Pay Stub Generators in Canada – The Benefits

1. Accuracy: Performs tasks like calculating deductions for EI, CPP, and taxes automatically.

2. Compliance: Designed by the laws of Canada pertaining to payroll taxes.

3. Efficiency: Time savings on immediate paystub creation.

4. Cost Savings: On the lower side to traditional payroll services.

5. Accessibility: An online pay stub making software, accessible for small businesses and freelancers, 24/7.

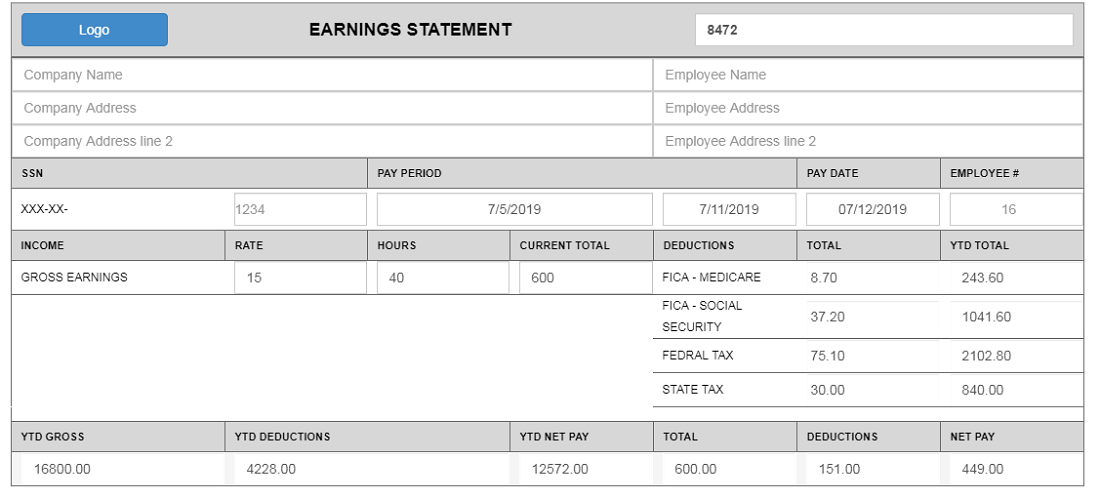

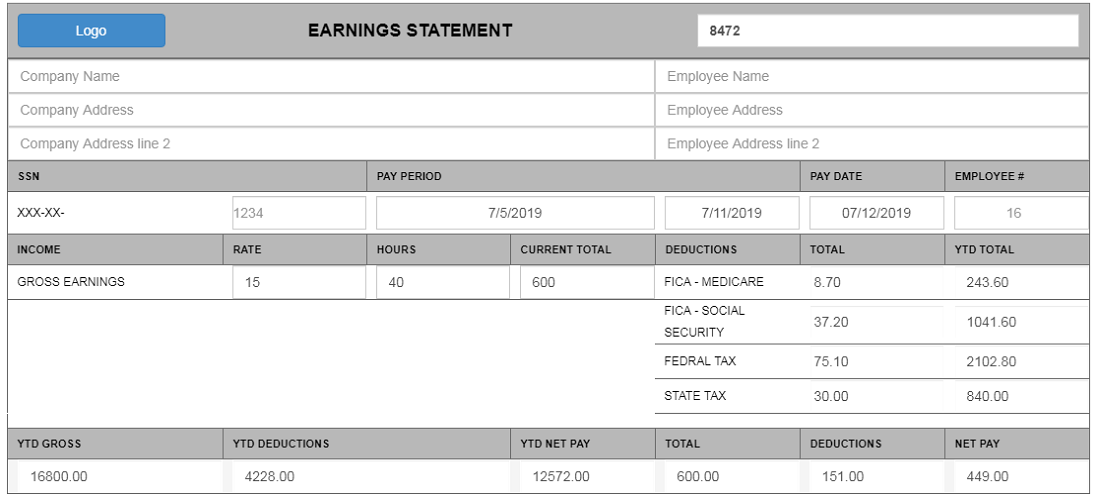

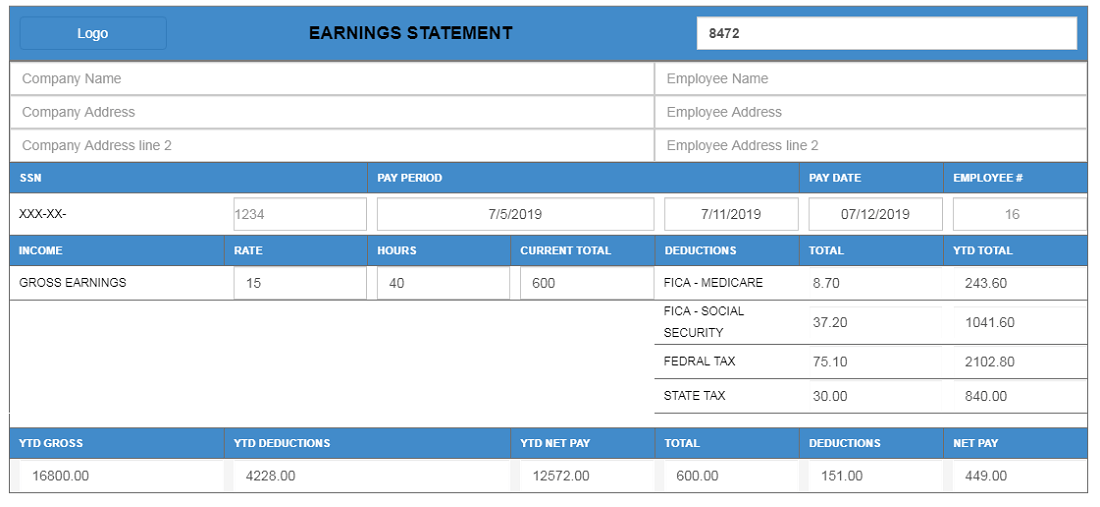

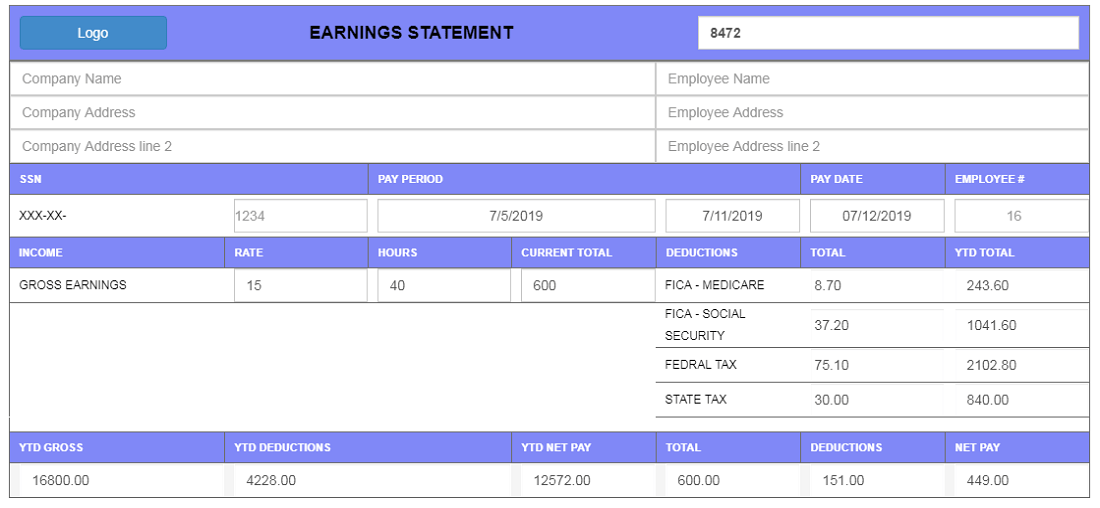

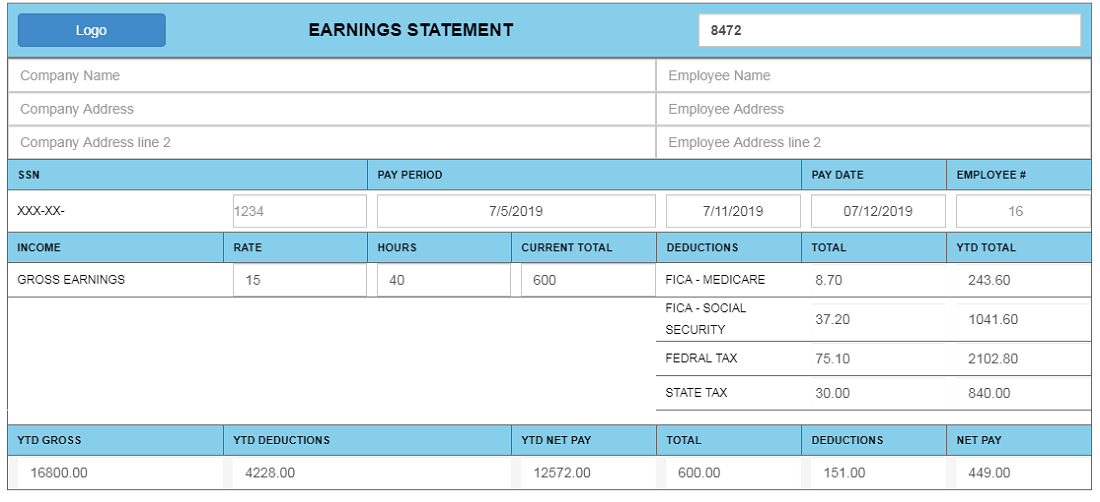

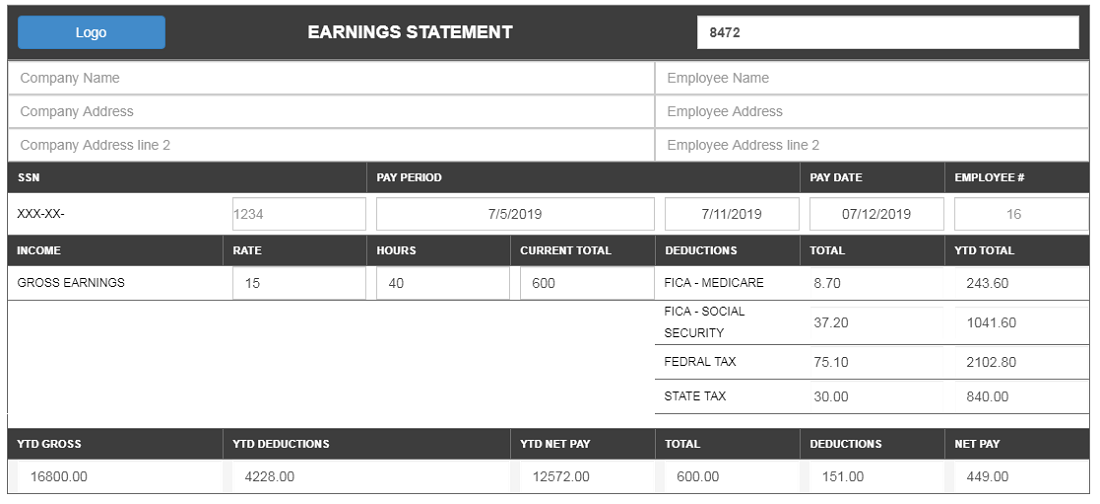

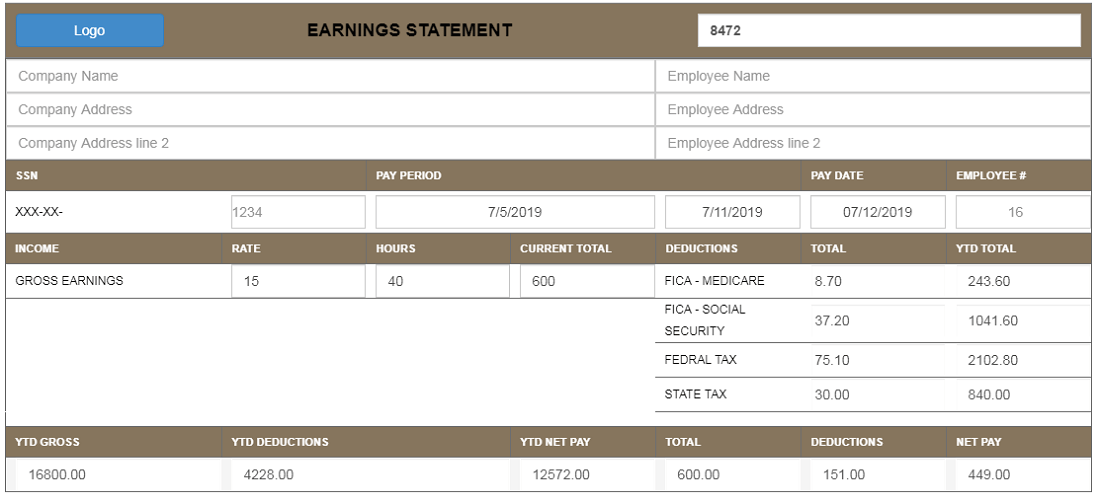

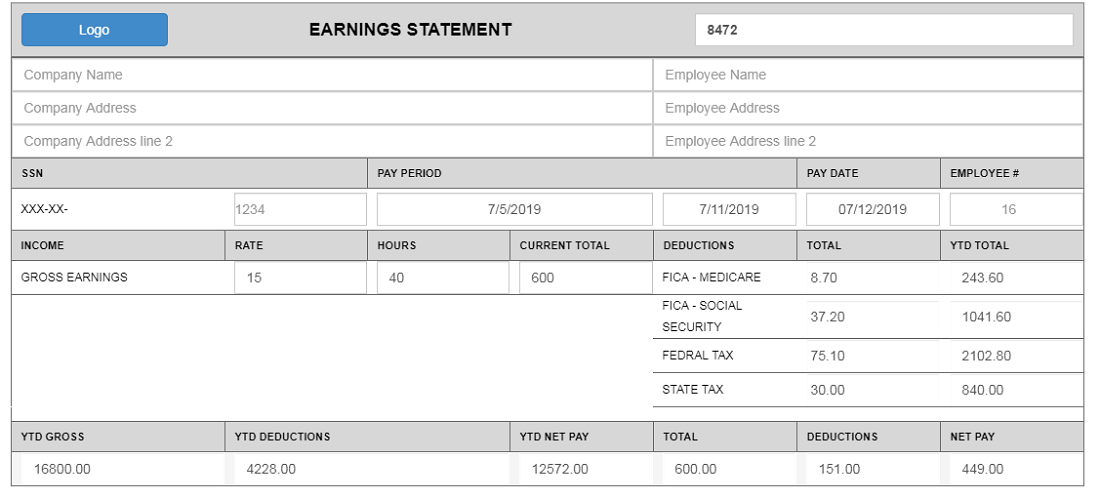

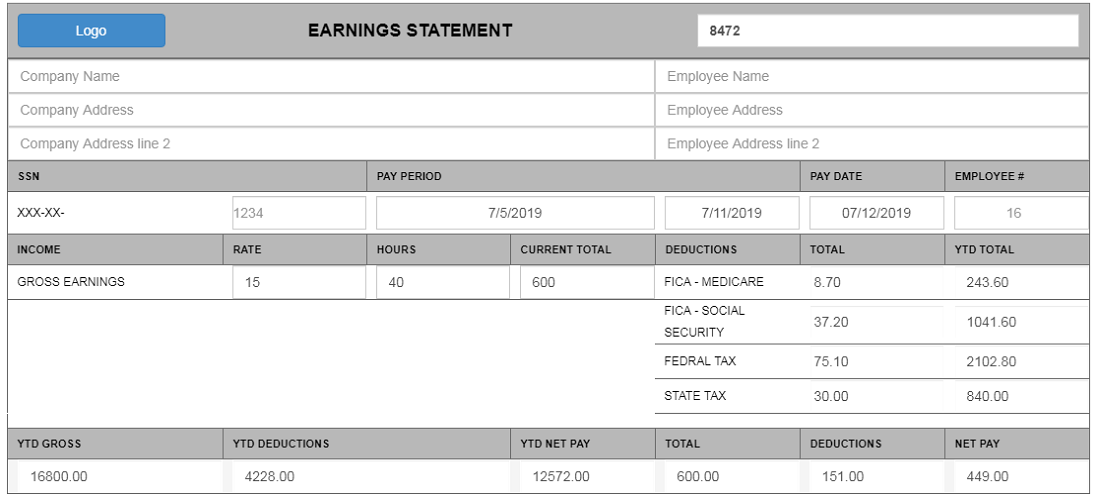

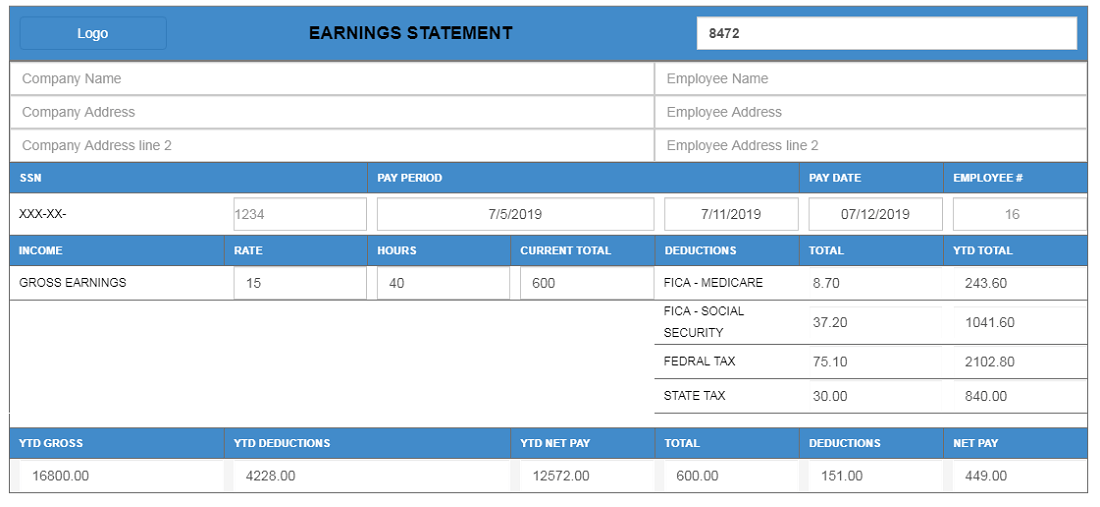

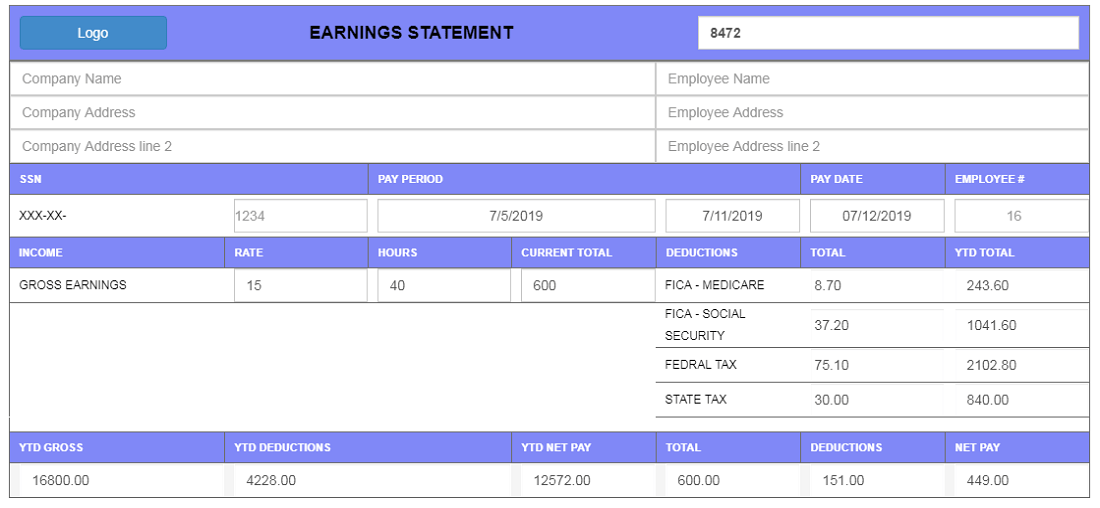

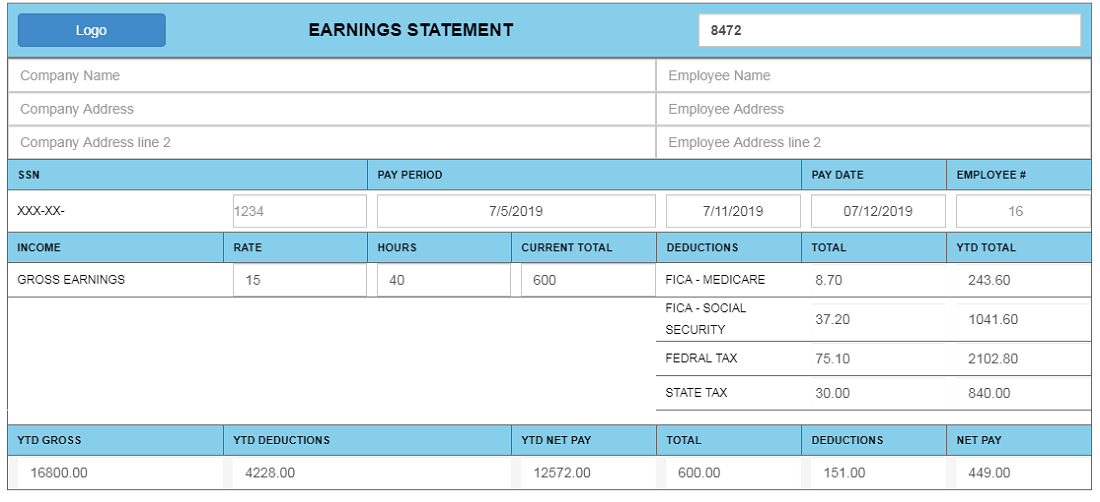

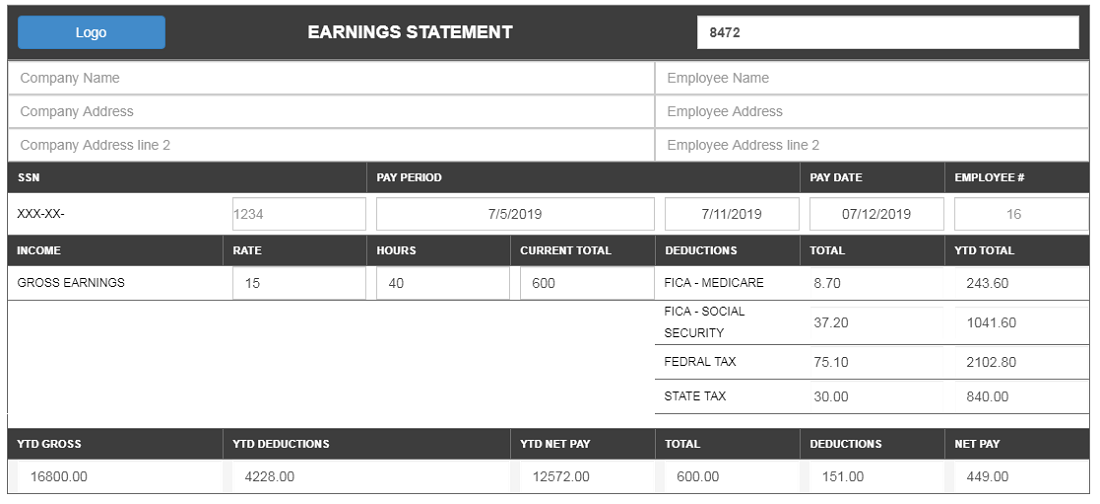

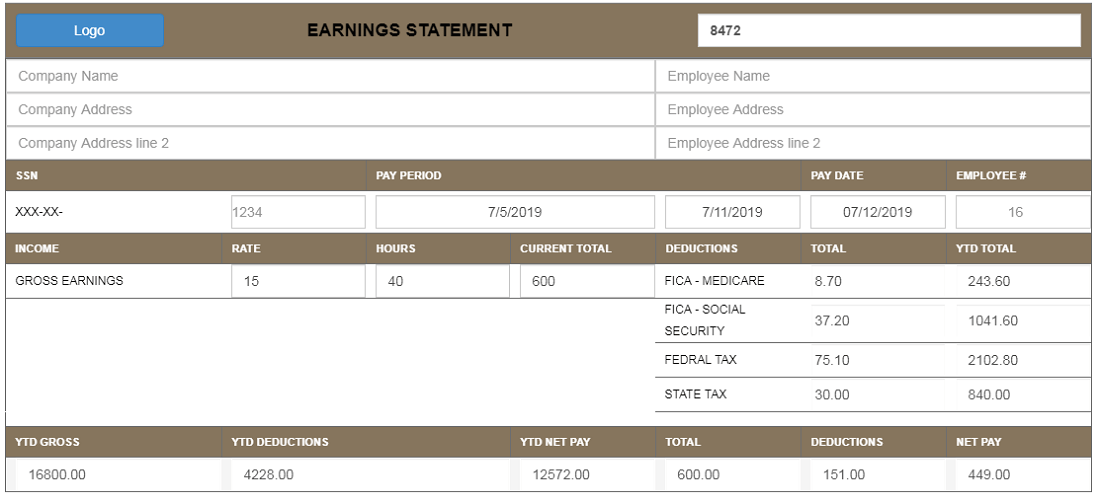

Sample Canadian Paystubs Templates

Sample Canadian Paystubs Templates-1

Sample Canadian Paystubs Templates-2

Sample Canadian Paystubs Templates-3

Sample Canadian Paystubs Templates-4

Sample Canadian Paystubs Templates-5

Sample Canadian Paystubs Templates-6

Sample Canadian Paystubs Templates-7

This is a sample paystub.

The watermark will be removed once you’ve made the payment.

An employee pay stub describes in detail the earnings, taxes, and deductions of an employee for the pay period. Other terms would include payslip, earnings statement, or paycheque stub.

Characteristics:

- All About: Gross pay, net income, and deductions (e.g., taxes, EI, CPP).

- Main Function: Enables employees to transparently see what they earned and for payroll purposes as income proof.

- Canadian Consideration: Paystubs are generated as part of the HR departments to show payroll compliance.

- Pay Stub Production: Pay stubs are made in-house by companies, either by hand or through software.

For example, a Toronto startup saved hours by generating pay stubs online in minutes, allowing for greater accuracy and compliance. Pay stubs clarify and bring confidence to the payroll procedures for anyone in Canada-whether employer or employee.

Who Needs a Pay Stub?

Pay stubs form a very vital part of Canada’s financial and employment systems and provide the details of an employee’s earnings, taxes, and deductions for every pay period. Here are the ones mostly concerned:

1. Employees

For employees, pay stubs are very important income proofs. They assist with securing loans, renting apartments, and verifying tax contributions. A teacher from Toronto used their pay stubs to claim the erroneous entry on their tax return, which led to a fast resolution with the Canada Revenue Agency (CRA). Furthermore, pay stubs let employees see how deductions like Employment Insurance (EI) and Canada Pension Plan (CPP) are being tracked.

2. Employers

Payroll transparency and compliance with relevant regulations demand the support of pay stubs by HR. Employers use them to support employee compensation claims, maintain records, and prove regulatory compliance during an audit. A small café in Montreal minimized payroll inaccuracies and achieved high employee satisfaction and trust by going digital with pay stub systems.

3. Entrepreneurs

Freelancers and small businesses use pay stubs to confirm income when filing taxes or applying for credit. In Calgary, a self-employed graphic designer illustrated their stable income over a few pay periods through an online tool for creating professional pay stubs to apply for a car loan.

- The National Government

- The State

- The Worker

Why Are Pay Stubs Important in Canada?

Informed financial accountability for employees, employers, and entrepreneurs is made possible by pay stubs. These documents attest to income either for the tracking of taxes or the proof of income test. This means they are crucial for the operation of the tax and employment systems in Canada.

Good investment in pay stub generation tools will save time, improve accuracy, and maintain compliance for stakeholders all round.

Why Are Pay Stubs Important in Canada?

Informed financial accountability for employees, employers, and entrepreneurs is made possible by pay stubs. These documents attest to income either for the tracking of taxes or the proof of income test. This means they are crucial for the operation of the tax and employment systems in Canada.

Good investment in pay stub generation tools will save time, improve accuracy, and maintain compliance for stakeholders all round.

How does an employee get pay stubs in Canada?

In Canada, pay stubs play an important role in showing the income of the employee, taxes, and deductions for the concerned pay period. Here are three reliable avenues to pursue to secure a pay stub, irrespective of income verification or payroll tax details:

Direct Deposit

If you have signed up for direct deposit, your employer may provide digital pay stubs. Pay stubs may be available to you via a secure employee portal or sent to your email by the HR department. For instance, a marketing agency in Toronto sends automated pay stubs to its employees after every pay period ensuring transparency and ease of access.

A stub maker is an online tool that is appropriate for someone who doesn't get a pay stub or who needs one replaced. These computable tools allow you to enter your income as well as expenses, thus generating correct and professional pay stubs. A freelance designer in Montreal independently obtained proof of income for a lease agreement by making a check stub and thus saved time and effort.

If you need pay stubs from a while ago, try contacting your previous employer. Canadian companies must keep payroll records for a number of years. A former employee of a construction representative in Vancouver successfully requested pay stubs from past years to rectify a tax disagreement with the CRA.

Risks of Having a Fake Paystub in Canada

Using a fake paystub may entail severe consequences in Canada. Here are the reasons for it:

Legal Accountability:

Fraud: Making a fake paystub or using it is regarded as fraud, which is a crime in Canada.

Penalty: Penalties include fine, jail time, or both.

Impact on Creditworthiness:

Loan Applications: Lenders generally look at the pay stubs to confirm your income is sufficient to qualify for the loan (mortgage, car loan, etc.). A fake paystub can affect the approval of your loan and can also harm your credit score.

Rental Application: Landlords may also require pay stubs to assess your ability to pay for rent.

The use of a fake pay stub is likely going to lead to rejection of your application.

Job Consequences:

Job Offer: Some employers may require pay stubs as part of their background checks. If any discrepancy is found, it may affect your job offer.

Internal Investigation: If your employer has reason to believe you provided a fake paystub, they could begin an internal investigation that may lead to disciplinary action against you or even termination.

Tax Issues:

Improper Filing of Taxes: Fake paystubs will lead to inappropriate tax returns, which will result in penalties and possible audits from

What Is The Difference Between Real and Fake Pay Stubs?

Pay stubs are an essential part of employee earnings documentation, especially in Canada. They summarize an employee's earnings, taxes, and deductions for a specific pay period. Distinguishing between real and fake pay stubs is critical for employers, HR departments, and financial institutions. Here’s how they differ:

1. Accurate Information vs. Fabricated Data

• Real Pay Stubs: Contain accurate employee details such as name, address, and Social Insurance Number (SIN). The data matches the employer’s payroll records.

• Fake Pay Stubs: Often have discrepancies in personal details or missing information, which can raise red flags during verification.

2. Legitimate Earnings and Deductions

• Real Pay Stubs: Reflect actual earnings, deductions, and taxes paid by the employee. The figures align with Canadian tax laws and payroll regulations.

• Fake Pay Stubs: May exaggerate income, alter deduction figures, or omit taxes to mislead lenders or employers.

3. Authentic Employer Details

• Real Pay Stubs: Include valid company information, such as a registered business name, address, and contact details.

• Fake Pay Stubs: Often use generic or non-existent employer names, making them easier to spot during verification.

4. Consistency with CRA Standards

• Real Pay Stubs: Comply with the Canada Revenue Agency (CRA) standards, showing clear deductions for CPP, EI, and federal/provincial taxes.

• Fake Pay Stubs: Lack compliance and may have misaligned or inconsistent data.

5. Verification from HR Departments

• Real Pay Stubs: Can be verified directly through HR departments or payroll providers.

• Fake Pay Stubs: Verification attempts often reveal inconsistencies, as no legitimate record exists.

Why Would You Need a Paystub Generator?

Tracking Tax and Deductions:Canada's payroll system is complex; from maintaining denial of liability records concerning proper deductions to reimbursements for benefits and insuring to comply with payroll taxes, all variables affect how quickly records can be traced back. Without paystub generation systems, businesses and employees face common tax-time difficulties like having wrong calculations or completely missing important employer details such as the withholding contributions of CPP, EI, and income tax.

Why It Matters

• Employees Need Proof of Income: Generally, banks and lenders in Canada request paystubs to process a loan or credit application. A missing or inconsistent paystub can mean delayed or denied applications.

• CRA Compliance: When the Canada Revenue Agency investigates payroll records, they require information to make sure taxes and deductions are being rightly calculated. Being imprecise with records opens up the possibility of penalties or audits.

• Manual Calculations Can Be Wrong: Errors can happen as you are manually calculating CPP, EI, and income taxes. Those mistakes could prove to be quite serious for the business and frustrating for the employees!

How a Paystub Generator Can Help ?

With a paystub generator, the payroll process becomes automatic, generating accurate, professional, and detailed paystubs with all the information required.

Advantages of the Paystub Generator:

1 All Tax Calculations Done Automatically: Automatically calculates CPP, EI, and income tax deductions based on the Canadian standard.

2 Certified Record-keeping: Guarantees that detailed information is provided in every paystub, including hours worked, gross pay, net pay, and itemized deductions.

3 Meets CRA Requirements: With accurate payroll records, gives peace of mind for audits and the CRA.

4 Gain Back Time: All work of creating paystubs manually is taken out, so more time can be spent on business growth.

A pay stub generator can solve payroll problems in Canada for self-employed persons. In the case of one small business in Toronto, payroll compliance problems occurred due to inconsistent records. They chose a paystub generator, saving themselves over 10 hours of work every month, along with accurately deducting Canada Pension Plan (CPP) and Employment Insurance (EI) fees, thus dodging the CRA audit penalty.

In other words, for ease of payroll and tax compliance in Canada, a paystub generator fits self-employed business owners, small businesses, and those needing proof of income.

What do Pay Stubs Accomplish?

Pay stubs serve as a crucial document for all employees across Canada accounting for the income, taxes, and deductions offered clearly. Therefore pay stubs serve an important purpose in any loan application or tax filing. Let us look into their usages:

Lack of clarity :Many Canadians don't realize the importance of their pay stubs, making them difficult when they try to obtain any financial products, verify income, or settle disputes.

Loss of opportunities :Not having proof, like a pay stub, can hinder the process, delay loan approval, and lead to challenges in filing taxes. All this can undoubtedly prove frustrating and time-consuming.

The intelligent way to use pay stubs

Knowing how to enter pay stubs can counter such adversities; here are some ways by which:

1. Pay Stub to Apply for Loans :Evidence of income in support of your loan application is often required by lenders. A thorough pay stub showing an individual's levels of earning over a period of time, taxes paid, and deductions helps substantiate his claims of being financially sound.

2. Pay Stub for Large Purchases :Financing large purchases, like buying a car or house in Canada, requires a pay stub to present an image of being trustworthy to the lender in regard to repaying the installments.

3. Pay Stub to Rent an Apartment :Pay stubs are a basic requirement for the landlord to have some confidence that you can pay the rent monthly. It is clear proof of your financial capacity.

4. Pay Stub as Evidence in Compensation and Claims :Pay stubs come in handy in claiming a workplace injury compensatory claim or settling wage disputes. They are the official record for your earning amounts.

5. Tax Filing with Pay Stub :Tax filing in Canada is of utmost importance. Pay stubs give an overview of the income and deductions of the employees; thereby, it assists in the finalization of tax returns and reducing the possibility of errors.

By relying on these pay stubs for the aforementioned purposes, you would be able to save time, avoid tension and stress, and improve considerably over making sound financial decisions.

Payroll Deductions Explained on an Employment Pay Stub (Canada)

To manage your finances properly, understanding payroll deductions on your pay stub is fundamental. In Canada, your pay stub shows how much you earn and what is deducted. Here is a lucid explanation using the P-A-S framework.

Many employees find themselves confused with deductions shown on their pay stubs. Without due diligence, it is easy for one to lose sight of the purpose of these deductions and their importance to their overall financial welfare.

Now imagine that you are giving it your all at work, only to see most of your pay being withheld with no explanation on where it goes! Such ambiguity can lead one to feel even more robbed of control over their income.

We will therefore go ahead and outline the most important payroll deductions in Canada so that you know just where your money is going and why:

1.Federal and provincial tax : Some part of your pay will be taken for federal and provincial taxes, depending on your level of income, tax bracket, and province of residence.

For instance, in Ontario, for a tax filer in 2023, the combined federal and provincial tax rate begins at 20.05% for the lowest bracket.

2. Contributions to the Canada Pension Plan:

- Contributions to the Canada Pension Plan are made by you and your employer. The employee rate for contributions for 2023 is 5.95% of earnings, there is a maximum of $66,600, so the maximum contribution is $3,754.45 for the year.

3. Employment Insurance Premiums :

- The unemployment benefits are funded through EI premiums. Employees pay an EI premium of 1.63% on their earnings, annual maximum $1,002.45.

4. Other Deductions :

- Other deductions may include union dues, group advantages, retirement savings plans, and other company-specific arrangements.

Your pay stub is not just a piece of paper, but it is quite literally a financial map. If you understand payroll deductions, you can track your own contributions, estimate your tax obligations, and make informed calls concerning your earnings. Stay tuned and stay in control!

Important Point about Paystubs - Can They Be Used as Proof of Income?

Across the Canadian scene, pay stubs are widely recognized as proof of income. Here are reasons why they matter:

1. To Serve as Proof in Financial Transactions: Loan lenders often require pay stubs in order to ascertain income for loans or mortgages.

Landlords may demand pay stubs during tenant screening checks in order to establish rental affordability.

2. Legal Stuff: Pay stubs furnish more specific information as regards earnings, taxes, and deductions; they become critical for purposes of law and finances.

3. The Importance of Regularity: Current pay stubs demonstrate the existence of continuous income; the pertinent evidence supports an individual's case when applying for financial relief or seeking legal remedies.

How Do Small & Medium-Sized Businesses Manage Payroll for Employees?

Small and medium-sized enterprises (SMEs) handling payroll in Canada are faced with many challenges. Below are some of the workable solutions they may adopt:

Use of Payroll Software: Pay gerichtete Lösungen such as Wagepoint, QuickBooks, and Ceridian simplify payroll calculation for these businesses:

1. Payroll Management Outsourcing: Many SMEs outsource payroll services to third-party providers so that these providers can take care of payroll matters and give the SMEs enough time to focus on various business processes.

- External providers assume the burden of payroll calculation, remittance, and compliance reporting.

2. Update on Tax Laws: Companies ensure their compliance with the federal and provincial changes in tax laws regarding the Canada Pension Plan (CPP) and Employment Insurance-related changes and income tax rates.

3. Methodical Record Keeping: File-keeping of hours worked, overtime, and benefits would help payroll processing and audits.

4. Employee Classification: Proper classification of employees as full-time, part-time, or contractors is crucial to determine the correct tax and deduction processes.

Benefits of Using Electronic Pay Stubs for Your Business

Going with electronic pay stubs offers great advantages for businesses in Canada:

1. Reduced Costs:The cost for printing, paper, and postage will be less.

2. Efficient:Electronic pay stubs save times for the human resources and payroll departments because of automation in distribution.

3. Go Green:Helps businesses achieve sustainability targets by curbing wastage of paper.

4. Secure:Electronic systems with encryption protect any sensitive information, such as Social Insurance Numbers (SIN) and earnings.

5. Access Made Easy:Employees can retrieve their pay stub information at any time through a secure online portal, bringing transparency and offering convenience.

6. Compliance:Digital records ensure compliance with CRA’s record-keeping requirements, thus minimizing the risk of incurring penalties due to non-compliance.

How to Use Payroll Pay Stub to Benefit Your Business

Pay stubs are more than just a record of earn

1. Efficient Tax Management: Carefully prepared paystubs simplify year-end tax filing by accurately defining the taxes that have been deducted.

2. Audit Preparedness: Precise paystubs help prepare the business for audits and possibly save it from penalties or fines.

4. Increasing Financial Literacy: Paystubs enable employees to learn about different concepts such as CPP contribution, EI deduction, and income tax, which in turn helps them manage their finances better.

5. Data Insight: This allows businesses to analyze payroll data for trend identification, labor cost optimization, and budget preparations.

A Canadian SME Chronicle

A small marketing agency in Toronto with 25 employees had difficulties handling the payroll through manual means, which resulted in mistakes and delays in paying out employees. Upon using an electronic pay stub software, such were the results:

1. Savings on Time : Payroll processing time is down to 60%, allowing HR to focus on more strategic initiatives.

2. Elevated Employee Satisfaction: Employees appreciated the online access to their pay stubs, consequently enhancing overall morale.

3. Assurance of Compliance : Thanks to the software's accurate calculation of taxes according to CRA regulations, the agency was able to avoid hefty penalties.

Through the adoption of electronic pay stub systems, the agency set internal automation into motion for the purpose of advancing employee relations and assuring financial accuracy.

FAQs for Canadian Pay Stubs

1. What is a pay stub, and why is it important in Canada?

Solution: A pay stub is a document that outlines gross income, deductions (e.g., taxes, EI, CPP), and net pay. It helps both employers and employees maintain transparency and meet legal standards in Canada.

2. How do I generate pay stubs for my employees?

Solution: Use a proper pay stub generator, for example, CanadaPayStubs, for greater accuracy; be sure to include the employee's information: their name, gross pay, taxes withheld-including income tax, CPP, EI-and net pay; payroll software may also be an option that meets Canadian payroll regulations.

4. Are pay stubs needed for every payment?

Solution: Yes, you have to give a pay stub for every payment. It maintains a transparent record of earnings and deductions, which can be very important for tax filings and in times of employment disputes.

5. Is it okay to email pay stubs in Canada?

Solution: Yes. You can email pay stubs in Canada. Make sure they are encrypted or password-protected, following privacy laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA).

6. Why are pay stubs useful for employees and businesses?

Solution: Pay stubs help employees by giving proof of income for loans or tax filings. With respects to employers, those pay stubs help ensure that the employer follows Canadian payroll regulations and builds trust with the employees.