Revocable Living Trust Agreements: What are they?

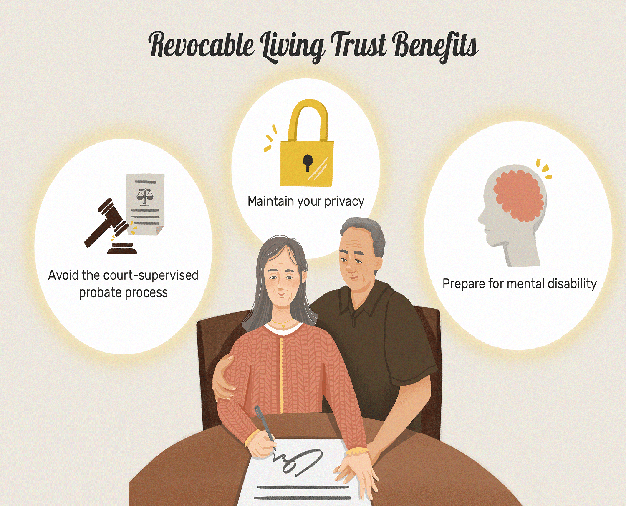

Detailed instructions on how the property is to be handled and ultimately divided after your death are included in the living trust agreement, a legal document that must be signed by both the trust maker and a notary public.

The agreement lists the assets, identifies a successor trustee—who may be a human, a corporation, or an attorney—and the beneficiary who will take possession of the assets upon the death of the trust maker.

When the trust creator passes away, the trustee will look after your assets. The trustee oversees the trust when you are unable to do so and acts as your agent to make sure the assets go to the intended beneficiaries. The beneficiaries are the individuals, groups, or other legal entities who will inherit your trust's assets following your passing.

Make A Revocable Living Trust Agreement FORM Now!

Is legal counsel required to create a trust?

A living trust can be created without a notary public or attorney. Using our Paystub Makers, you can create your own revocable living trust if your conditions are reasonable and unambiguous. Paystub Makers ensures that your personal information is completely protected and confidential by taking the guesswork out of producing legally binding papers. With a team of businesspeople, tax experts, and lawyers available to answer your queries, together with user-friendly tools to help.