Is it possible to handwrite a promissory note?

Although a promissory note can be written by hand, it is not advised. This is because it is frequently easier to add material to a handwritten document after the fact, even if both parties did not agree on it.

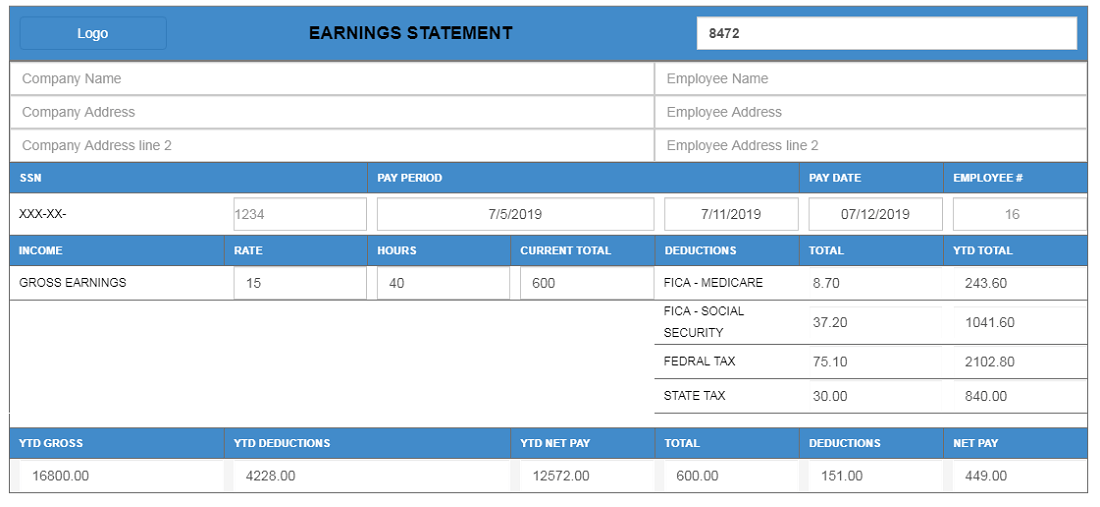

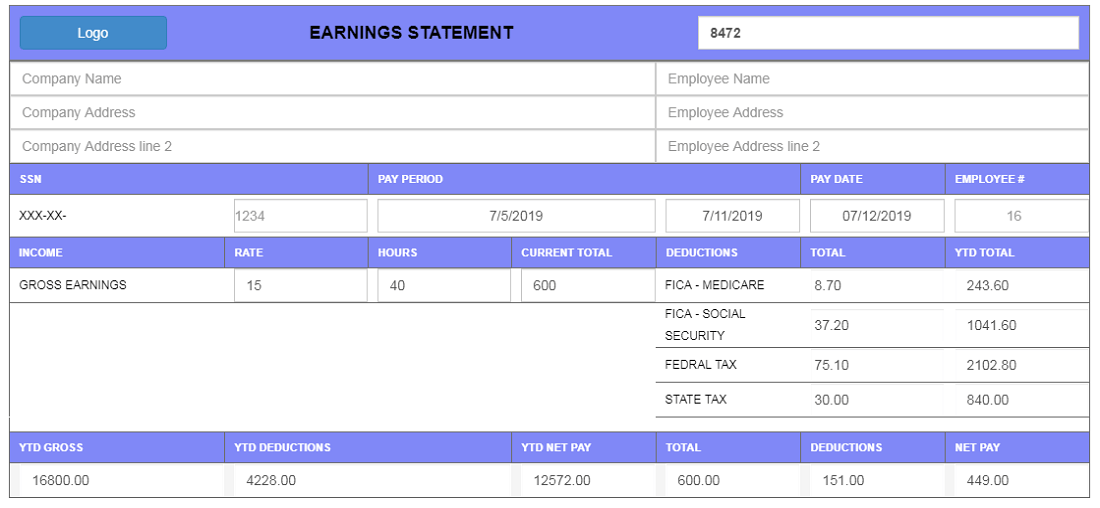

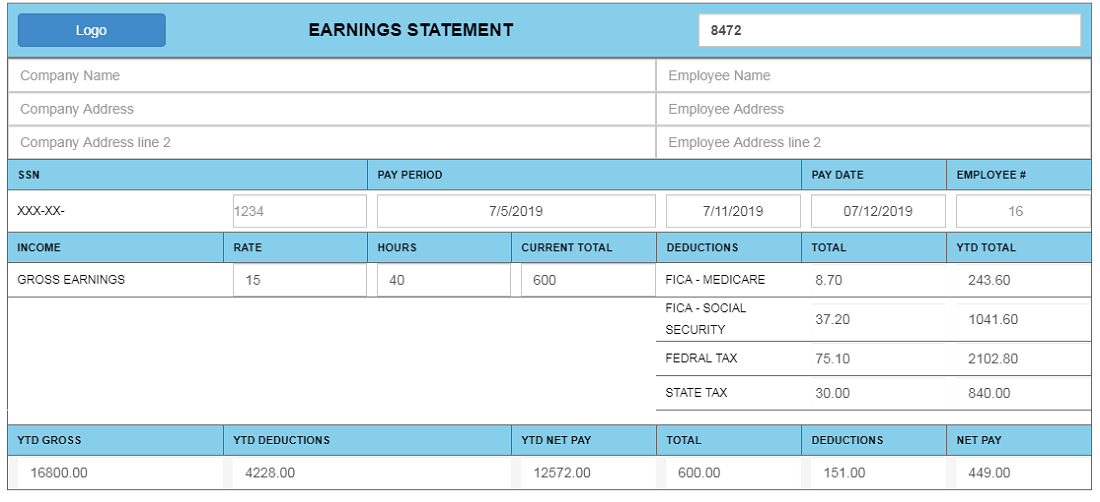

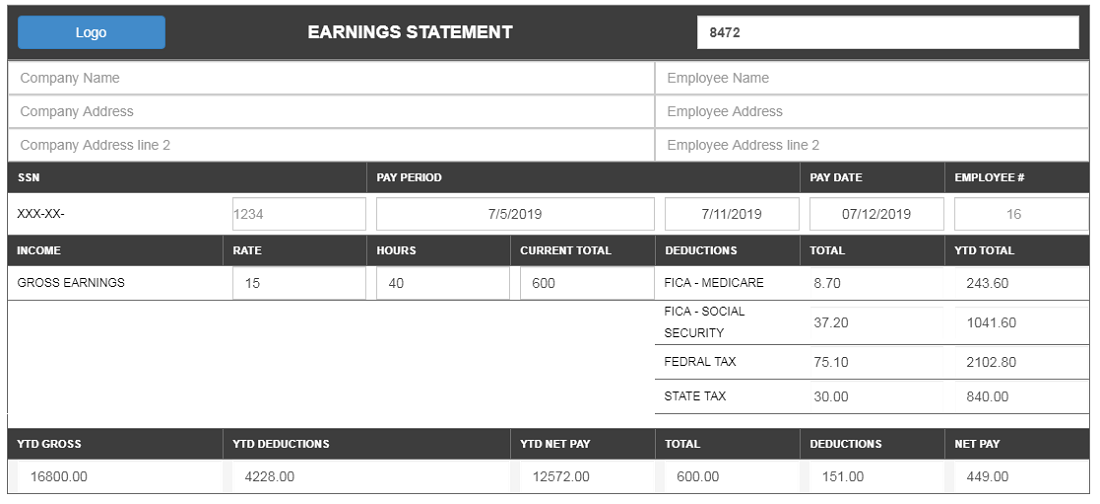

Using legally binding online tools, such as Paystub Makers, can help you avoid costly mistakes and potential legal ramifications associated with handwritten papers.

What is the purpose of a promissory note?

A promissory note is a common technique for two parties to formalize a simple repayment commitment. This agreement specifies the terms, due dates, and amounts for each payment. Without one, you may not get paid on time or face other problems.

A promissory note might be secured or unsecured.

- A loan made purely on the maker's ability to repay is referred to as an unsecured promissory note.

- A secured promissory note signifies that a valuable property, such as a house secures the loan.

When is a promissory note required?

If you wish to make a legally enforceable agreement that specifies the terms of repayment, a promissory note should be created.

It also serves as an official record of the repayment guarantee. In the following cases, a promissory note should be used:

- You intend to borrow money and want to secure the loan with collateral.

- You intend to lend money and require a payment schedule, or you intend to charge interest.

- If you intend to borrow money from friends or family and want to demonstrate your willingness to repay.

What Are the Most Important Details to Include in This Form?

Even if you're simply making a simple promissory note, it's critical to include all of the necessary details.

The following are the main elements that must be included in your promissory note form:

- Details about the borrower and lender: List both the lender and the borrower to clearly identify both parties engaged in the loan. Borrowers might be either individuals or corporations.

- Dates of payment: Indicate when the first payment is due and how much time a borrower has to make it.

- Promissory date expiration: Specify the end date of the promissory note.

- Payment schedule: Make a plan for how the borrowed amount will be repaid and how regularly (weekly, monthly, annually). Here are a few other ways to pay:

- installment in one lump sum: The entire loan amount is to be repaid in one installment.

- Due on demand: When the lender requests repayment, the borrower must repay the loan.

- Installment: A predetermined payment plan dictates how the debt is to be repaid.

- Interest rate:The interest rate, if any, should be specified in the agreement. The interest rate is often expressed as a percentage of the loan amount and is calculated at predetermined intervals over the life of the promissory note.

- The loan amount, including interest, and how it will be compounded

- Collateral: Collateral is used to secure the repayment of a loan. When anything is offered to the lender as collateral, it guarantees repayment. Real estate (such as a house) is an example of collateral on a mortgage.

- Late payment(s) consequences: Specify what will happen if the borrower does not pay on time, if they will be charged late fees, and if so, what the penalty or amount will be.

- Permissions for transfer or sale: Indicate whether the lender has authority to sell or transfer the loan and under what conditions this can occur.

- Amendments:Amendments, like many contracts or agreements, are only enforceable if both parties agree to change the conditions of the note.

- Signatures: Once the note has been created, both parties must sign the agreement to bind the conditions of the contract. You may also want to get the signatures notarized, depending on how much trust the parties have in each other.

Are promissory notes legal contracts?

A promissory note or letter, like common law contracts, is a legal instrument. However, certain requirements must be met for the document to be legally enforceable, such as an offer and acceptance of the offer. The loan amount and repayment terms will be included in a legal promissory note. Furthermore, the promissory note includes the terms and conditions agreed upon by the two parties.

The promissory note will meet all of the requirements for a legally enforceable contract once the aforementioned loan conditions are agreed upon and signed by both parties.

Is it necessary for me to have witnesses sign the promissory note?

In general, the signature of the promissory note does not require the presence of a witness or notary public. If your state requires it, a witness or notary public may be required to be present as you sign the promissory note.

Even if it is not needed, having an objective third party witness the note's signature will provide greater evidence if you need to enforce the note's agreed-upon payback.

The greatest evidence that the borrower signed the paper is signing the note in the presence of a notary public.

Reasons to Avoid Using a Promissory Note

A promissory note isn't always the best solution. Consider the following potential disadvantages:

- Unsecured loans can have higher interest rates.

- Before lending larger quantities of money, lenders may want a more formal agreement.

- Your company lacks the cash flow to support debt financing.

- Promissory notes can nevertheless be classified as a public securities offering.

- If you fail to pay the promissory note, the lender may be able to purchase your assets in bankruptcy for the amount of the outstanding debt.

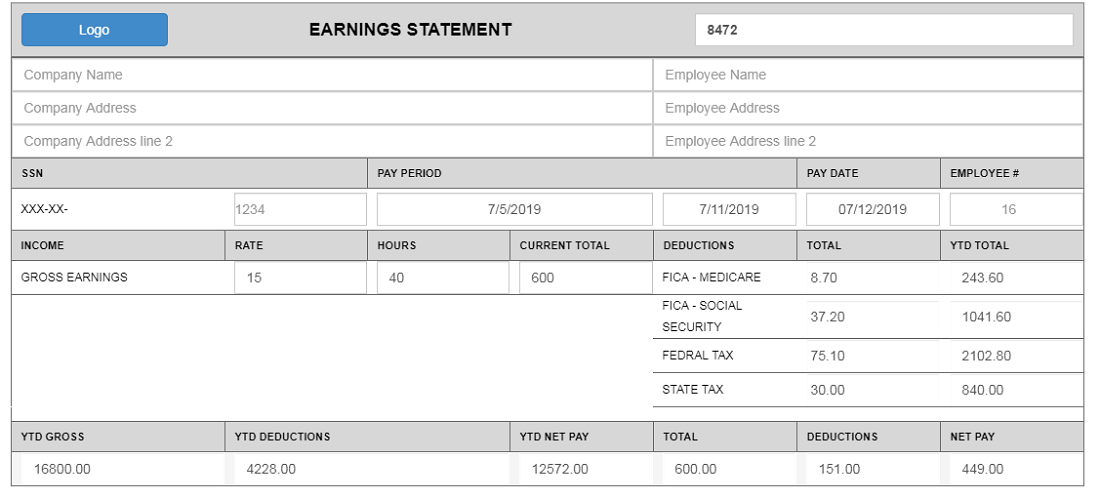

What are the tax consequences of promissory notes?

When interest is earned or paid, both lenders and borrowers face income tax consequences.

Basis, Principal, and Interest

Before we get into the tax implications for lenders and borrowers, it's crucial to understand the principle, interest, and tax basis of the note. The principal of the note simply refers to the amount of money loaned to the borrower. The interest is the payment made by the lender for lending the money.

Furthermore, all loans have a foundation that refers to the investment's acquisition price and accompanying charges.

Implications of taxation for the lender

The income from a promissory note is taxable and must be declared as such. The interest earned by the lender on the note would be considered income.

If you lent the money in your personal capacity rather than through a business, you must record it on your income tax return.

It's also worth noting that if your income is over $1,500, you must declare it on Schedule B on Form 1040 or 1040A.

Borrower's Tax Implications

The borrower's tax consequences vary depending on whether the loan is used for personal or corporate reasons. Unless the loan is used for a home loan, the interest payments are not tax-deductible if used for personal purposes, according to IRS laws.

Under IRS standards, interest repayments can be deducted as business costs if the loan is used for a legitimate company purpose.

Loans at below-market rates, loan forgiveness, and interest not paid

If a loan is forgiven, the amount must be declared as income on the borrower's tax return.

If the interest rate on the loan is lower than the IRS rate, the foregone interest can be treated as income.

Steps to Take When Using a Promissory Note

Because a promissory note is a legally binding financial document, you must follow particular procedures in order to comply with the law. When using a promissory note, take the following steps:

- Perform financial due diligence to ensure that you will be able to repay the loan.

- Compare various funding possibilities to find less expensive alternatives.

- Do not seek a loan from a third party without first consulting with an attorney. Unless you meet the standards of Regulation D, the JOBS Act, or another exemption, this could be considered a public offering.

- Examine the promissory note's provisions carefully. Standard forms may leave out key information or contradict your intentions.

- Execute the agreement and retain copies for your records in a secure location.

What Is the Difference Between a Promissory Note, an IOU, and a Loan Agreement?

The fundamental distinction is in the nomenclature, not in the functions. IOUs are less formal and may not have specific repayment terms.

Loan agreements, sometimes known as loan contracts, are more formal and are frequently used by banks. Mortgages guarantee a loan by securing the title to real estate property. Let's look more closely at what each of these represents.

What Exactly Is a Loan Contract?

A loan agreement and a promissory note have similar ideas and goals in that they both give an agreement concerning the terms of loan repayment. The loan agreement, on the other hand, is more thorough than the promissory note.

Loan agreements are preferable when the loan principal is significant and the lender is unfamiliar with the borrower.

For minor loans between trustworthy parties (such as family or friends), a promissory note is a better option.

What exactly is an IOU?

An IOU is an acronym for "I owe you" and refers to a document that acknowledges a debt between two parties.

Promissory notes are legally enforceable, whereas an IOU is an informal written agreement that specifies that one person owes another money.

Due to the informal character of an IOU, a formal written agreement may follow because these contracts can be difficult to execute in the absence of specified lending conditions.

What Exactly Is a Mortgage?

A mortgage is a financial contract between a homeowner and a lender in which the homeowner promises to repay the loan used to purchase real estate.

A mortgage, like a promissory note, specifies the payback terms, the loan amount, the interest rate, and the penalty for late fees. The note is not recorded in an official record, which is the distinction between a mortgage and a promissory note.

What are the most common promissory note mistakes to avoid?

A promissory note should be written rather than verbal. A note is only valid if it directly deals with the exchange of money.

If you intend to incorporate interest, make it plain in the paper. Include the date on which the loan will "mature," or be satisfied. Remember that the promissory note is not valid unless both the borrower and the lender sign it, so make sure you get it signed.

Here are some examples of common errors:

- The agreement does not include all of the relevant terms.

- Failure to provide adequate financial flow to make timely payments

- Breaching covenants with other debtors or equity holders that forbid further borrowing.

- Failure to safeguard your personal assets in the event of a default Soliciting funds in a manner that is illegal under securities regulations

When does a promissory note become void?

- The Original is Gone: You have a problem if you can't prove the note ever existed. Assume your debtor stops making payments, and you decide to sue for restitution. You can't find the note, or even a copy of it, when you go over your evidence. You can still collect if you can establish that you own the note and that it was lost or destroyed. If your main source of proof is your memory, you may be unable to prove your case. Judges have varied ideas about what constitutes proof of debt. A replica of the original may not be sufficient because it is easier to forge.

- Proof of Ownership: Even if you can demonstrate that the note exists, you must also demonstrate that you are the legal owner. In numerous mortgage cases, the mortgage note was transferred from one owner to the next, but the second owner never got it. Even if they paid for the note, they never had it. The debt was unattainable.

- Note Flaws: Even if you have the original note, it may be void if it was not properly drafted. If the individual from whom you are attempting to collect it did not sign it, the note is null and void. It may also become void if it violates another piece of legislation, such as charging an illegally high interest rate.

What Happens If You Don't Pay a Promissory Note?

If a person fails to return a loan specified in a promissory note, he or she may lose an asset used to secure the loan, such as a property, or face other consequences. If someone you lent money to does not repay you, you have a few options.

First, you must request restitution in writing. A written reminder may be all that is required to get your money back. Late charge reminders are often sent 30, 60, and 90 days after the due date. If the borrower still does not pay you back, you may want to explore asking for a partial payment.

If you opt to accept partial repayment of a debt, you can draught a debt settlement agreement.

First, you must request restitution in writing. A written reminder may be all that is required to get your money back. Late charge reminders are often sent 30, 60, and 90 days after the due date. If the borrower still does not pay you back, you may want to explore asking for a partial payment.

If you opt to accept partial repayment of a debt, you can draught a debt settlement agreement.

A debt collector works with you to collect the note, collecting a share of the payment in most cases.You can also sell the note to a debt collector. When you sell a note to a debt collector, you give the debt collector ownership of the loan and the right to collect the entire amount.

If everything else fails, you can sue your borrower for the entire sum owed to you.

Do I need to hire a law firm, accountant, or notary?

You can easily establish a promissory note without the assistance of a lawyer, accountant, or notary. Creating the form online using legally binding solutions like Paystub Mkaers can save you time and money. It can also save you money on the high cost of hiring a lawyer.

Why Should You Use Pay Stub Makers' Promissory Note Generator?

Our simple free promissory note template generator was built by a team of lawyers and business experts, and it generates promissory notes for a fraction of the cost of hiring an attorney.

Our application also provides a subscription option that allows you to produce an infinite number of promissory notes at a minimal cost.