Having an accurate paycheck is not just necessary for employees; it is also essential for businesses because these checks can help them avoid legal trouble. If a business owner fails to pay employees fairly under state, federal, or local laws, you might find yourself in trouble of paying thousands of dollars in the form of fines. .

Underpaying employee overtime is among the most common labor law violations that many organization commits. As a business owner, you are required to be diligent if you reside in California, New York, Florida, or Texas where local laws are more complex than the federal requirements.

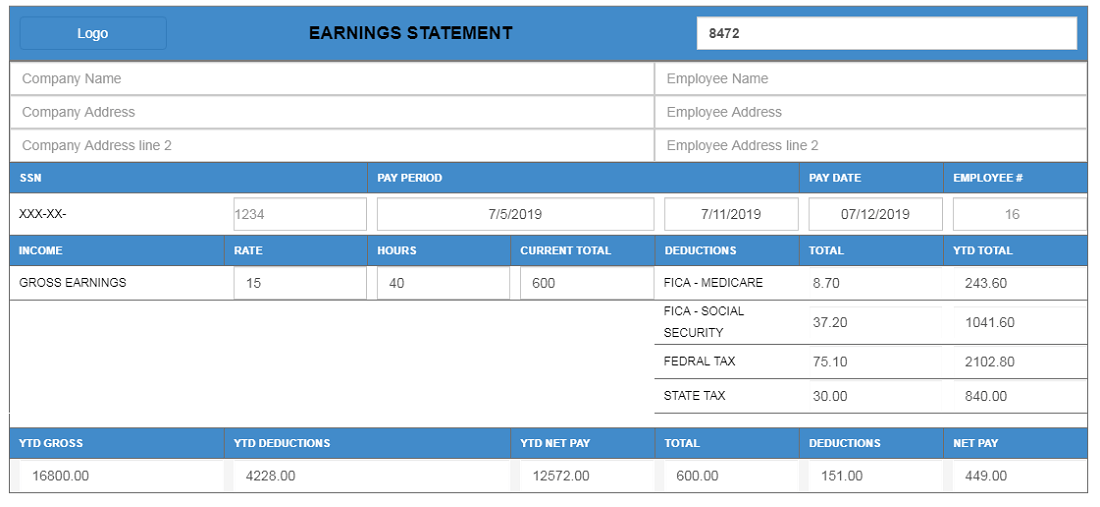

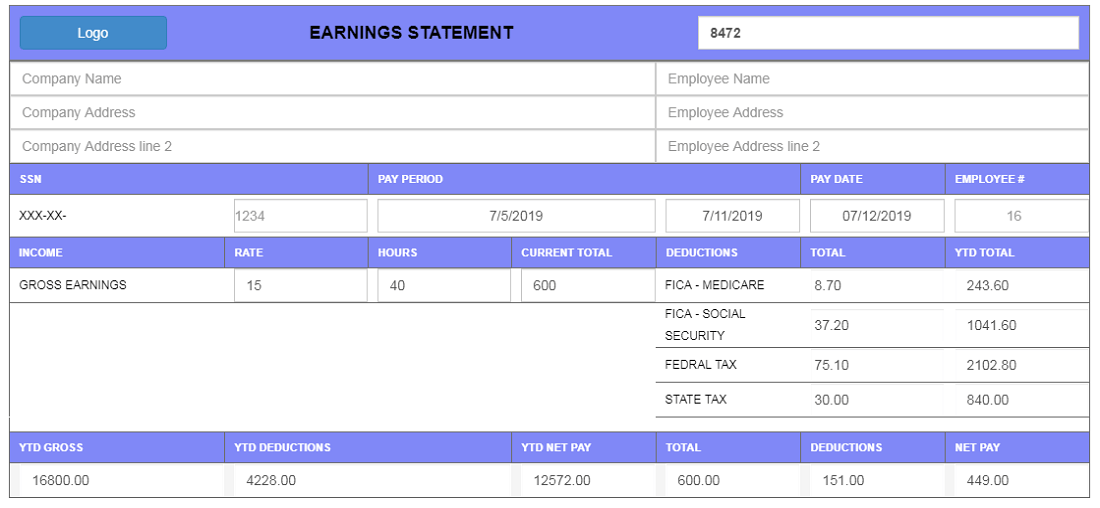

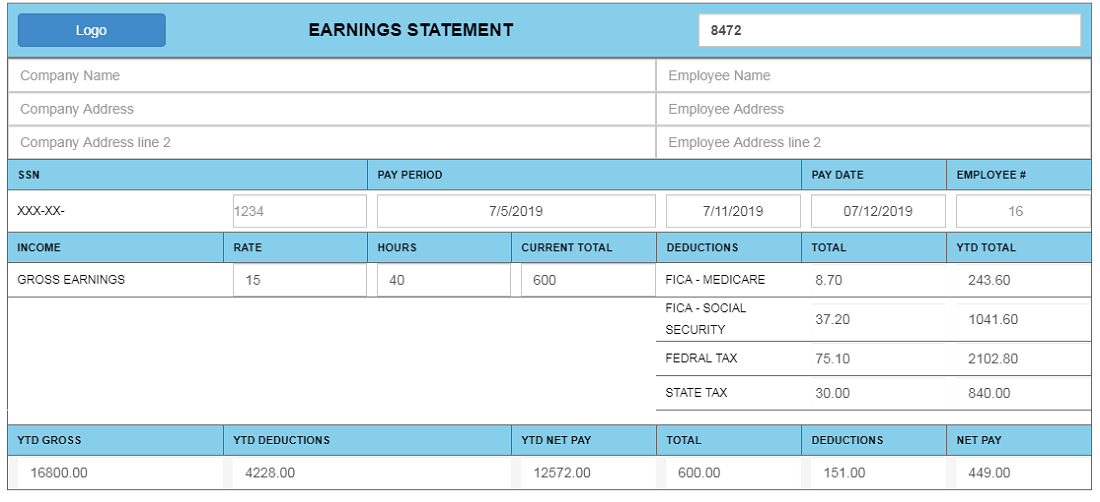

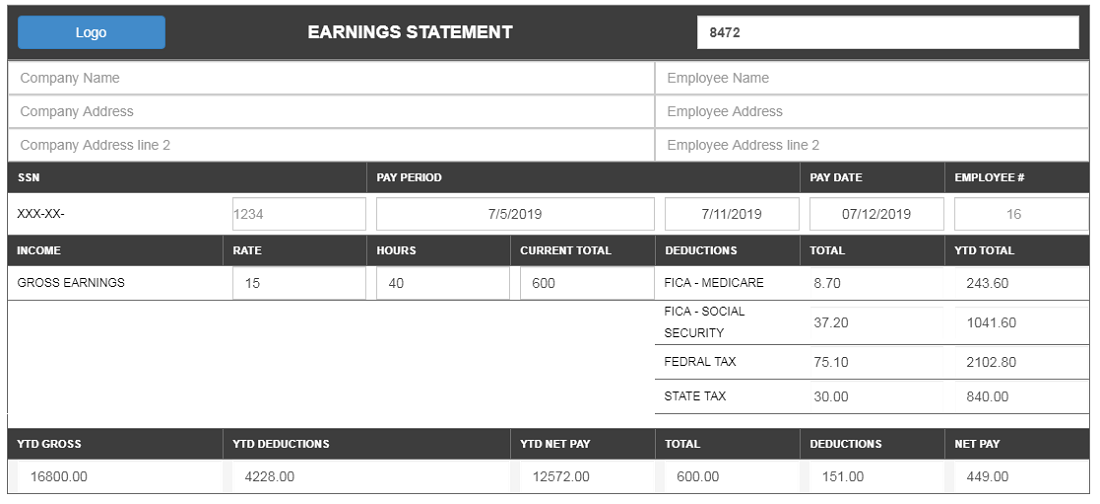

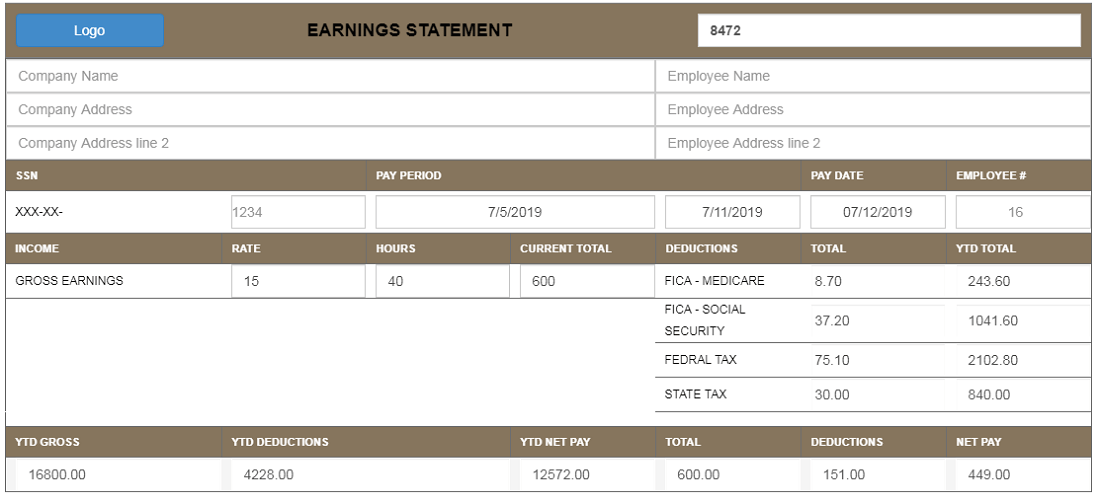

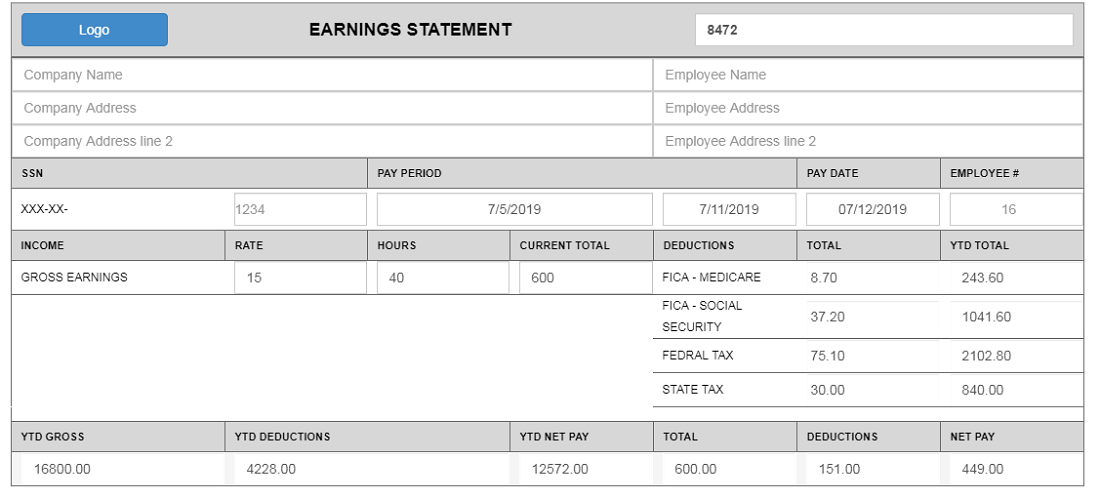

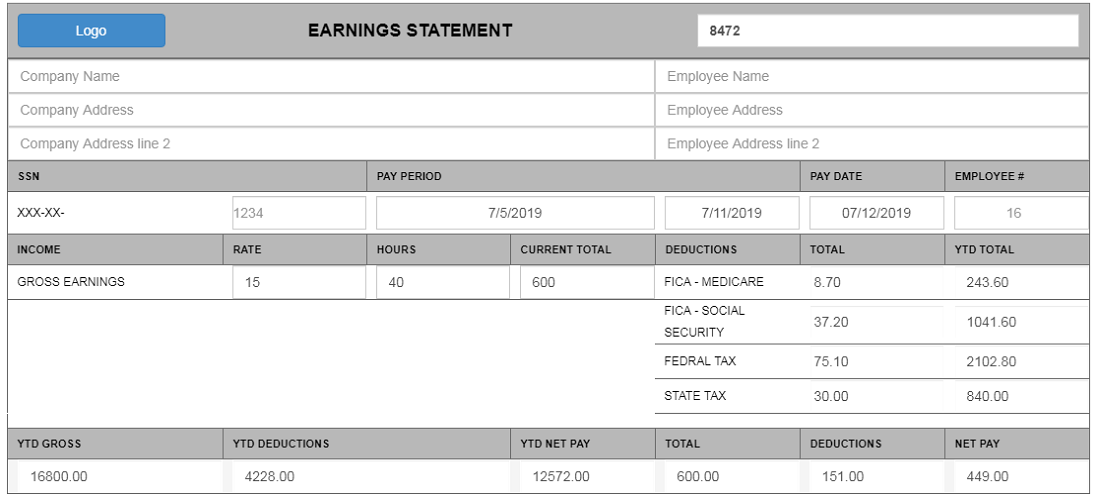

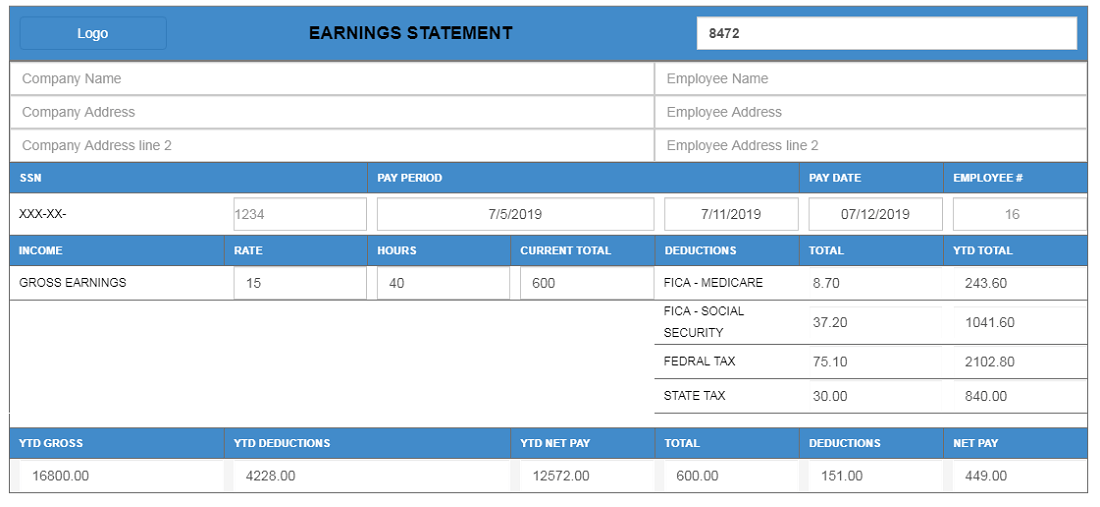

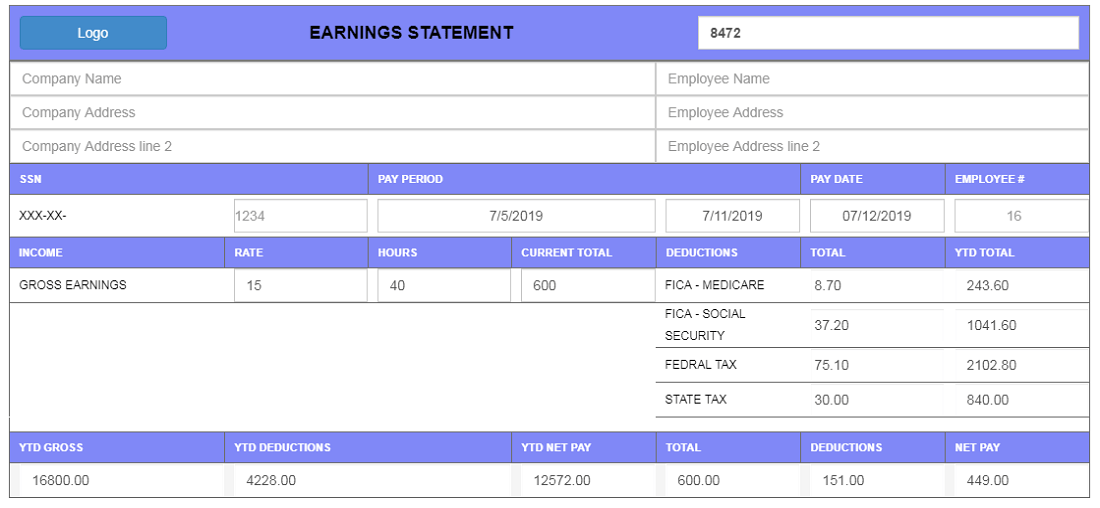

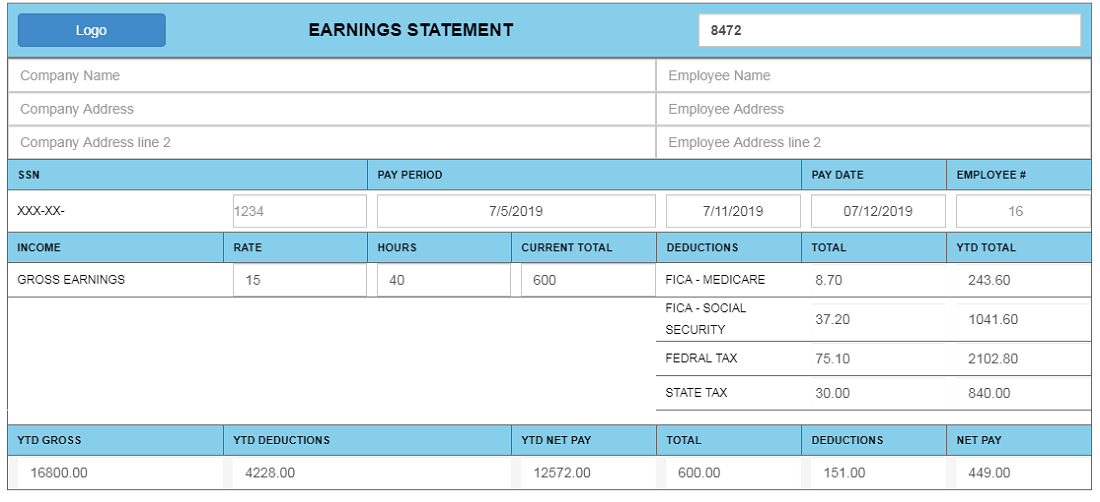

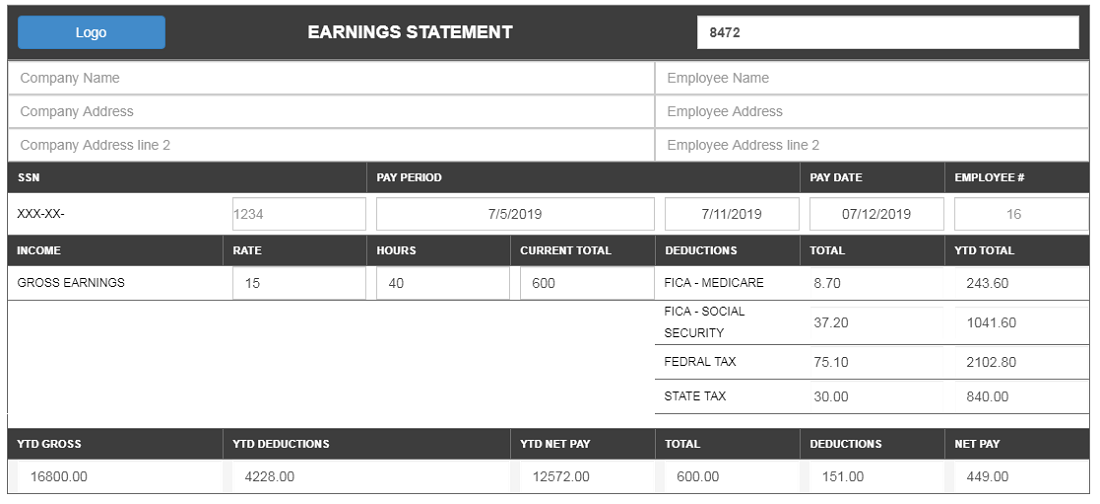

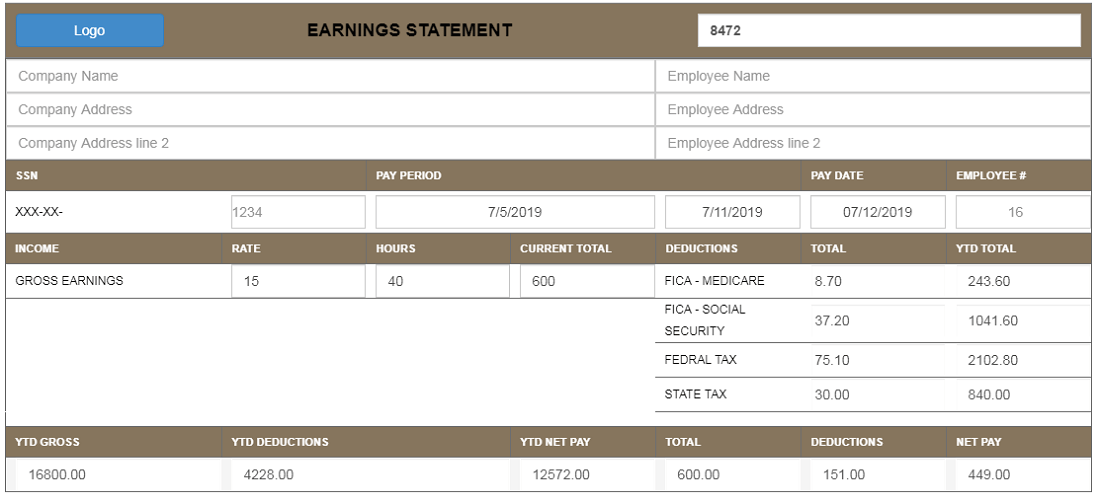

Sample Templates

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

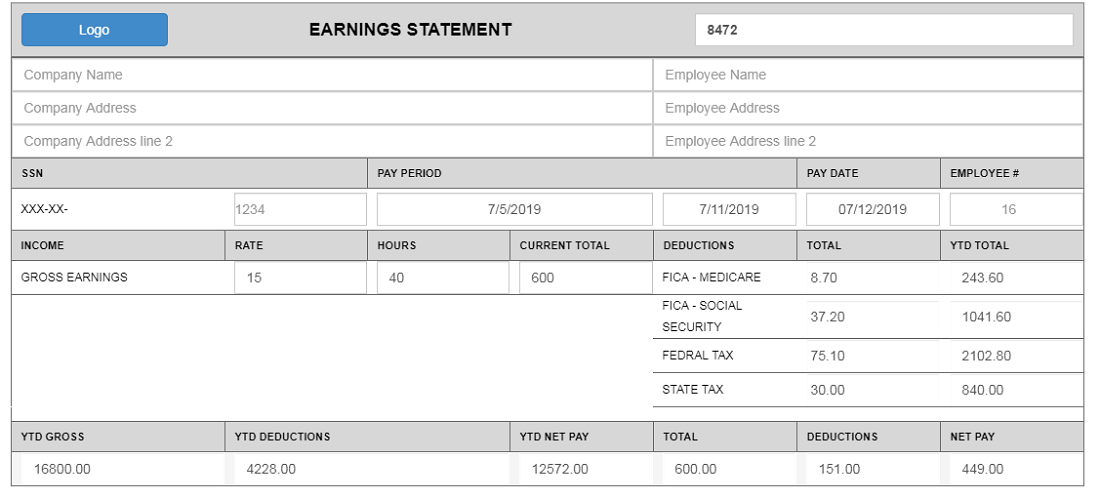

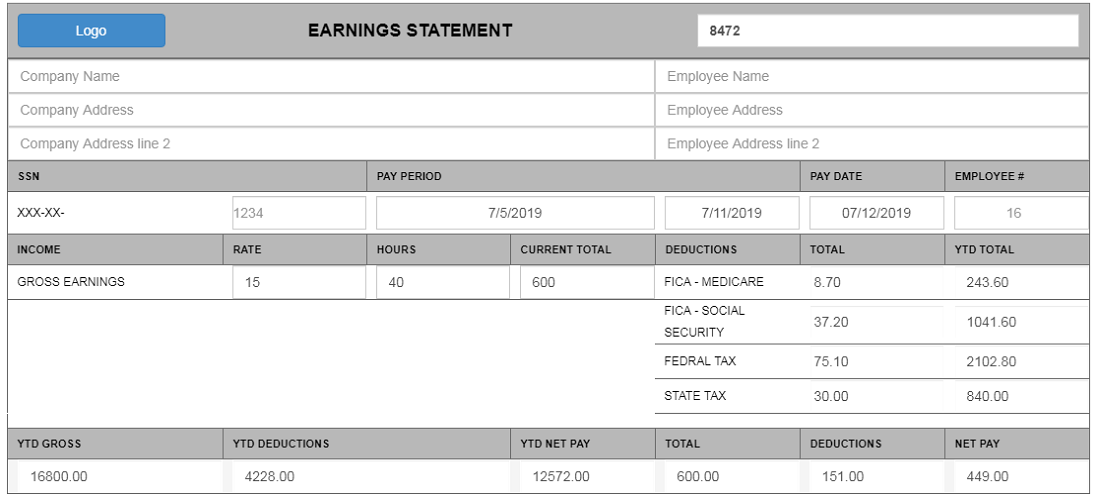

This is a sample paystub.

The watermark will be removed once you’ve made the payment.

That is why, you should use our Salary Employee Calculator for accurate paychecks. Whether you are an employee, freelancer, or employer, our tool will help you determine the right paycheck amount. .

How to use Paystubmakers Free Paycheck Calculators ?

Our free Gross-Up Calculator makes it easy for employers to calculate pay for all their workers, like hourly wage earners and salaried employees. However, you must be able to use this tool efficiently to take the most advantage. We have listed the steps that you must follow to use this tool: .

Enter the details of your employees :

Initially, you should file the employee’s details, especially the state where he or she lives. It will help our free withholding calculators to calculate some of the local taxes.

Include the employee’s pay information :

Next, you will notice the field that includes pay type, hours worked, pay rate, pay period, and pay period. Here, you should begin with the “pay type” and choose salary or hourly from the menu.

Suppose the employee is hourly. In that case, you should enter their pay rate and hours numbers that they worked that pay period. If he or she has worked more than 40 hours and recorded 40 here, then you should save the rest for the additional pay.

Similarly, you are going to see both “pay rates” and “hours worked” if your employee is salaried. Here, you are required to understand how much the employee makes each pay period. You must put that into the field called “amount.” Then you just choose the pay date and the pay frequency or you can select weekly or biweekly.

Enter any additional pay :

Next, you must include any details about any extra pay if you want. You will see two fields named bonus and commission if your employee is salaried. Similarly, you will notice four fields, including commission, bonus, overtime worked, plus salary if your employee is hourly.

In addition, you should input the number of overtime hours they worked in case the employee earned through overtime. This serves as an opportunity to add any extra pay they deserve to receive during this period.

Include your employee’s federal tax information :

Once entering the details about the additional pay, you should fill out the details about the employee’s federal tax information. Here, you should include information like the employee’s number of allowance, filing status, and more.

You should see the W-4 form of your employee to find these details. In case, you do not have a W-4 form, our free Paycheck Calculators will automatically enter the tax rates to give you a semi-accurate estimate of your paycheck.

Add the employee’s state tax information :

After filing your federal tax information, you should include your worker’s state tax information. Similar to the previous steps, you should again include details, such as the employee’s number of allowance, filing status, and more. We remind you that you can find this information in the employee’s W-4 form.

See the paycheck :

Once entering all the records in our free Online tax calculators for all your paycheck and payroll, you should click the “calculate paycheck” button to see the estimate of your employee’s earnings for the pay period. Thats it! Now, you can explore and analyze the paycheck for your employee. .

Understanding paychecks: deduction and withholding

When you get the paycheck from our free paycheck calculators, we understand your new employees will consider why their home-take money is less than the actual salary or hourly rates. Below are the factors that decrease the overall paycheck:.

1.Federal income tax:

You can withhold the federal income tax from your employee’s pay based on current tax rates and W-4 forms. Our Free Payroll Calculators will help you determine the right amount to withhold. If your employee’s W-4 is misplaced or does not have enough information, our tool will adjust the data accordingly.

2.FICA Withholding :

Social Security and Medicare taxes are two types of taxes included in the FICA Withholding. You can withhold fixed percentages of your employee’s earnings for these taxes. It ensures that your employees contribute to and get these benefits from these social programs.

3.State and local withholding :

State and local withholding differ by your location. However, it includes withholding for state & local taxes, SUTA, short-term disability, and more.

4. Benefits deduction :

You can withhold money for benefits, like health insurance, or a retirement saving plan. and more from your employee’s salary. Depending on the type of perks and regulations, you can cut the amount in the form of pre-tax or post-tax. However, pre-tax gives more benefits to your employees because it decreases their tax bill.

5. Wage garnishment :

Employers might deduct garnishment from your employee wages in case they get a court order to do so. It happens when your employee defaults on a loan, has unpaid taxes, and other cases.

.

Start calculating your paycheck today

Paycheck calculation is essential to prevent any legal trouble. Paystubmakers can help you calculate your employee’s paychecks effectively. Our free paycheck or Hourly Employee Calculator will give you an estimated paycheck.

FAQ

1. How do I figure out my pay?

You should begin with the annual salary amount and divide the same amount by the number of pay periods in the year to calculate a paycheck. However, you can use our Gross-Up Calculator to figure it out easily.

2. Which paycheck calculator is best?

Paystubmakers is the best net-to-Gross calculator to know the paycheck.

3. What is the most common paycheck?

Biweekly is the most common paycheck.

Free hourly employee calculator

Paystubmakers hourly employee calculator lets you calculate your hourly income after taxes and other deductions.

Free Salary Paycheck Calculator

Paystubmakers Free Salary Paycheck Calculator allows you to estimate your net pay or paycheck after tax deduction.