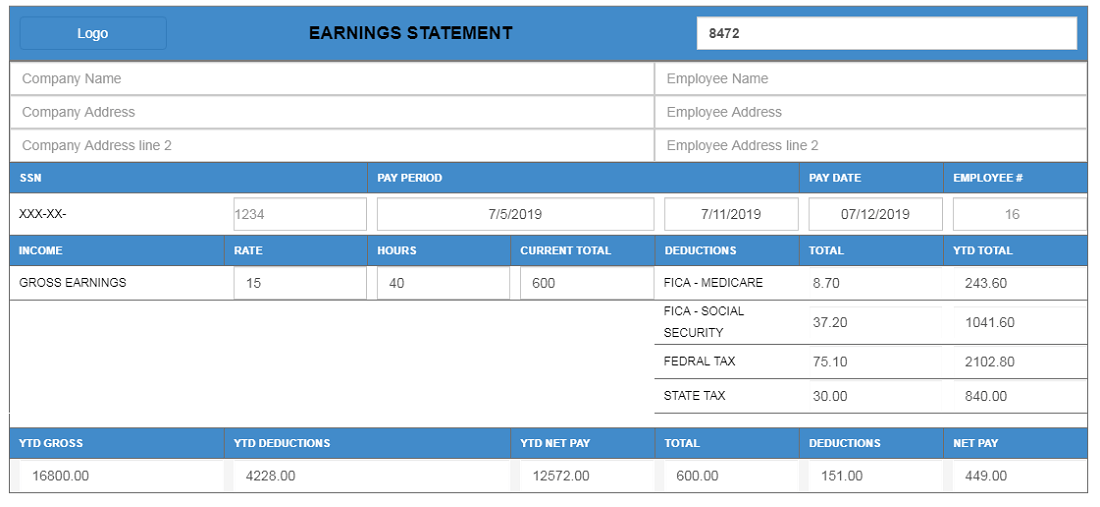

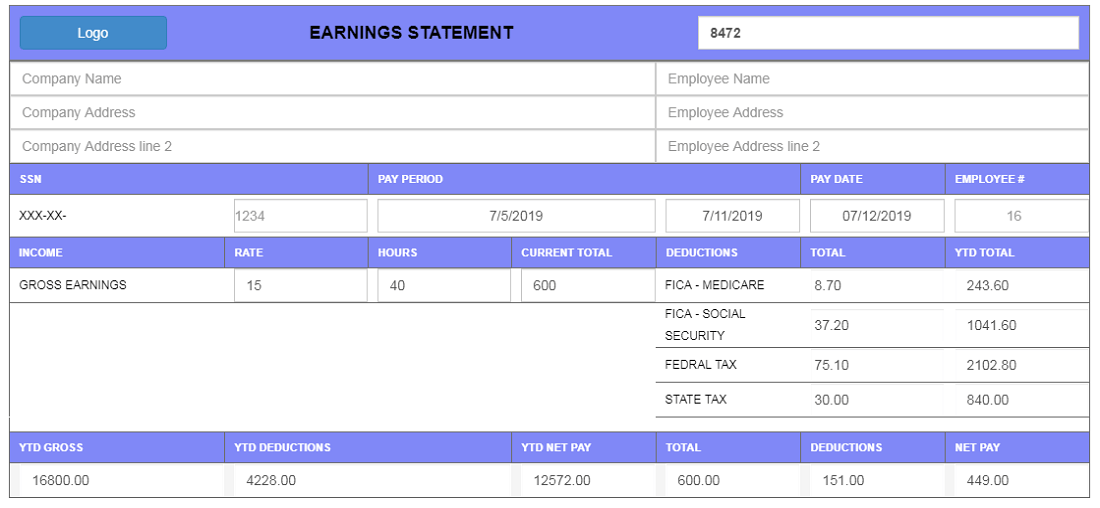

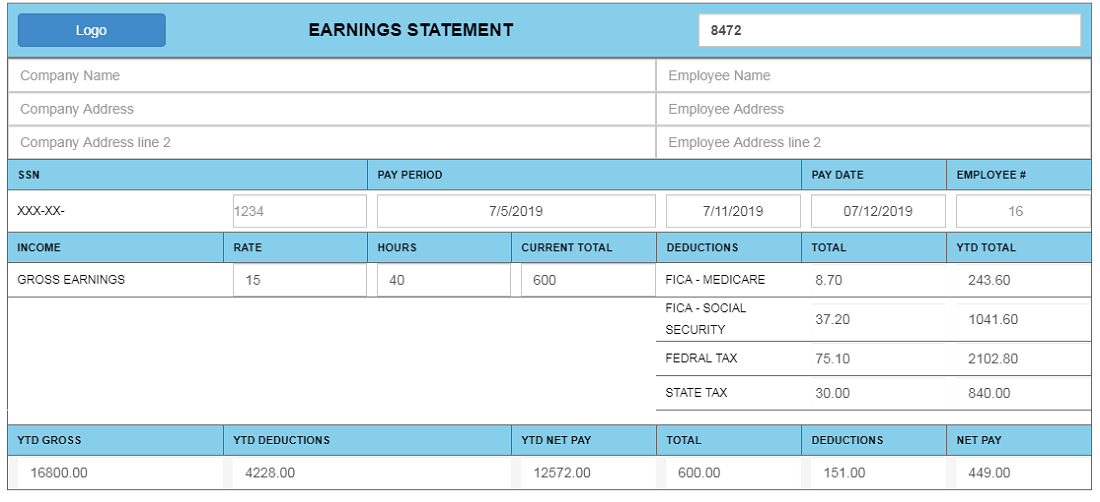

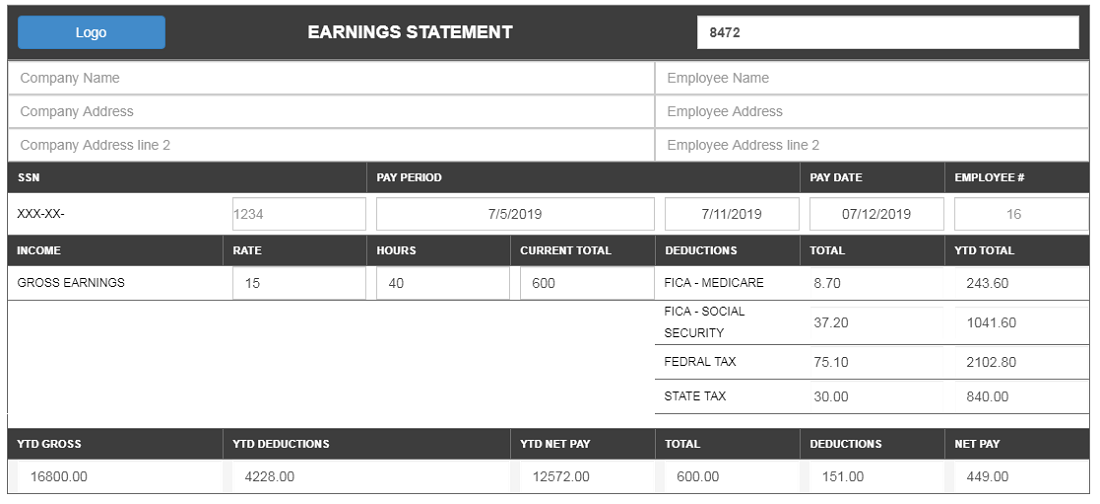

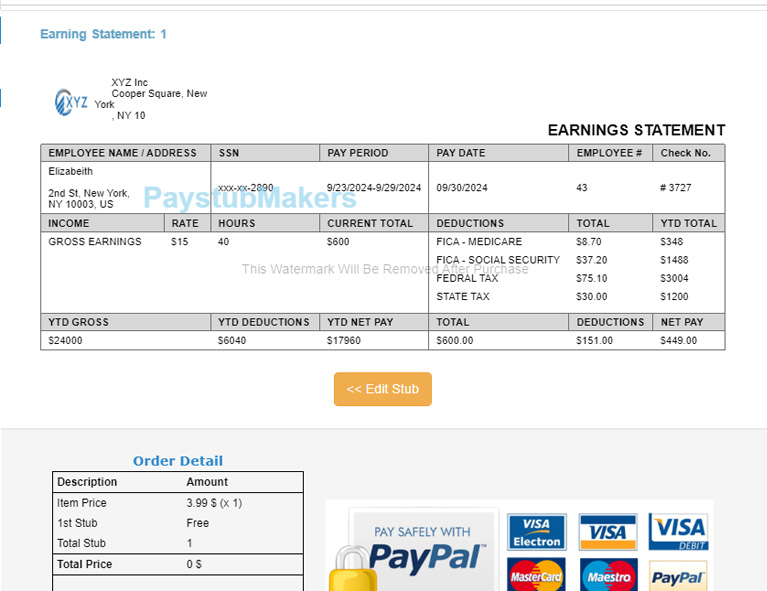

Step-2: Preview Next, select the theme, preview your pay stub, and edit if required.

Step-3: Print Finally, download and print.

Also read A Guide to Pay Stubs for Rental Applications : How to Provide Proof of Income ?:

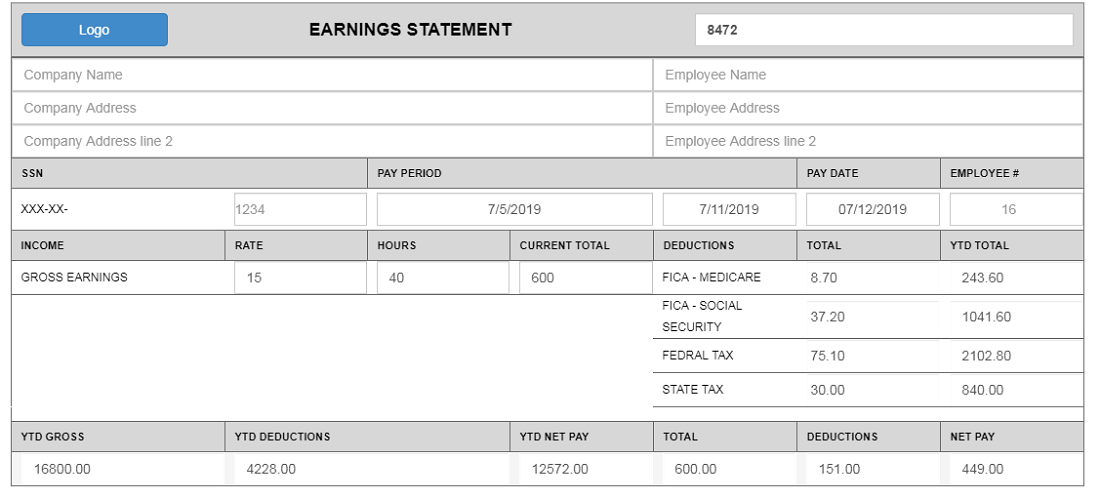

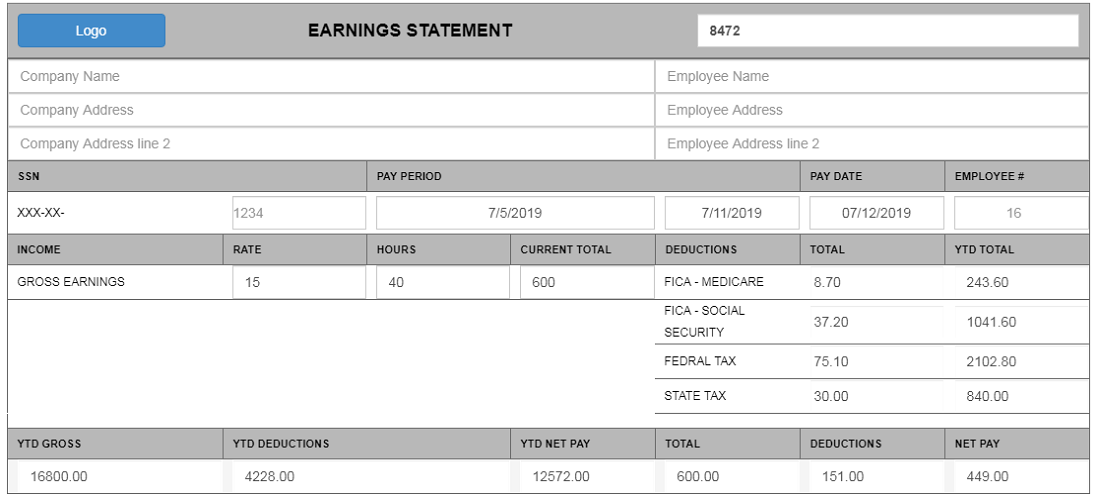

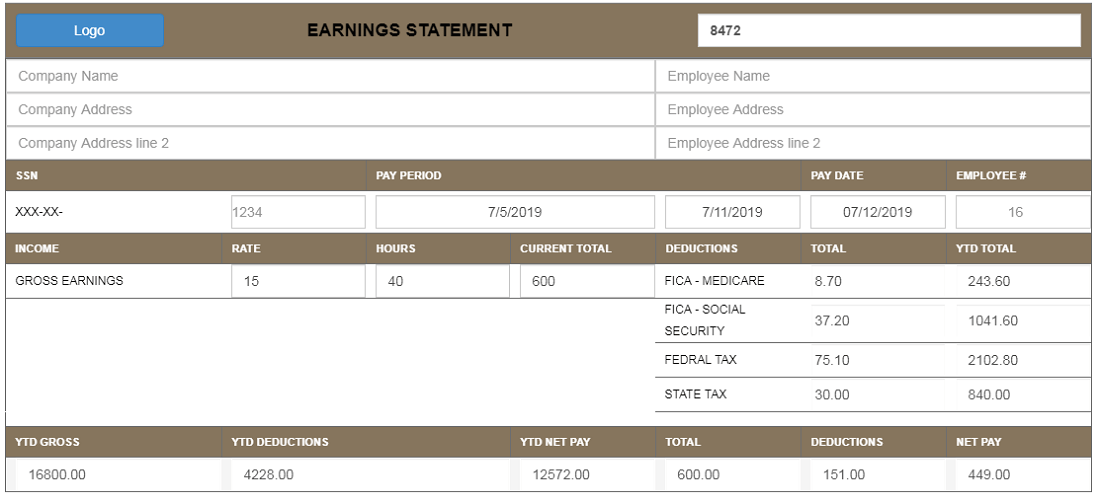

Elements of a Pay Stub

Understanding your pay stub is essential for managing your finances and ensuring that you are accurately compensated for your work. A pay stub, also known as a paycheck stub or earnings statement, is a detailed document provided by an employer that outlines an employee's earnings and deductions for a specific pay period. Here are the key elements of a pay stub:

1. Employee Information

This section includes:p

• Name: The employee's full name.

• Employee ID: A unique identifier assigned to the employee.

• Address: The employee's current address.

2. Employer Information

This section includes:

• Company Name: The name of the employer or business.

• Company Address: The employer's business address.

• Contact Information: Phone number or email address for the employer’s payroll or HR department.

3. Pay Period

This specifies the timeframe for which the employee is being paid. It typically includes:

• Start Date: The first day of the pay period.

• End Date: The last day of the pay period.

4. Pay Date

The date on which the employee receives their paycheck.

5. Earnings

A detailed breakdown of the employee's earnings, including:

• Overtime Earnings: Additional pay for overtime hours worked.

• Bonuses: Any extra compensation awarded.

• Commissions: Earnings based on sales or performance.

6. Deductions

This section outlines the amounts deducted from the employee's gross pay, including:

• Taxes: Federal, state, and local taxes.

• Social Security: Contributions to the Social Security fund.

• Medicare: Contributions to the Medicare fund.

• Health Insurance: Premiums for health, dental, or vision insurance.

• Retirement Contributions: Deductions for retirement savings plans, such as a 401(k).

7. Net Pay

The amount of money the employee takes home after all deductions >have been subtracted from the gross pay. This is also known as "take-home pay."

8. Year-to-Date (YTD) Totals:

This section provides cumulative totals for earnings, deductions, and net pay from the beginning of the year up to the current pay period.

Perks of having a pay stub

There are many advantages of having a pay stub other than it being a proof of income. As an employee,

a pay stub can be useful for to handle the following situations in your day to day life:

Loan application: While applying for a loan whether personal or business, you need to show your proof

of income. The banks approve the loan amount on the basis of your current financial status and ability

to repay the loan. A pay stub helps them to check your financial stability before the approval of the

requested amount.

Large purchases like buying a land, house, or a car: As an employee, when you plan any large purchase

like land or car, you are required to show your recent pay stubs. These pay stubs act as a guarantee that

you have the ability to pay future installments without any fail.

While renting an apartment: Have you a found a good apartment? You might need to show your recent

pay stubs along with your ID proofs as a security.

To claim the compensation: Federal and state government has made worker’s compensation law to

help them in case of any on-site accident. However, you need to present your pay stub as a proof of

your employment and income to claim the allotted compensation amount.

Tax filing: A pay stub always keeps you aware of the recent changes in the tax laws. Moreover, you

might need your pay stub to file your income tax returns and complete other formalities properly.

Visa application: A pay stub is also used as a proof of income at the time of visa application.

Benefits

Our

paycheck stub calculator is an easy and professional tool that helps you to keep a track of your

monthly finances and use it as your

proof of income. Our

pay stub generator offers you the following

benefits:

Accurate Tax Calculations: With our Online pay stub generator, you don’t need to worry to about manual tax

calculations and errors. It helps in accurate and state-specific tax calculations.

Free Customizable Templates: Our pay stub generator allows you to choose from many professional

looking customizable templates according to your preferences.

Customize According to your Needs: With our templates, you can easily add or deduct earnings like

bonuses, overtime, employer contribution, etc. according to

industry needs.

Create Multiple Stubs: It allows you to create multiple stubs at a time and saves your time to enter the

details repeatedly.

How Do Small & Medium-Sized Businesses Handle Employee Payroll?

Managing payroll is a big task for small and medium-sized businesses (SMBs). According to Deloitte, 54% of SMBs have payroll errors due to manual processes and it costs time and money.

Let’s say a small retail store with 10 employees. They used to use spreadsheets for payroll and it would lead to tax miscalculations and late payments. After switching to payroll software like Paystub makers, they streamlined tax filings, automated direct deposits and reduced payroll processing time by 70%.

Here’s how SMBs do payroll:

1. Payroll Software: Tools are affordable and simplify calculations, tax compliance and employee payment processing.

2. Outsource Payroll: Partner with a payroll service to reduce errors and compliance.

3. Monitor Staff Hours: TSheets for hourly employees

SMBs can focus on their operations, save time, and prevent errors by doing this.

Advantages of online pay stub generator for small businesses

As a business entity, it is a difficult task to manage everything manually. An online pay stub generator

helps the employers to keep record of the salary they distribute. It offers countless benefits to small

businesses and startups; we have mentioned some of them below:

Less paperwork: Online pay stub generation reduces the manual paperwork and record-keeping. It

makes it easier to maintain online records of all the transactions of salary distributions. It helps at the

time of government audits, as the access to any of your digital transactional records is just a couple of

clicks away.

Less time consumption: As an employer, making pay stubs for all your employees manually can be

highly time consuming. Our online pay stub generator allows you to generate multiple paystubs within a

few clicks and lesser time consumption.

Less chances of error: Errors are common when entering the information and calculating the deductions

and contributions manually. Online pay stub generation also eliminates human error while calculating

taxes and deductions. Moreover, it also aids in keeping you updated with all the latest laws and keeps

you out of every legal trouble in the future.

Creates professional document: With our professional looking and easily customizable pay stub

templates you make your company documents look more professional and presentable. These

customizable templates allow you to design your pay stub document that goes well with your company

requirements. Moreover, it also gives you the freedom to choose what to enter and what not.

Easy to Use: An online pay stub generator allows you to create multiple pay stubs easily with just three

simple steps. All you need to do is setup your pay stub template and enter the legal and required

information. Our online pay stub generator will do the rest from calculations to record-keeping.

Above all, it also cuts down your cost of hiring a professional bookkeep to maintain the payroll documents and transactional records.

Is pay stub similar to a paycheck?

Many people confuse between a pay stub and a pay check. However, both the documents have a very

sleek line of difference that actually changes their meaning. A paycheck is the original signed check that

can be converted into liquid form of money. An employer gives your monthly payment in the form of a

paycheck. Employers can either give a paycheck to the employee or they can directly deposit it in the

employee’s account online.

While on the other hand, a pay stub is the proof of the income that you have earned. It is a document

that is given to the employee along with their paycheck. It contains all the information regarding your

salary earned like taxes, deductions, compensation, bonuses, employer contributions. Working period,

etc. The verification of all these details on a pay stub prevents any future problem and legal issues with employees and contractors.

How to calculate Your Pay Instantly with Our Free Paycheck Calculator ?

Paystubmakers make managing your finances simple, efficient, and accurate. Whether you are a freelancer, employee, or employer, our free paycheck calculators tools will help you calculate your net income, deduction, and taxes in a couple of seconds.

Our Salary calculator tools

Paystubmakers provides you with a couple of tools to let you calculate your salary effectively.

Take a look at these tools:

- Paycheck calculator: Our free paycheck calculator is a tool that estimates your take-home income after taxes and other deductions.

- Hourly employee calculator: Our hourly employee calculator is another tool that can help you calculate the hourly charges of your employees.

- Salary employees calculator: Our salary employee calculator helps you calculate your take-home salary and gross or annual salary.

Why chooses Paystubmakers ?

Save Time: Paystubmakers help you save time as it allows you to know your net income in a few seconds.

Free and easy to use: You can get your result instantly just by entering your details even without paying a single penny through our Free Paycheck Calculator.

Secure & Private: We understand the importance of privacy and security. Therefore, we focus on keeping your data safe.

Start calculating Today : Paystubmaker excels in calculating your salary effectively. So, we recommend you begin your calculation with our Free Paycheck Calculator.

Is there any law that mandates giving a pay stub to an employee?

Till date there have been no federal that indicates that it is mandatory to provide your employees a pay

stub as an employer. However, according to the Fair Labor Standards Act, it is mandatory for the

employers to keep a record of their payment cycle.

Online pay stub generator is a great choice to keep pace with this rapidly increasing digitization in the

world.

Can I have a fake pay stub?

Yes, some employees can get a pay stub by photoshopping and or any fake pay stub generator. Fake pay

stubs are becoming more common these days and are hard to identify. However, the companies and

audit teams can easily spot the fake pay stubs with the data entry and spelling mistakes. If caught with a

fake pay stub you might get into a trouble. Possessing a fake stub is a punishable offence and results in

the following consequences:

- You might lose your job.

- Your loan application won’t be entertained.

- You might be jailed for 5 years in case of fraud.

- You can be charged serious penalties and heavy fine.

- Your personal image and reputation will be at stake.

Use our legitimate online pay stub generator to avoid getting caught into any of these tough situations.

It has a user-friendly interface that allows you to generate a professional looking pay stub within a couple of seconds.

How to Identify a Fake Pay Stub?

A fake pay stub is hard to identify. However, you can identify a fake pay stub by focusing on the

following points:

Missing Information: Examine the pay stub thoroughly, to spot any crucial information missing from the

pay stub.

Formatting Issues: Misaligned rows and unstandardized fonts are the major signs that are used to

identify a fake pay stub.

Excessive Rounding Off: A legal document contains accurate calculations up to the smallest decimal

point. Excessive and unnecessary rounding of figures is a sign of a fake pay stub.

Why is it necessary to provide a pay stub to the employees?

Although you are not bound to provide a paystub as an employer. However, pay stub distribution is

beneficial for both employees and employers. As an employer pay stub generation helps you keep the

records of all your payroll transactions. It helps you at the time of tax audits. It prevents the verbal

questions of your employees regarding the deductions and saves you from the trouble of answering

them. It maintains the transparency among the employers and the employees. It also assists the

employers to fill the W2 form for their employees.

A pay stub is highly beneficial for an employee as it acts as a proof of his regular income and displays all

the details of his monthly earning. It proves to be an important document for loan application,

purchasing a property, or renting an apartment.

Also read : How to Provide Proof of Income ?

For how long am I entitled to keep a record of my pay stubs?

It is necessary to keep a record of all your pay stubs for at least a period of 5 years as an employer. It

aids in the company audit sessions. However, for an employee it is important to keep a record of his pay

stubs for at least 12 months or until the time of tax filing.

What do the numerous abbreviations mentioned on the pay stub mean?

You might notice a number of abbreviations for various tax deductions on you pay stub. We have

mentioned some common tax deduction abbreviations and their meaning below:

401(k): It is a retirement plan in which the employers deduct a fixed amount from your monthly and deposit it in your retirement account.

EIN: EIN stands for Employer Identification Number. It is a 9-digit government issued number. You can also locate it on your pay stub by the abbreviation FEIN (Federal Employer Identification Number) and FTIN (Federal Tax Identification Number).

FED: It refers to the federal tax deduction from your monthly pay. Federal taxes are generally based on you hourly wage rate of earning.

FICA: FICA stands for Federal Insurance Contributions Act. According to this act, a fixed sum of your monthly pay is deducted to aid your Medicare and Medicaid account.

Gross: The gross amount refers to your gross pay. It is the amount that you agreed to work on before any tax deductions. It is your monthly earning prior to multiple deductions implemented on your salary.

ST: ST refers to the state taxes deducted from your monthly pay. These taxes possess some similarity to federal taxes.

YTD: YTD refers to the Year-to-Date format. These are variable figures that show the amount of your

annual earnings and deductions on your pay stub. These figures change regularly with the passage of

each year.

OT: OT refers to the overtime earned by the daily wage employees. It is generally calculated at 1.5 times

of the fixed daily wage rate. Any daily wage employee working more than 40 hours a week is paid OT as

per government norms.

Data Privacy

An employee can discard his pay stubs after completing the tax filing procedures. A pay stub contains

very sensitive and confidential information of the employee. The theft of this sensitive information can

lead to serious issues like identity theft and harassments. So, an employee should always be mindful and

act wisely while discarding his pay stub.

It is always advised to shred a confidential document to ensure the security of personal and confidential information.

Pay Stub Generator as a Productivity Tool

As an employer, you might be always looking for effective and efficient ways to increase the productivity

of the company. Our online pay stub generator is here to satisfy your business needs and increase your

productivity with less time and money consumption.

It aids smart work by eliminating lengthy and manual procedures involved in the pay stub generation

procedure. It allows you to handle your payroll affairs efficiently without the need of hiring any payroll

agency or dedicated personnel for the same.

Our pay stub generator is legal and compliant that helps you to avoid getting into any legal issues. It

makes your pay stub generation tasks automated and streamlines your payroll documents quickly.

Moreover, it copes with today’s digital needs and allows you to share the pay stubs electronically.

With automatic tax calculations, it aids in eliminating the human error and making it an accurate document while tax filing.

Use our online pay stub generator to satisfy and simplify your business needs.

Solving Payroll Challenges: Practical Pay Stub Strategies to Boost Business Efficiency

Payroll management is key to any business. According to the American Payroll Association, payroll errors cost companies 1-8% of their payroll per year, unnecessary expenses and frustration.

For example a mid size retail company had high employee turnover due to payroll errors. Pay stubs would show incorrect deductions and create mistrust. After implementing payroll software that automated pay stubs and calculations they reduced errors by 90% and employee retention by 25% in 6 months.

Try this:

Standardize Pay Stubs: Every stub should have gross pay, taxes, deductions and net pay.

Use Payroll Software: Paystubmakers.com makes calculations and compliance easy.

Educate Employees: Explain pay stub details to them regularly to build trust and transparency.

By pay stubs you can save costs, retain talent and improve operations.